Recently, Ukraine’s President Zelensky signed the “On Payment Services” bill into law. Among other things, the bill permits the country’s central bank to issue a central bank digital currency. Notably, it also allows the institution to create a testing environment for fintech startups. This comes as the culmination of several years of study on the topic, including a report which was issued in 2019.

“On the one hand, the NBU has been looking into how to develop and issue a CBDC since 2018. On the other hand, I think Estonia has pushed their hand. Obviously, this was well in the works since before Eesti Pank recently released its report on CBDCs. But, Estonia has been a leader in technology and the startup scene in so many different ways. I think that every player in the region really has to be watching Estonia. You don’t want to be left behind, especially if a regional neighbor is able to develop a CBDC that both functionally works and is culturally accepted,” noted Richard Gardner, CEO of Modulus, a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges.

“On the one hand, Ukraine has some of the pieces necessary to use the move towards a CBDC to build their existing tech infrastructure. Ukraine is definitely a player in the tech space. On the other hand, you have to look at what Estonia has done over the past couple decades and acknowledge that they are trending in the right direction. In many ways, the country is a case study, or even a masterclass, in how to build up a critical new segment of your economy,” said Gardner.

“In the end, regional competition can really be a positive for an economy. Iron sharpens iron, and when you strive to compete, you’re better positioned to win. Technology isn’t a zero-sum game. There is more than enough innovation to go around. What’s great about technology is that, while connections and money and historicals can certainly help, the technology that’s trending is really based on what adds value. If you can build something cool that adds value to people, companies, or governments, then you’re going to be a winner in the tech space,” offered Gardner.

Modulus is known throughout the financial technology segment as a leader in the development of ultra-high frequency trading systems and blockchain technologies. Over the past twenty years, the company has built technology for the world’s most notable exchanges, with a client list which includes NASA, NASDAQ, Goldman Sachs, Merrill Lynch, JP Morgan Chase, Bank of America, Barclays, Siemens, Shell, Yahoo!, Microsoft, Cornell University, and the University of Chicago.

“What I see here, when you look at the race to build a CBDC, is three different battles happening concurrently. First, there is the power of being an early adopter. Those who find a way to build a technologically sound digital currency and get their citizenry to adopt it — there’s no question that they are going to gain prestige in the international monetary community. Secondarily, there are going to be new fintech firms that build a lot of innovative technologies on their way to launching the CBDC, and that’s going to be a major economic boon. But, finally, and, in terms of long-term implications, perhaps the most important: getting in on this early is going to build a culture of innovation. Companies are going to see that the government values innovation, especially if they work to build public-private partnerships and bring the private sector in to help craft commonsense regulatory guidance,” said Gardner.

“That culture of innovation is what has brought Estonia and Tallinn so much economic success lately. If Ukraine can follow that roadmap, they may have a chance to benefit from a technological revolution that won’t soon depart. Blockchain technologies are here, and they are destined to change the way the world conceives of finance. That’s real. That’s here to stay. Getting on board quickly is the best move Ukraine has in its quiver,” opined Gardner.

Forex2 weeks ago

Forex2 weeks ago

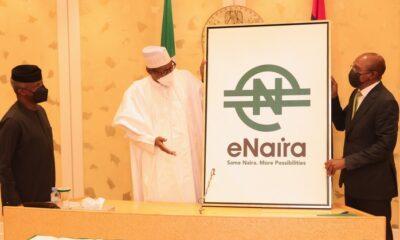

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago