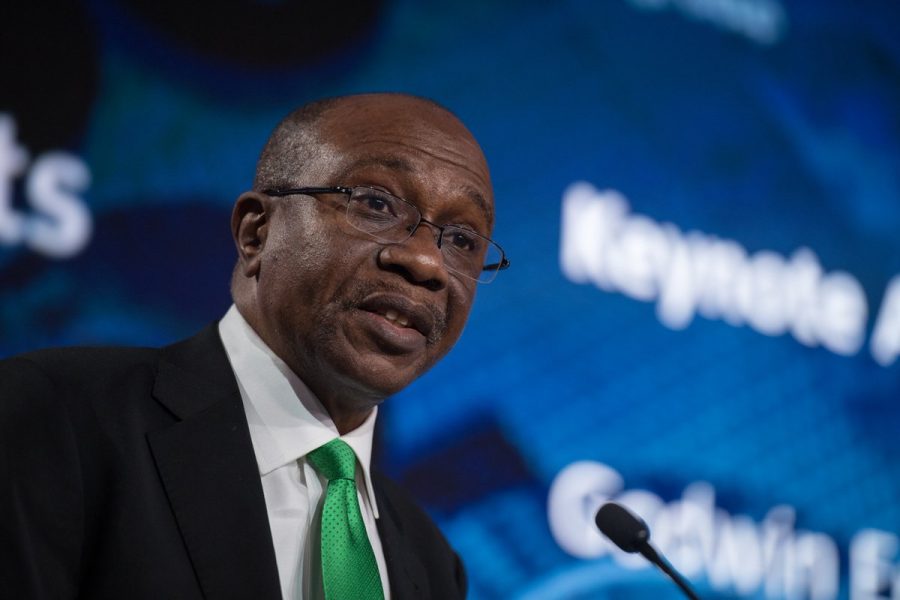

The Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, yesterday said efforts are ongoing to reduce the country’s import bill by about 35 per cent.

He said President Muhammadu Buhari’s insistence about five years ago on the diversification of the country’s economic base had already started to yield positive results.

The CBN governor, while receiving a delegation from the Central Bank of The Gambia (CBG), led by its governor, Mr. Buah Saidy, on a two-day working visit to the country, stated that the country currently has the potential to export and earn foreign currency from the production of urea for local production of fertiliser as well as petroleum product as soon as the Dangote refineries goes into operation by the first quarter of next year.

This, he said would help to reduce importation by about 35 per cent.

He said a country with a population of over 200 million should have food security, pointing out that this was why the CBN was aggressively looking into the area of food and, “where we can use our own available raw materials to produce what we need in our country”.

He said: “And we believe with time Nigeria will really be a greater country than it is today. We don’t think we are great yet because we have a high import dependence in the country and we are doing everything possible to reduce imports.

“But like you know, when we are able to reduce imports, encourage exports and encourage consumption spending and investment, those are some of the parameters that will ultimately boost our economy so that we can continue to see rapid growth in our GDP and see prosperity for our people.”

He also told the visiting team that the apex bank has vast experiences in IT and cybersecurity, adding that its infrastructure had been proven to be impregnable to hackers.

He said: “There were some protests sometime last year and when the protest was going on we saw that people were trying to hack into systems and they tried to hack into the CBN systems.

“I got a message that the CBN system had been hacked into and I said the CBN system cannot be hacked into. I called our director in charge of IT and she responded that we have enough firewall that prevented the hack into our system. So those are the kinds of experiences we can share with you though expensive but will share then with you and think of how to work together to collaborate with yours.”

However, Saidy, who also said the CBG was having a difficult time regulating the banks in the Gambia especially in the areas of meting out sanctions to erring financial institutions had further sought to know the magic which the CBN had adopted to sanction banks’ executives without repercussions.

Responding, however, Emefiele attributed the successes to the support which the apex bank had enjoyed from the National Assembly.

He said: “On the issue of the CBN independence, I thank you for the kind words. But I think the point is that we thank our own parliament. Our parliament has been extremely supportive of the CBN.

“They put in place a central bank Act that grants independence to the CBN and we have our Banks and Other Financial Institutions Act that also grants a lot of power and authority for the CBN to bite when we find people who want to take advantage of the system for their own personal benefit and we don’t breed any nonsense about people who try to take advantage of our system for their personal benefits.

“Everything must be done keeping in mind the overall national goals and objectives and that is why the CBN will act very fast on any economic agent that tries to undermine our policies and that’s why we are very firm on them.”

He said: “Working with your parliamentary I believe you can have laws that can give you the kind of independence that you need in any, practically most of the central banks in the world today have independence that gives them the power to be able to manage monetary policy in a way that is beneficial to their countries and economy.”

Emefiele also said the apex bank was doing everything possible, apart from looking at currency adjustment when necessary, to confront issues of supply management and ensure that economy grows.

He said the CBN had adopted demand management strategies that will help to curtail imports and ensure that some of those goods that can be produced locally are not imported.

Meanwhile, there are strong indications that CBN may seal an agreement with the Central Bank of the Gambia (CBG) to undertake the printing of legal tender for the latter.

This followed a request by the CBG for a possible collaboration as it seeks to address acute currency shortages in the country.

Already, Emefiele, while receiving a delegation, assured that the CBN has extremely competitive advantage to manage the currency printing job for The Gambia.

He said the Nigerian Security Printing and Minting Plc which was established in the early 1960s had been printing currency for the country, adding that the facility has a lot of idle capacity to satisfy the demand of the CBG.

Among other considerations, Saidy had informed the CBN governor that it is currently costly and unsustainable for the Gambia to continue to rely on its printer – De La Rue of London – for its currency needs.

He added that the distance coupled with some logistics and resource constraints had partly led to a current situation whereby the country had witnessed acute shortage of currency with the attendant implications for the economy.

Emefiele, nevertheless, said: “I note your point on currency management. The Nigerian mint was set up in the early 1960s and we’ve been producing our currency since the early 60s and we have a lot of idle capacity to ensure that instead of you going to Europe or other countries, you will be able to benefit from our ideas.”

He said: “Our colleagues will take you to the security printing facility. Our colleagues that came in from Liberia two months ago were fascinated by the kind of facilities, we have at our Nigerian security printing and minting facility and I am sure that you will also enjoy them.

“And I am sure they will follow you back to the Gambia to see how they can help you to structure your economic order quantities so we can also be of assistance in printing your currency.

“And I can assure you that we can be extremely competitive if only from the stand point of logistics and freight from Europe but it’s just going to be a few hours from here to the Gambia and the rest of them.”

The CBG governor had further explained that it costs the bank about £70,000 to lift printed currencies from Sri Lanka to the Gambia.

He said: “We also need assistance in currency management. Right now we have a situation where we are running very low on currency and at some point I get scared because we cannot at the central bank run out of currency completely as that will be a disaster.

“So we want to learn from your estimate. We have a model but we have not looked at it yet – given to us by our printers – De La Rue. How they estimate the currency need of the country on yearly basis.

“But I think it has some defects otherwise, the acute shortage we have currently would not have happened.”

Saidy said: “We placed an order for three years of currency to be printed but again, the contract with De La Rue since independence they have been printing our currency.

“Yesterday in my interaction with the Deputy Governor, Mr. Kingsley Obiora, we realise that you print your own currency and I asked about security and he assured me that you have top of the line security features.

“So this is another area I would want us to exchange ideas and have discussions on how possibly if we decide to go with you we can collaborate with your assistance to be printing our currency.”

He said: “Again, it is closer, De La Rue is in London but they do the printing in Malta and also Sri Lanka. The last one was done in Sri Lanka.

“Lifting those things all the way to the Gambia is costly because we had to do some emergency order and that cost was going to be on CBG but with negotiations and assuming then that we will give them this contract of three years of printing our currency, they now paid for the flight – about £70,000 to lift those currencies to the Gambia.”

He also said the CBG was in the country to benefit from the CBN’s vast experiences on how it had successfully regulated the financial system and sought assistance in the areas of information technology, modernisation, cybersecurity, forex shipping and management, among others.

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago