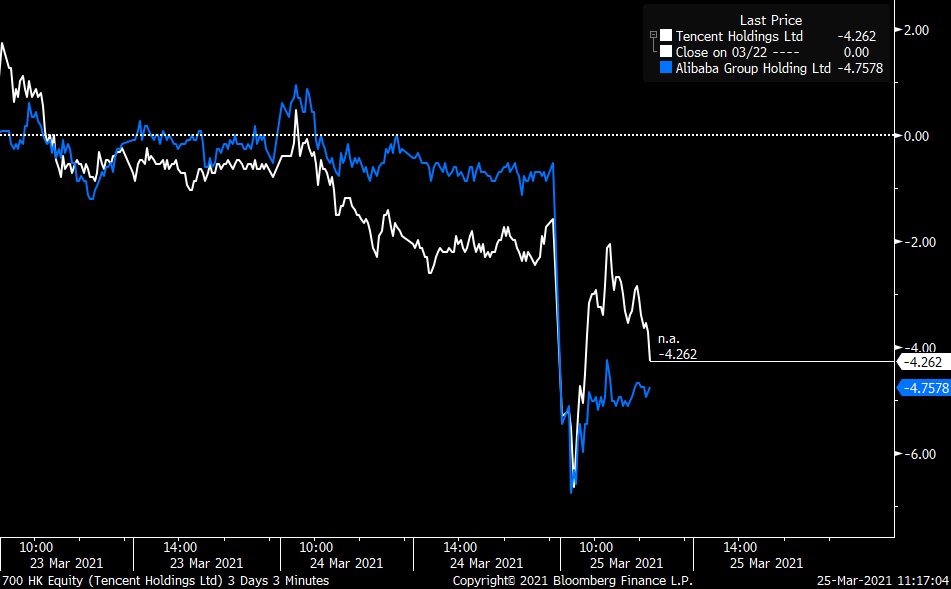

Tech giants from Tencent Holdings Ltd. to Alibaba Group Holding Ltd. dived after U.S. regulators revived threats to toss China’s largest corporations off U.S. bourses, compounding concerns of a widening domestic antitrust crackdown.

Alibaba slid almost 4% in Hong Kong Thursday, joining a U.S. selloff that wiped at least 20% off Chinese tech names including Tencent Music Entertainment and iQiyi Inc., Baidu Inc.’s Netflix-like streaming subsidiary. The Hang Seng Technology Index slid to its lowest since November before ending down just 1.2%.

Tencent, which on Wednesday sought to allay investor concerns about the fallout to its fintech division from growing regulatory pressure, slid 2.8% and has now shed more than $200 billion of market value since a January peak. Following Tencent’s fourth-quarter results, brokerages including Goldman Sachs, Macquarie and HSBC cut their price targets on Asia’s largest company for the first time in at least a year.

Baidu, the search giant that debuted in the city only on Monday, finished 9.7% lower while Alibaba-rival JD.com Inc. lost 3.6%. Food delivery giant Meituan, which reports 2020 results Friday, shed 1.6%. The losses followed a warning from the Securities and Exchange Commission that it’s taking steps to force accounting firms to let U.S. regulators review the financial audits of overseas companies — the penalty for non-compliance being ejection from exchanges.

That threat worsened sentiment in China’s giant tech sector just as Beijing is widening a crackdown on the country’s largest corporations, fearful of their growing clout after years of relatively unfettered expansion.

That threat worsened sentiment in China’s giant tech sector just as Beijing is widening a crackdown on the country’s largest corporations, fearful of their growing clout after years of relatively unfettered expansion.

“Sentiment got hurt after Chinese technology stocks slumped overnight on Nasdaq,” while local reasons accelerated the selloffs, including a lack of upside surprises in Tencent earnings and worries about government regulation on the sector, said Daniel So, a CMB International analyst.

On Wednesday, Bloomberg News reported China’s government has proposed establishing a joint venture with local technology giants that would oversee the lucrative data they collect from hundreds of millions of consumers. The preliminary plan, which is being led by the People’s Bank of China, would mark a significant escalation in regulators’ attempts to tighten their grip over the country’s internet sector. Tencent executives sought to tamp down the impact of Beijing’s heightened scrutiny after reporting revenue growth that barely met expectations.

“The major reason is still valuation,” said Linus Yip, First Shanghai Securities analyst. “Even after such a big drop, the sector is still not cheap. I don’t think the tech stocks will resume upward trend any time soon. Any bad news will trigger further selloffs, be it Nasdaq plunge or news about China’s regulation.”