Cryptocurrency

Blockchain Hackers Have Stolen Over $13.6 Billion in 330 Hack Events

Cryptocurrency

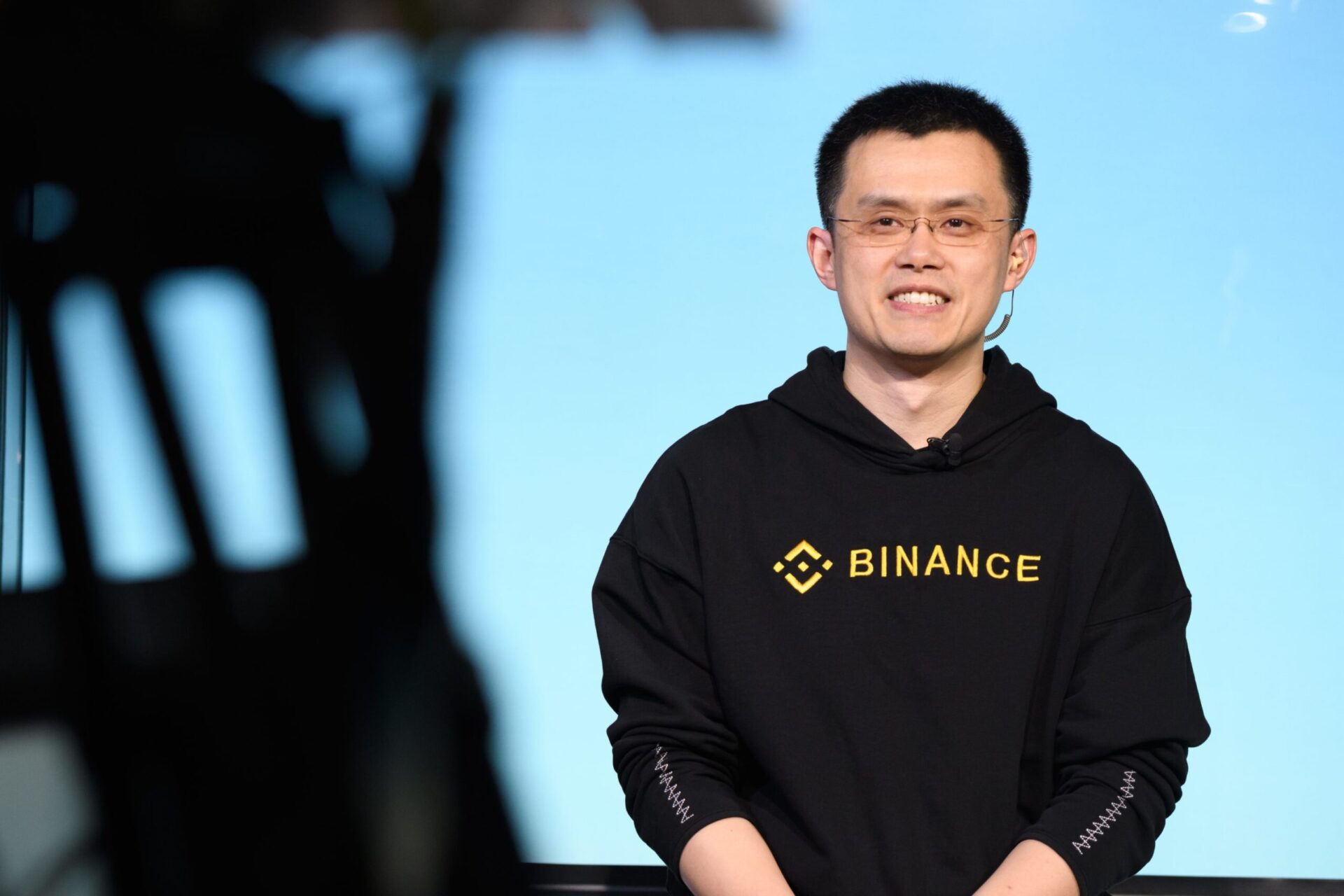

U.S. Prosecutors Recommend 36-Month Prison Term for Binance Founder Changpeng Zhao

Cryptocurrency

SEC Philippines Urges Removal of Binance App from Google Play Store and Apple App Store

Cryptocurrency

Binance Loses Ground in Global Bitcoin Trading Amid Regulatory Challenges

-

Forex3 weeks ago

Forex3 weeks agoZiG to the Rescue: Zimbabwe Shifts Gear with New Currency Backed by Gold

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira2 weeks ago

Naira2 weeks agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

-

Naira1 week ago

Naira1 week agoDollar to Naira Black Market Today, April 17th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 1st, 2024

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 2nd, 2024