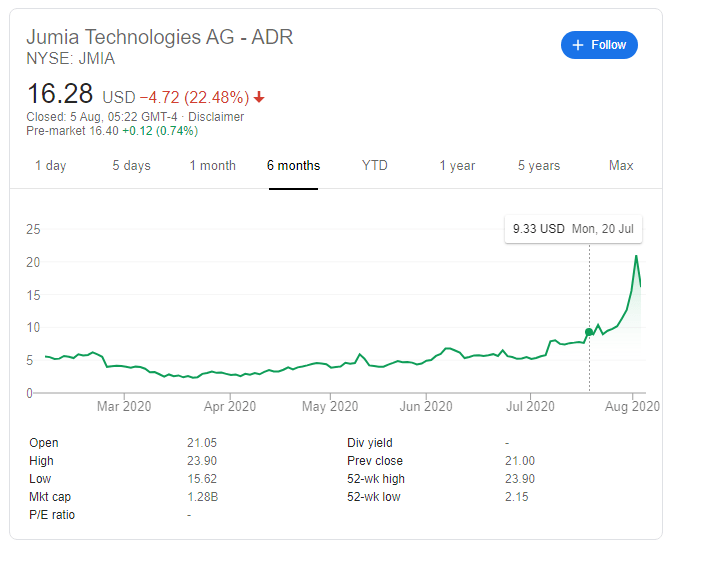

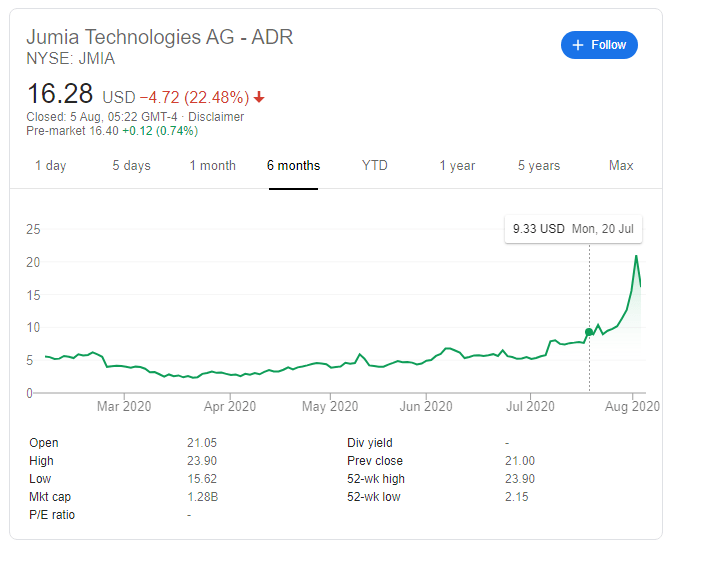

Jumia Gains 307 Percent in Three Months

Jumia stock has risen more than 300 percent in the last three months despite the COVID-19 pandemic and a general decline in household income in Nigeria, Africa’s largest economy.

Shares of Nigeria’s first e-commerce company rose from $4 per share on 18th of May, 2020 to $8.95 on July 21, 2020 before more than double that number this week to $16.28 per share after hitting $21 per share on Monday. The Jumia stock has risen by 307 percent since May 18th 2020.

While Jumia fundamentals have not changed in recent months, the forces propelling the stock were largely perception-based as retail investors were predicting that Nigerians and other Africans where the company operates shopped more on Jumia during the COVID-19 lockdown like Amazon, Alibaba and others experienced.

While Jumia fundamentals have not changed in recent months, the forces propelling the stock were largely perception-based as retail investors were predicting that Nigerians and other Africans where the company operates shopped more on Jumia during the COVID-19 lockdown like Amazon, Alibaba and others experienced.

Therefore, retail investors started taking positions on the struggling e-commence company, popularly referred to as Amazon of Africa, ahead of its second-quarter earnings report due next week. They are betting that the company would have experienced a similar upsurge in sales to other global e-commerce companies during the lockdown.

This was after Massimiliano Spalazzi, CEO, Jumia Nigeria, stated that the company sales drop in April, at the beginning of the lockdown, but picked up in May and June with ease of lockdown.

Spalazzi said “We definitely had challenges due to the COVID-19 lockdown, currency devaluation and prices of goods increase in this market. However, with our contactless delivery initiatives, contactless payment via Jumia Pay and partnerships with several companies that produce consumer goods, we saw more new and old customers come on our platform to shop in safety.”

Accordingly, Tolulope George-Yanwah, country manager, Jumia services, said: “Our delivery partners increased year on year (YoY) by 73 percent, delivery associate community saw a 65 percent increase YoY and our pick up points and warehouses increased YoY by 109 percent with over 200 hubs. This shows that our delivery methods have significantly improved with higher volumes of purchases and deliveries made.”

Investors are already pricing in the expected surge in sales for the quarter, forgetting that the e-commerce company was only active in May and June when President Buhari eased the nation’s lockdown.

Also, Jumia is trading below its IPO price of $25.46 per share of April 12, 2019 and record high of $40.21 per share attained on April 26, 2019 when the company was aggressively pushed as Amazon of Africa before Citron Research released fraud statement that eventually plunged its value to $2.33 per share as early as March 20, 2020.

Other factors like disruption in global logistics and supply chain would like impacted Jumia’s potential during the period as most Nigerian vendors on the e-commerce site import goods to sell on the platform. Meaning, without those import goods, Jumia sales would be affected during the lockdown period.

Forex2 weeks ago

Forex2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Company News4 weeks ago

Company News4 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago