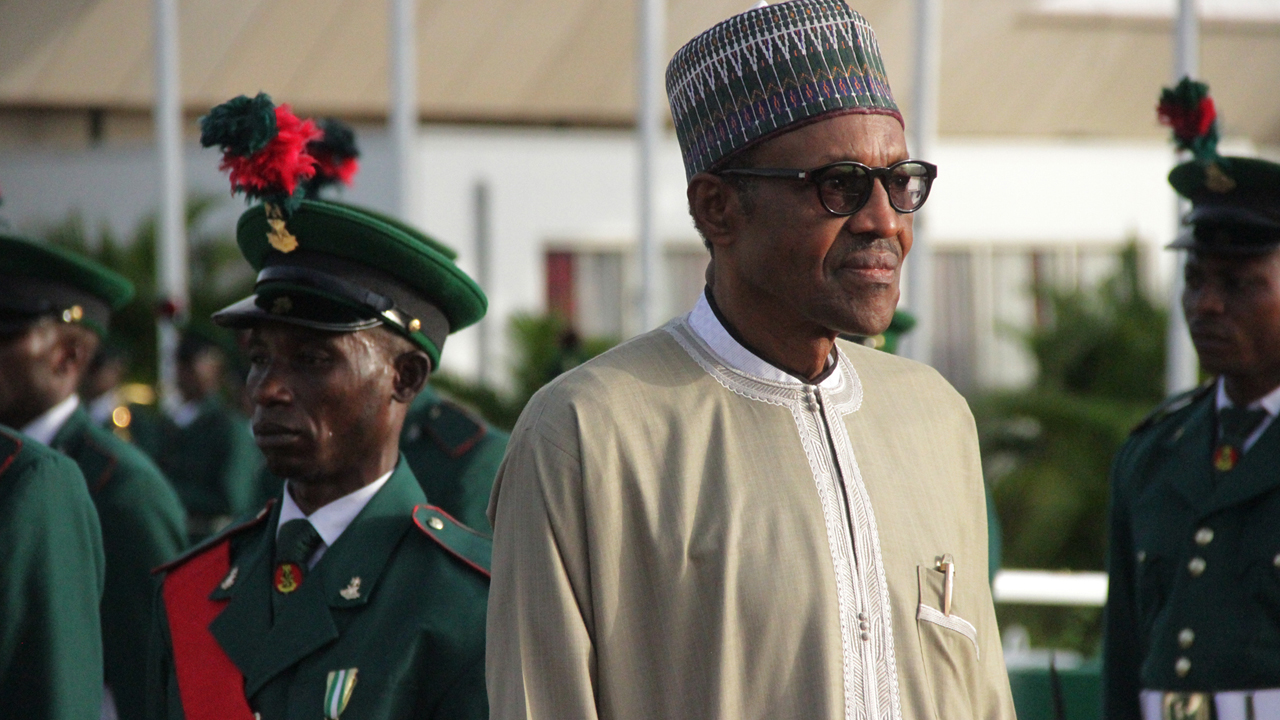

- Buhari Signs N30,000 Minimum Wage, Workers Hail President

President Muhammadu Buhari on Thursday signed the N30,000 National Minimum Wage Bill into law, ending the anxiety caused by the delay.

The Senior Special Assistant to the President on National Assembly Matters (Senate), Senator Ita Enang, was elated on Thursday as he broke the news to State House correspondents soon after Buhari gave his nod to the bill.

The presidential liaison officer stated that the payment of the N30,000 to workers would begin immediately.

The former senator said, “President Muhammadu Buhari has assented to the Minimum Wage Repeal and Enactment Act 2019.

“This makes it compulsory for all employers of labour in Nigeria to pay to their workers the sum of N30,000. And this excludes persons who are employing less than 25 workers; persons who work in a ship which sails out of jurisdiction and other persons who are in other kinds of regulated employment which are accepted by the Act.

“It also gives the workers the right, if you are compelled by any circumstance to accept a salary that is less than N30,000, to sue your employer to recover the balance and it authorises the minister of labour and any person nominated by the minister of labour, or any person designated by the minister of labour in any ministry, department or agency to on your behalf, take action in your name against such employer to recover the balance of your wages.”

He added, “It also ensures and mandates the National Salaries, Income and Wages Commission and the minister of labour to be the chief and principal enforcers of the provisions of this law. And this law applies to all agencies, persons and bodies throughout the Federal Republic of Nigeria.”

On the effective date of the Act, he said, “The effective date is 18th of April, 2019, as Mr President has assented to it. It has been assented to today and it takes effect today, except such other provisions as are contained in the Act.

“But the enforcement and the right to start the implementation of the provisions commences today (Thursday), including such steps that are to be taken gradually under the provisions of the Act.”

Meanwhile, at the signing of the bill, the President was quoted to have said that he expected Nigerian workers to be more committed to their jobs.

“I expect them (workers) to be more committed to their work at whichever level.

“I will like, with the cooperation of the Nigeria Labour Congress, to look at the economic situation of the country, the population, the poor infrastructure that we are trying to fix in terms of roads, rail and power.

“So, I wish Nigerian workers the best of luck”, he reportedly said in a brief speech.

In its reaction, the organised labour in the country said Nigerian workers appreciated the signing of the new minimum wage bill into law, stressing that labour unions would ensure its compliance by all states.

The President of the Trade Union Congress, Bobboi Kaigama, on a telephone chat with our correspondent, said, “Workers and TUC appreciates President Muhammadu Buhari for signing the Minimum Wage bill into law. It is a welcome development to workers and everyone and we hope that the template will be released soon by the Salaries and Wages Commission so that we can have consequential discussion on the increases.

“All we need now is to call on government to convey the meeting of the Trade Council to discuss the issue of consequential increases so that circulars can be issued to the states for guidance.”

Effort to get the General Secretary of the Nigeria Labour Congress, Peter Ozo-Eson, was not successful as his mobile number was busy.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago