- LCCI Cautions Govt Over Forex Ban on Textile Imports

The Lagos Chamber of Commerce and Industry has advised the Federal Government to reconsider the Central Bank of Nigeria’s ban of forex to textile importers.

It argued that given the position of Nigeria in Africa as a leader in fashion, the range of fabrics produced by the Nigerian textile industry could not support the industry in terms of the quantity and quality.

The Director-General, LCCI, Muda Yusuf, said this in a statement made available to our correspondent on Sunday.

Yusuf, who noted that his submission was not to diminish the importance of the local textile industry in any way or the significance of the nation’s industrialisation, however, added that this was to underscore the importance of a strategic approach to industrialisation.

The LCCI DG said before such policy pronouncement, the government ought to have strengthened the capacity of domestic industries, enhanced their competitiveness and reduced their import dependence as espoused in the Nigeria Industrial Revolution Plan.

Yusuf said, more importantly, the power issue must be addressed, as it was almost impossible to achieve rapid industrialisation without resolving the issue of power and the deficit in key infrastructure.

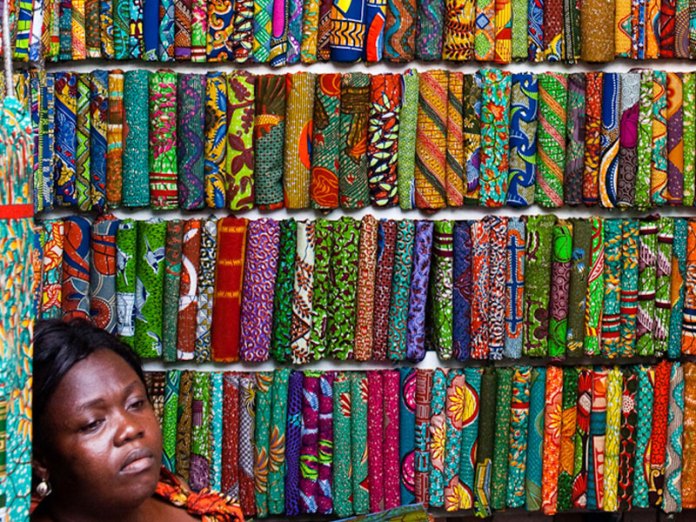

He said, “Today, Nigeria is clearly the leader in Africa as far as the fashion industry is concerned. Currently, the range of fabrics produced by the Nigerian textile industry cannot support the fashion industry in terms of quantity and quality.

“This vibrant industry should not be sacrificed on the altar of textile industry regeneration. This submission is not to diminish the importance of textile industries in any way or the significance of industrialisation. It is to underscore the importance of a strategic approach to industrialisation.

“The starting point is to strengthen the capacity of domestic industries, enhance their competitiveness, and reduce their import dependence as espoused in the Nigeria Industrial Revolution Plan.

“More importantly, the power issue needs to be addressed. It is almost impossible to achieve rapid industrialisation without resolving the issue of power and the deficit in key infrastructure.

“Textile production is energy intensive. This is a high energy cost environment and it is very difficult for any energy intensive sector to survive.”

Listing other implications of the CBN’s ban on forex for textile import, he said the exclusion had grave implications for businesses in the fashion, tailoring, fashion accessories and garment industry in the country.

He said the industry was one of the fastest growing industries and had created amazing opportunities for many young Nigerians to express their creativity and innovation, adding that the sector was estimated at N5tn, with about 500,000 jobs.

He said, “The industry provides significant value addition to fabrics, whether imported or domestically produced. The policy contemplation of the CBN will put all of these at risk.”

Yusuf stated that trading in textiles was also a major economic activity in the country, both in the northern and southern parts of the country, and hundreds of thousands were making their living from there.

He said, “It is a market that responds to changing tastes and fashion trends in the country and beyond.

“Hundreds of thousands of women and men make a living in the marketing of textiles. The policymakers cannot afford to ignore this segment of economic players. The traders are the bridge between the producers and the consumers.

“It is, therefore, very important for policymakers take into account the full ramifications of the consequences of policies and collateral outcomes.”

Yusuf explained that the textile industry had been a beneficiary of several fiscal incentives and protectionist measures over the years, yet it had remained stagnant.

He said, “Some of them have even gone into receivership as they could not repay their loans. The lesson is that we should deal with the fundamental issues of production competitiveness in our economy.

“The textile industry needs to be saved from the excruciating burden of high operating and production cost.”

Yusuf added that in order for the local textile industry to experience a boom as in the line of Executive Order, President Muhammadu Buhari should order that all uniforms of military and paramilitary institutions should be made from Nigeria- produced textiles.

He said, “This is a low hanging fruit that could be explored while the issue of high production cost is being addressed.”

Yusuf, however, commended the FG on its move to create special economic zones in the six geopolitical zones in the country, describing it as a step in the right direction.

He stated, “The Bank of Industry has also done a great deal to provide funding for industries, textiles inclusive. But we need to deal with the fundamentals.

“In the meantime, as we progress to the next level of the Buhari administration, policy coordination and collaboration among the economic ministries and agencies is imperative. There should be collaboration and coordination between the CBN, the Finance Ministry, Budget and Planning and Trade and Investment on trade policy issues.

“The boundaries of monetary policy need to be properly defined. Exclusion of sectors from the forex market is not a monetary policy issue. It is a trade policy matter.”

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Naira1 week ago

Naira1 week ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira3 weeks ago

Naira3 weeks ago

Naira1 week ago

Naira1 week ago