- Forex Weekly Outlook December 10-14

Global foreign exchange market remained highly volatile despite temporary trade agreement reached by the U.S. and China. The slowing growth in China, the world’s second largest economy, and the unexpected drop in the number of jobs created in the U.S. in November following the Federal Reserve comment on possible slow down in rates hike in 2019 have weakened market confidence and increased global uncertainty going into the new year.

The U.S. stocks dropped $1 trillion in value last week as investors seem to be abandoning the high flying American stocks for emerging assets amid inverted yield curve that signals possible recession in 2019/2020.

Emerging markets, however, may not enjoy huge inflow of capital as previously projected because of the change in the European Central Bank’s monetary policy and current China’s economic position. ECB announced it will stop buying bond in January 2019 and commence normalization, which might involve rate hike. Therefore, most funds are likely to go to the Euro-zone (developed economy) with lesser risk.

This, may offer some form of support for the Euro currency in 2019 despite Brexit uncertainty, Italy debt crisis and slowing global growth.

Still, it all depends on the outcome of the Brexit vote on Tuesday in the United Kingdom, where MPs will vote to either approve and disapprove Prime Minister Theresa May’s draft Brexit deal.

In Canada, crude oil production will drop by 325,000 barrels per day starting from January 2019 as the oil-producing nation plans to reduce the gap between the price of U.S. WTI crude and the Canadian crude that rose to almost 50 at a point.

Experts believe the move will slow economic growth to 1.8 percent from the 2 percent predicted for 2019 as revenue generated from sales of crude oil is expected to drop in billions, partly due to falling oil prices and reduce production.

Meanwhile, OPEC+ agreed to cut 1.2 million barrels per day against the 1 million widely expected by the market to artificially boost price despite President Trump saying otherwise.

Giving the aforementioned reasons, USDJPY, NZDJPY, AUDUSD, and CADJPY top my list this week.

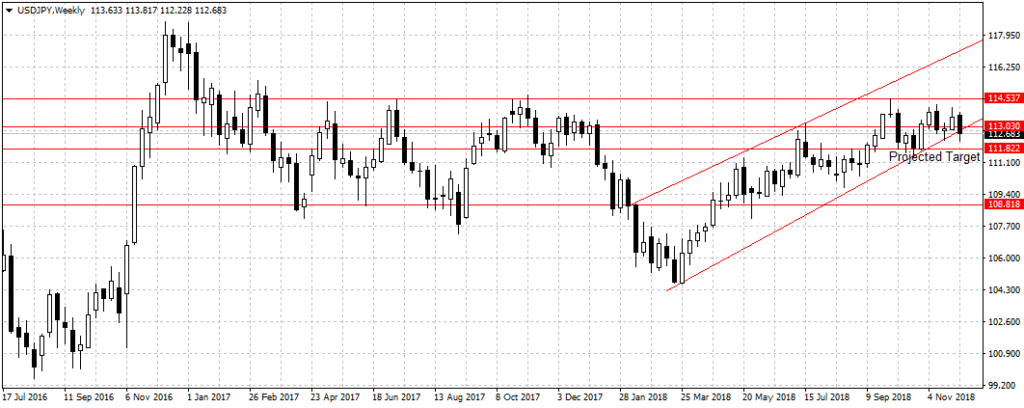

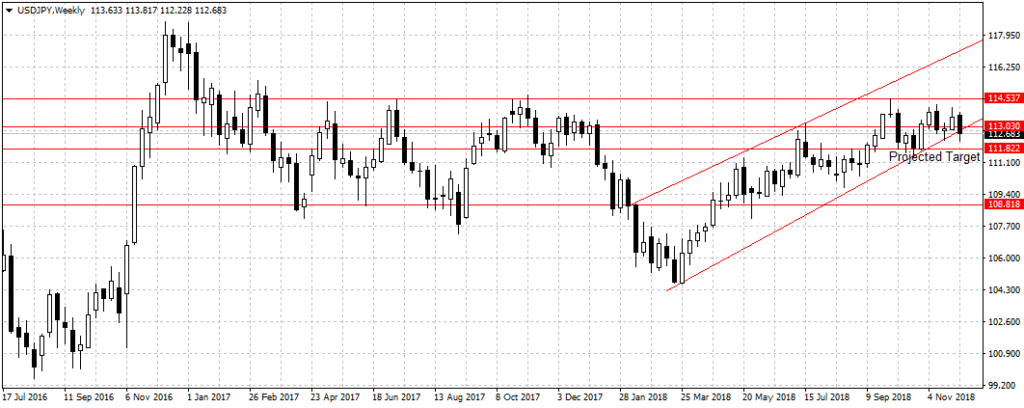

USDJPY

The growing uncertainty surrounding the U.S. assets following Federal Reserve’s rate comment, fewer than expected job creation in November and inverted yield curve is weighing on the U.S. dollar’s attractiveness, forcing investors to jump on haven currency, the Japanese Yen.

The USDJPY closed below the ascending channel for the first time in nine months last week to trade at 112.68 as shown above. Indicating an unusual selling pressure, especially after Meng Wanzhou, Huawei CFO was arrested in Canada on the order of U.S, a move China kicked against and insisted there will be consequences.

Therefore, a sustained break below the 113.03 resistance level should pressure price towards the 111.82 supports and vice versa.

NZDJPY

New Zealand dollar is a commodity-dependent currency that reflects China’s economic position. Since Wanzhou was picked up on Friday and Chinese inflation number disappointed after falling to 2.2 percent in November, Kiwi attractiveness drop against the Yen.

The pair was aided out of the 16 months descending channel by the temporary truce reached two weeks ago, however, with the new economic numbers pointing to possible slow down in Chinese economy and weak commodity outlook. The pair may fail to sustain its nearly two weeks bullish run above the descending channel.

The pair was aided out of the 16 months descending channel by the temporary truce reached two weeks ago, however, with the new economic numbers pointing to possible slow down in Chinese economy and weak commodity outlook. The pair may fail to sustain its nearly two weeks bullish run above the descending channel.

This week, as long as price remained below the 77.71 resistance level breached for the first time in 6 months two weeks ago. I will look to sell this pair for 75.55 supports in line with previous analysis. However, 76.85 support stand in the way.

AUDUSD

Australian currency has been battered by weaker than expected economic growth in the third quarter, the economy expanded at a rate of 0.3 percent and 2.8 percent year on year, lower than the 0.6 percent and 3.5 percent expected, respectively. Also, consumer spending continued to drop amid weak wage growth and rising household debt. Meaning, the Reserve Bank of Australia may be forced to lower rate from the current 1.5 percent in 2019 to stimulate growth despite record low unemployment rate.

Like New Zealand, China is Australia’s largest trading partner, therefore, the Australian economy is indirectly impacted by the Chinese economy. Hence, all the factors mentioned above will equally weigh on the Aussie dollar.

The AUDUSD dropped about 200 pips last week after the disappointing GDP report to close at 0.7198. Since January 2018, the pair has dropped a total of 936 pips and broke out of the descending channel ahead of the US and China trade agreement five weeks ago.

The AUDUSD dropped about 200 pips last week after the disappointing GDP report to close at 0.7198. Since January 2018, the pair has dropped a total of 936 pips and broke out of the descending channel ahead of the US and China trade agreement five weeks ago.

Therefore, this is likely a temporary breakout given the aforementioned reasons. This week, as long as price remained below the 0.7314 resistance I am bearish on AUDUSD.

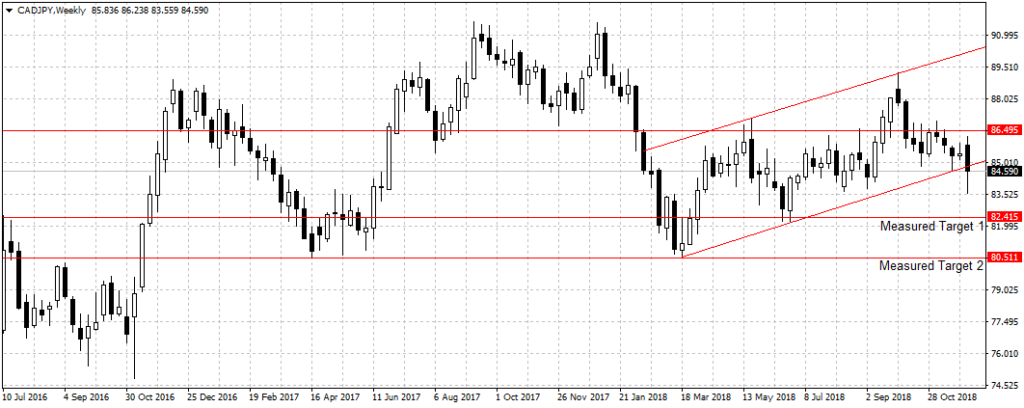

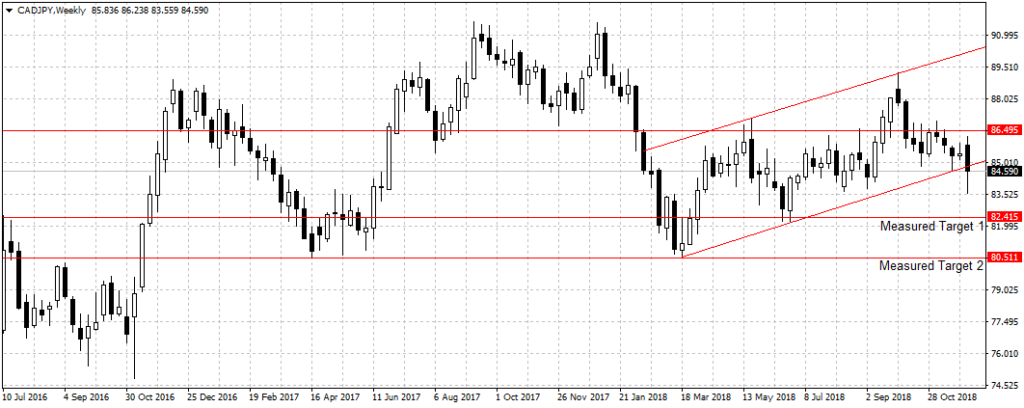

CADJPY

Despite better than expected unemployment rate of 5.6 percent and over 94,000 jobs that were created in Canada in November, the Canadian currency dropped against it counterparts to close lower last week.

The Bank of Canada held interest rate unchanged at 1.75 percent as expected but warned the economy could be heading for a slowdown in the final quarter of the year.

This was after the oil-producing nation announced it would cut production by 325,000 or 8.7 percent in January to aid price, a move believed by most experts would hurt economic productivity next year as national revenue is expected to drop.

Also, the economy grew at 2 percent rate in the third quarter, down from 2.9 percent recorded in the second quarter. Indicating possible slowing growth.

Technically, the pair closed outside the ascending channel for the first time in nine months to validate downward pressure. Therefore, because of the renewed interest in haven currency, Yen, especially in a week of Brexit vote. Investors are likely to jump on haven currency to curb risk exposure.

Technically, the pair closed outside the ascending channel for the first time in nine months to validate downward pressure. Therefore, because of the renewed interest in haven currency, Yen, especially in a week of Brexit vote. Investors are likely to jump on haven currency to curb risk exposure.

Hence, I am bearish on CADJPY and will look to sell below the ascending channel for 82.41 support.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago