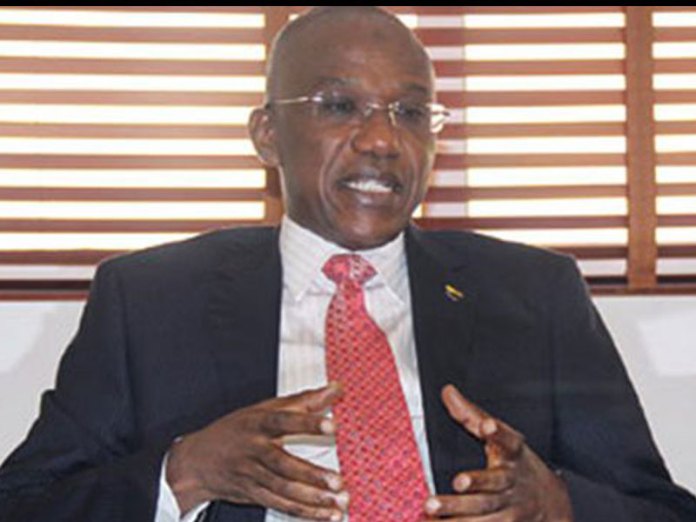

The Governor of the Central Bank of Nigeria (CBN), Dr. Olayemi Cardoso, has pledged to employ decisive measures, including maintaining high interest rates for as long as necessary.

This announcement comes amidst growing concerns over the country’s soaring inflation rates, which have posed significant economic challenges in recent times.

Speaking in an interview with the Financial Times, Cardoso emphasized the unwavering commitment of the Monetary Policy Committee (MPC) to take whatever steps are essential to rein in inflation.

He underscored the urgency of the situation, stating that there is “every indication” that the MPC is prepared to implement stringent measures to curb the upward trajectory of inflation.

“They will continue to do what has to be done to ensure that inflation comes down,” Cardoso affirmed, highlighting the determination of the CBN to confront the inflationary pressures gripping the economy.

The CBN’s proactive stance on inflation was evident from the outset of the year, with the MPC taking bold steps to tighten monetary policy.

The committee notably raised the benchmark lending rate by 400 basis points during its February meeting, further increasing it to 24.75% in March.

Looking ahead, the next MPC meeting, scheduled for May 20-21, will likely serve as a platform for further deliberations on monetary policy adjustments in response to evolving economic conditions.

Financial analysts have projected continued tightening measures by the MPC in light of stubbornly high inflation rates. Meristem Securities, for instance, anticipates a further uptick in headline inflation for April, underscoring the persistent inflationary pressures facing the economy.

Despite the necessity of maintaining high interest rates to address inflationary concerns, Cardoso acknowledged the potential drawbacks of such measures.

He expressed hope that the prolonged high rates would not dampen investment and production activities in the economy, recognizing the need for a delicate balance in monetary policy decisions.

“Hiking interest rates obviously has had a dampening effect on the foreign exchange market, so that has begun to moderate,” Cardoso remarked, highlighting the multifaceted impacts of monetary policy adjustments.

Addressing recent fluctuations in the value of the naira, Cardoso reassured investors of the central bank’s commitment to market stability.

He emphasized the importance of returning to orthodox monetary policies, signaling a departure from previous unconventional approaches to monetary management.

As the CBN governor charts a course towards stabilizing the economy and combating inflation, his steadfast resolve underscores the gravity of the challenges facing Nigeria’s monetary authorities.

In the face of daunting inflationary pressures, the commitment to decisive action offers a glimmer of hope for achieving stability and sustainable economic growth in the country.

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago