- Buhari Assures Chinese Investors of Support

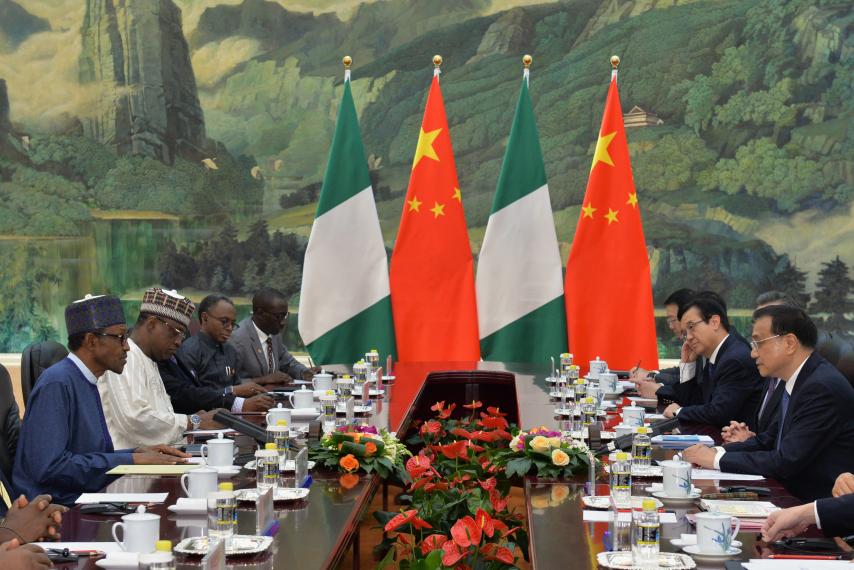

President Muhammadu Buhari on Wednesday assured existing and prospective Chinese investors of high-level support for their investment plans in Nigeria.

He gave the assurance on the sidelines of the Forum on China and Africa Cooperation (FOCAC) in Beijing, China.

In separate meetings with prospective investors, President Buhari said Nigeria is endowed with abundant human and material resources and a young population that is very energetic and innovative and ready to work.

He encouraged Chinese companies and entrepreneurs to take advantage of the improved business environment in Nigeria to invest in key sectors of the economy.

Acknowledging the contributions of Chinese companies in Nigeria in developing the country’s infrastructure, the President noted that there was still more to do.

The Ruyi Group, a leading Chinese company, had met with the President with a plan to invest $200 million for an industrial park in Kano State, cotton farms in Funtua, Katsina State and textile and garment manufacturing establishments in Aba, Abia State and Lagos.

The proposed investment, according to a statement by the Senior Special Assistant on Media and publicity, Garba Shehu, will cover the entire cotton value chain, farming, ginning, spinning, weaving and power generation to support the processes.

Ruyi Group Chairman, Mr. Yafu Qui told President Buhari that they settled for Nigeria after one-and-a-half year search for an African hub because of the country’s population, abundant human and material resources and a ‘strong leadership’ that has diversification agenda for the country.

President Buhari also received Professor Justin Yify Lin of the Pekin University, a former World Bank Chief Economist, currently serving as a consultant to the Nigerian government on the setting up of Special Economic Zones.

In this follow-up meeting after the first in 2016, Professor Lin told the President that progress has been made with the identification of the cotton value chain as a pilot for the setting up of labour intensive industrial parks, noting that the idea of the Ruyi Group as an investor was partly coming from their studies.

At a separate meeting, the Senior Vice President of, telecom giants, Huawei, Yi Xiang announced that the company will provide 10,000 Nigerians talent training in ICT each year.

Huawei is executing the second phase of the National Information and Communications Technology Backbone Project (NICTIB II) $328 million project, which was signed between China and Nigeria earlier on Wednesday.

The telecom giant chief said of the 10,000 Nigerians, half of them will undergo intensive training on Huawei certification programme to empower them to work anywhere in the world.

Mr Yi also told President Buhari the company had trained 1,000 civil servants in Nigeria and will offer additional 1,000 training slots for training within and outside the government.

Responding, President Buhari expressed satisfaction on the development of the ICT infrastructure backbone in the country, noting that it was consistent with the administration’s determination to institute e-governance to help fight corruption by increasing transparency.

The President said that the project would promote better education in the rural areas and encouraged Nigerian youths to optimize the opportunities of the new infrastructure facilities.

He also played host to top executives of CITEC Group, who indicated interest on investing in real estate, finance, infrastructure, agriculture and telecommunications in Nigeria.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Economy4 weeks ago

Economy4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Business3 weeks ago

Business3 weeks ago