- Forex Weekly Outlook August 20 – 24

Global uncertainty and rising interest rates in developed economies are dictating the direction of the currency market. The slow down in China, rising risk in emerging economies, global trade tensions and weak wage growth are some of the key factors that will decide the foreign exchange rate of most nations going forward.

In the Uk, the pound has been falling since the Bank of England raised policy rate to 0.75 percent despite the projected increase in domestic demand, surged in consumer spending, 14-month record high expansion in the construction sector and moderate manufacturing growth. Indicating that growing uncertainty surrounding the Brexit negotiations is overshadowing the underlying fundamentals, therefore, hurting business sentiment and economic growth.

In Canada, surge in domestic inflation boosted the odds of the Bank of Canada raising interest rate as soon as September. The inflation rate rose to 3 percent year-on-year in July, up from 2.5 percent from the previous month and beats analysts’ projection of 2.5 percent. This was after the central bank raised interest rate for the fourth time within a year in July, validating the central bank’s assessment of the economy — “that the economy is operating close to capacity and further rate hikes will be needed”.

In Australia, the unemployment rate declined to 5.3 percent, while wage growth and inflation rate remained below expectation. This, the governor of the Reserve Bank of Australia said will hurt consumer spending in the near term, especially with the rising household debt. However, he expects wage growth to pick up gradually as the labour market gets tighter. The optimism he expressed during ‘Opening Statement to the House of Representatives Standing Committee on Economics’ bolstered Australian dollar outlook.

But growing uncertainty in emerging economies like Turkey, Venezuela (after the government devalued the currency by 95 percent) etc is disrupting the outlook of emerging currencies.

Therefore, because of the pound’s broad sell-off following the possible “no deal comments”. The focus will be on pound’s pairs this week.

GBPCAD

After the head and shoulders pattern, the GBPCAD dropped 663 pips to set a new record low at 1.6593 for the year. But with the renewed interest in the Canadian dollar due to the projected rise in interest rates in September and strong economic outlook, we might see a further surge in sellers’ interest on GBPCAD. Enough to push price towards 1.6339 support level in coming days. Therefore, as long as price remains below 1.7054 resistant level, I am bearish on this pair and will be looking to jump in below the 1.6661 support.

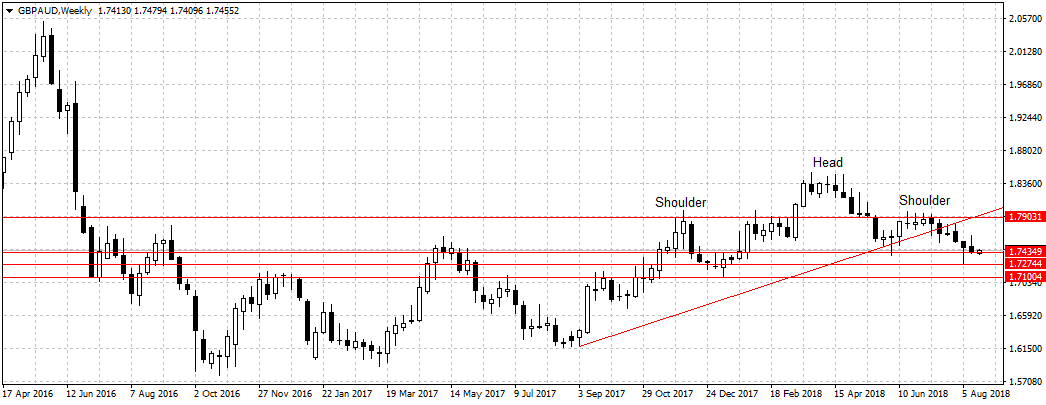

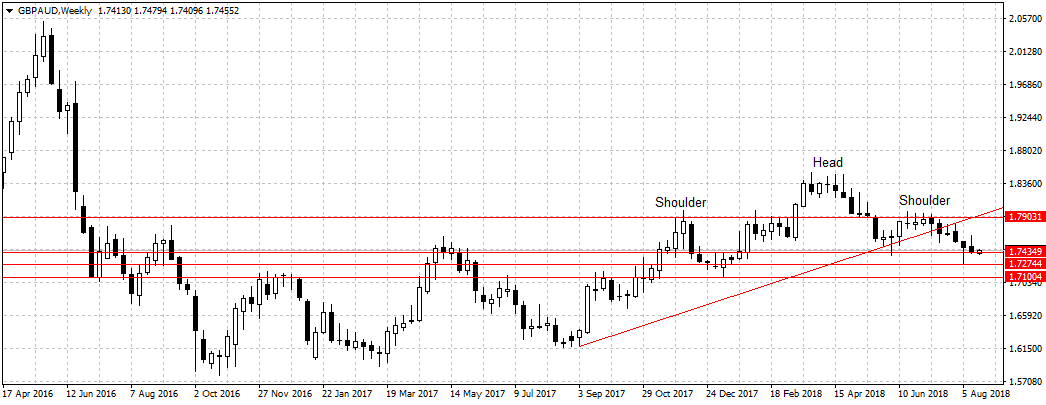

GBPAUD

Similarly, the Australian dollar is a haven currency, therefore, enjoys rise in trade volume during a period of high uncertainty. Also, despite the weak consumer spending and sluggish wage growth, the surge in global commodity prices is supporting its economic growth. This week, I will be looking to sell the GBPAUD below the 1.7434 for 1.7274 support and expect a sustained break of that level to open up 1.7100 support level.

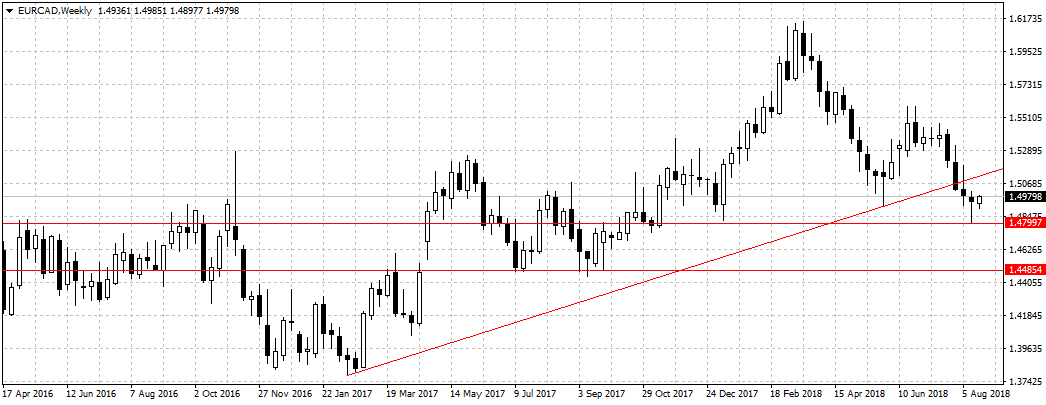

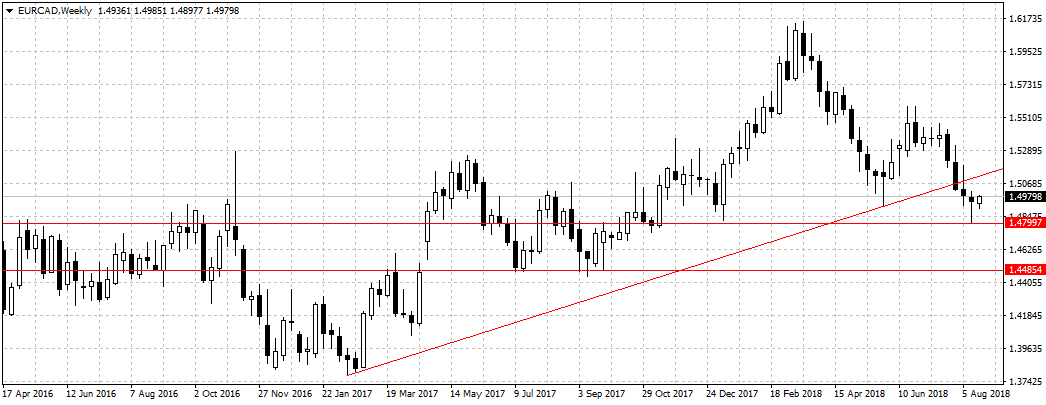

EURCAD

While the Euro gained back part of its lost ground against the Canadian dollar on Monday, due to the drop in the value of commodity-dependent currencies following Venezuela devaluation, it is unclear if the new momentum can be sustained. This is because the currency crisis in Turkey and the uncertainty about the planned budget in Italy could weigh on the Euro, especially if the planned US-China trade talks scheduled for this week fails.

Again, as long as price remains below the ascending channel as shown above, I will be looking to sell this pair for all the aforementioned reasons. The bearish trend started in March is likely to continue towards the 1.4799 support level now that the odds of the Bank of Canada raising rates in September is growing. However, I will be cautious because of the numerous events due this week.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago