- Forex Weekly Outlook July 2-6

Trade tensions between the US and other nations continued to hurt market sentiment as the US insisted on additional trade tariffs on imported goods from China, Canada, the European Union, and presently pushing allies to stop the importation of Iranian crude oil by November 4th, leading to increased market uncertainty across both emerging and developed markets.

Trade tensions coupled with economic fundamentals have become key factors in projecting possible market direction in recent months, therefore, both will be used to broaden forex outlook ahead of unemployment data this week.

EURUSD

The US dollar gained on strong economic fundamentals and progressive rate hikes by the Federal Reserve, however, lower than expected economic growth rate and slowing consumer spending despite tax cuts weighed on US dollar outlook against the Euro currency last week.

On Friday, the Euro jumped 0.83 percent against the US dollar following an agreement reached by the European Union leaders on immigration control and better than expected Consumer Price Index ‘estimate’ released for the month of June. The agreement is now expected to put an end to the uncertainty surrounding Angela Merkel coalition party and boost business sentiment in the Euro area.

The EURUSD closed as a bullish pinbar as shown above but below 1.1740 resistance levels. While the data pointed to a better business sentiment in the region, the growing trade war with the US and the possibility of the European Union buying long-dated bonds from next year to maintain record low interest rates will impact the Euro outlook against the greenback and expected to contain rebound below the 1.1852 key resistance that doubled as double top.

Therefore, a break above 1.1740 resistance level should attract enough sellers to reinforce the bearish move started in February towards the ascending channel, a sustained break of that level should open up 1.1398 support.

Please note that a positive Fed report due on Thursday will further strengthen the US dollar outlook against the Euro while a weaker than expected unemployment number may temporarily weigh on EURUSD outlook.

USDCHF

The Swiss Franc gained across the board on Friday after Swiss Finance Minister Ueli Maurer said the Swiss franc-euro rate has normalised and is not a problem for the exports dependent nation. But while the currency surged against the US dollar, it formed an evening star pattern as shown below. Indicating a possible continuation below the 0.9900 support level.

Despite the strong US dollar, the uncertainty surrounding trade war between nations is likely to increase demand for haven currencies like Swiss Franc going forward. Hence, the reason USDCHF is expected to extend downward to 0.9819 support levels on a sustained break of 0.9900 support.

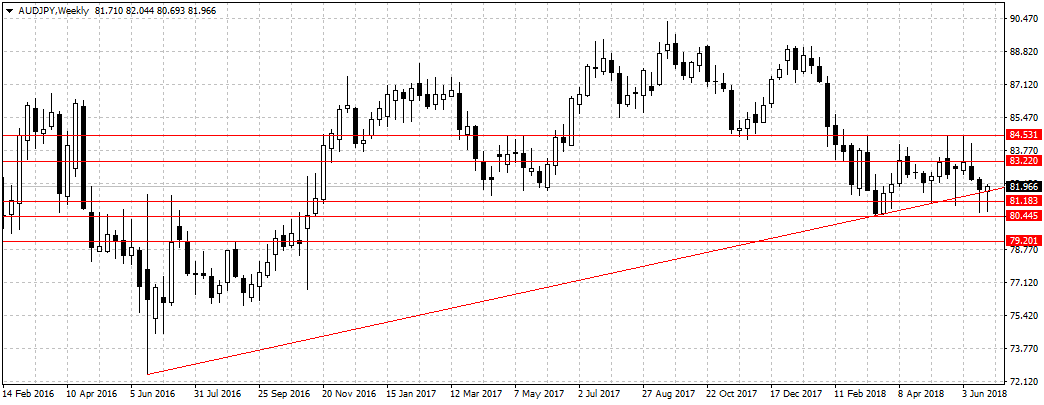

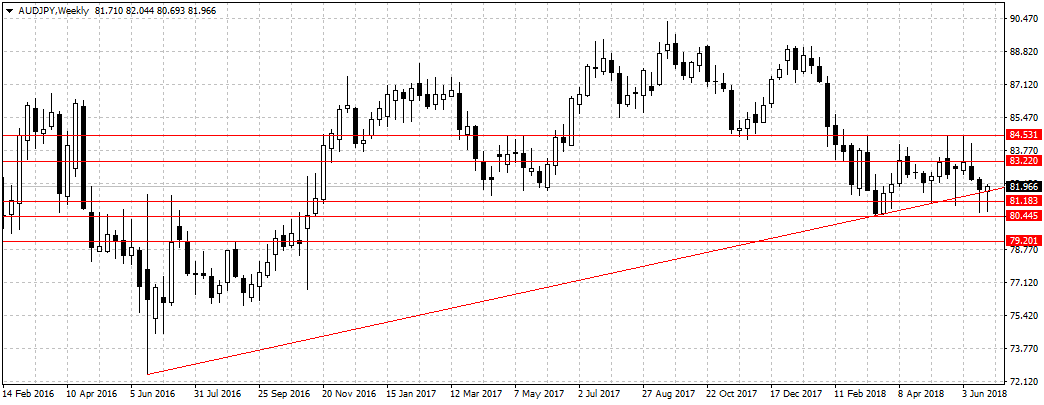

AUDJPY

For a similar reason, the Japanese Yen may get stronger as the rush for haven currencies increases. Also, the Australian dollar is likely to be weighed upon by slowing Chinese economic growth, its largest trading partner, and the ongoing trade war.

Likewise, growing household debt and sluggish wage growth amid rising job creation are hurting Australian retail sales and the economy at large.

Therefore, despite the pair closing as a bullish pinbar last week, a close above 83.22 resistance level is needed to validate bullish continuation. Otherwise, the trade war, new ‘steel’ import policy in China and global uncertainty will further push AUDJPY below the ascending channel. The reason I will be treating the pinbar as a temporary rebound and will expect a close below the 81.18 support level to open up 80.44 support.

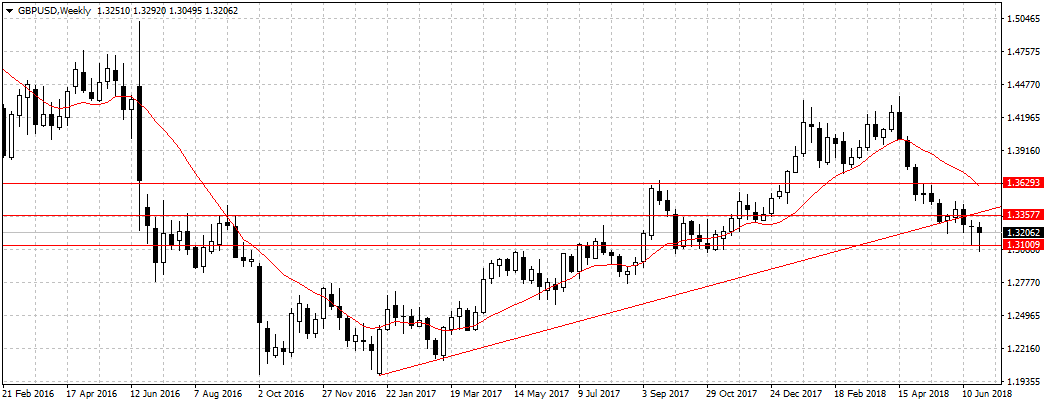

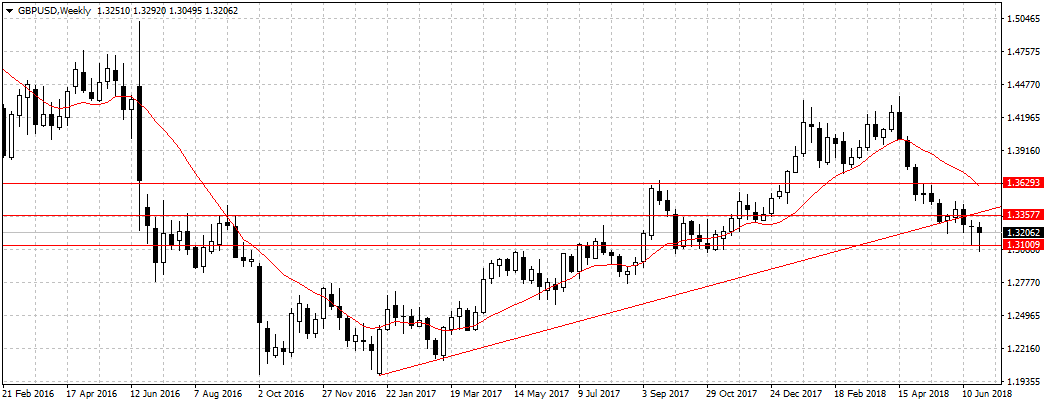

GBPUSD

The pound remained unattractive below the 1.3357 resistance level, and with the uncertainty surrounding the UK economy ahead of Brexit. I am expecting a retest of 1.3100 support level as long as price remained below the 1.3357 resistance under the ascending channel. Especially with the renewed interest in the US dollar.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago