- NB Rebrands Gulder for Positioning

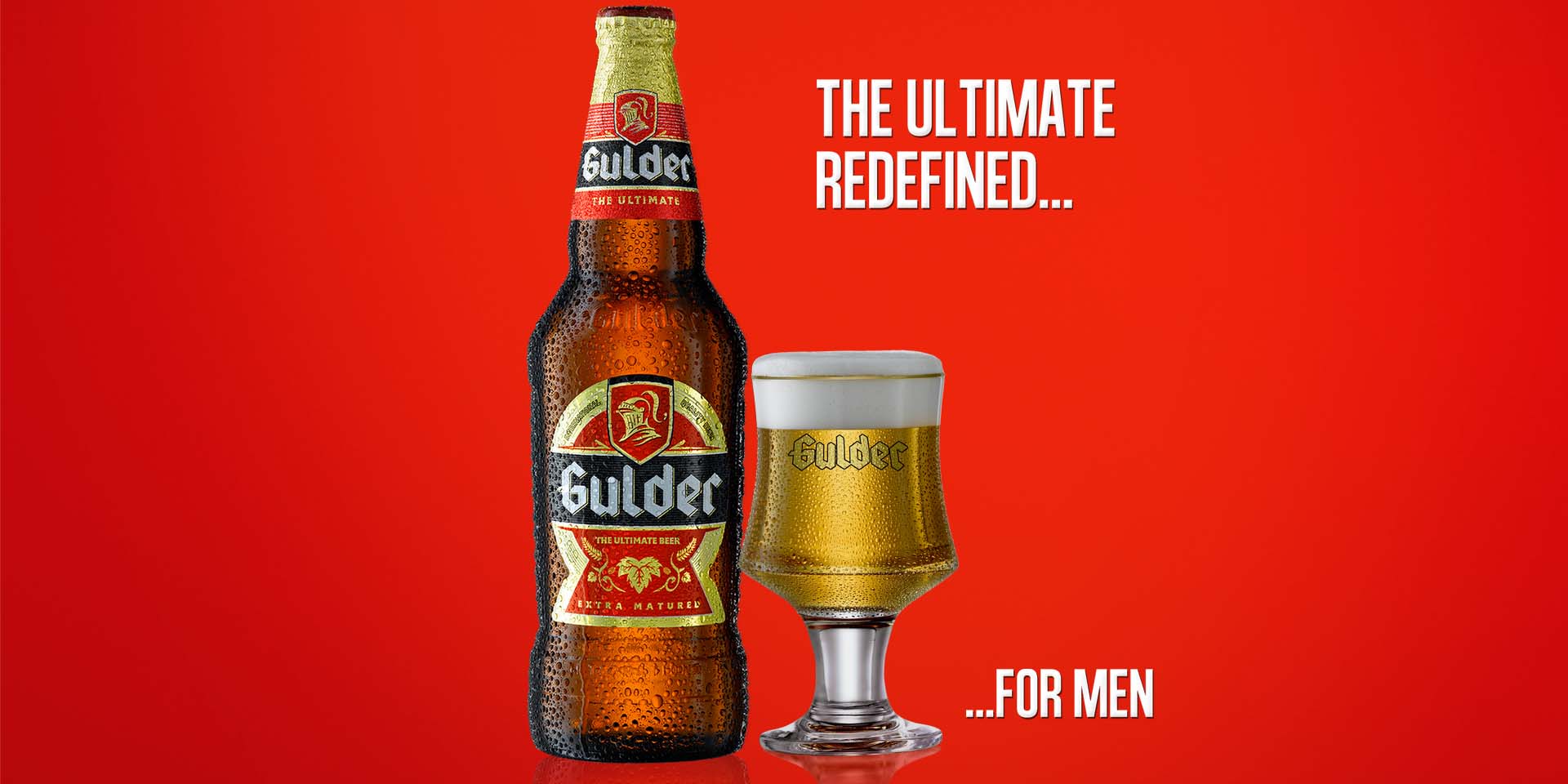

As part of its efforts at repositioning the Gulder brand for growth in the market place in the face of searing competition, Nigerian Breweries Plc, has rework the neck, back and front labels of the Gulder brand to be more in tune with the aspirations and desire of the youth market segment.

Coming bolder and more daring, the label which presents a simpler and more appealing look and feel lends itself to youthful look and modernity in its various presentations.

Gulder, respected for its unique flavour and taste, was first launched in a brown bottle with a unique label design over four decades ago and has gone through a couple of modernization processes to keep with the times as the labels and bottle designs have been tinkered with a view to appeal better to consumers.

One of the most outstanding and visible part of the current label make-over is Gulder’s strongest brand assets, ‘The Gulder Knight’, which now faces forward, giving the Gulder brand a more progressive outlook. “This change also symbolizes Gulder as the drink of the modern man”.

This one decisive move will also help in disabusing some consumers’ age-old misconceptions which include “Gulder inducing pot belly” and the notion that the brand is for old fellas, however they may be successful in their own rights.

The new design and positioning will allow the leading beer brand to take its daring and ultimate living mantra to another level.

According to the presentation on the new design, the brand’s credo, “Ultimate” will no longer be determined by some macho looking men or strenuous jungle exercises but it will be determined by the loyal consumer of the brand.

In all, he new label is a brilliant combination of the beer’s brand credentials and creative sagacity aiming to change the perception of the non Gulder drinker, from ‘Gulder is the beer for my father’ to ‘Gulder is my beer’, while also giving existing Gulder consumers another reason to be proud of their beer.

Commenting on the new label design, The Portfolio Manager, National Premium Lager, Nigerian Breweries, Olayinka Bakare explained the reason behind the new label and the brand proposition.

“Gulder has always been big on transformation and consumer satisfaction. With the launch of our all new label design, we want to delight our consumers and inspire them to be the best version of themselves as symbolized by every element in the new design. Gulder still maintains its unique taste, but with a better branding which positions it as the beer for the strong hearted, upwardly mobile and daring beer lover.”, Bakare said.

The Gulder beer reworked label design will lead the brand’s onslaught as a staple for the young, bold and courageous Nigerian against ravaging competition posted by brands of lower price points. The design will also lend itself to celebrating the daring and brave spirit of the modern man even as Gulder retains its content make-up – unique flavor, crisp taste and signature look.

To make it up to the consumers, a lot of add-ons special programmes and events will be thrown in as incentives to Gulder consumers as Nigeria’s premium beer brand.

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Travel4 weeks ago

Travel4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Travel3 weeks ago

Travel3 weeks ago