- Nigeria Can Bridge Electricity Gap With Microgrids —Kane

The Managing Director for Africa, Eaton, a power management company. Mr. Seydou Kane, in this interview with ’FEMI ASU, says the adoption of microgrids can help bridge the huge electricity gap in Nigeria.

what are your thoughts on the Nigerian power sector?

South Africa, with a population of about 55 million habitants, has a generation capability between 48,000 megawatts and 50,000MW, with new renewable energy coming online. When I look at Nigeria, a country with about 198 million inhabitants, we are talking about 5,000MW to 6,000MW. So, obviously, there is a significant challenge in terms of the capacity in Nigeria to cater for the electricity needs of the country.

It is very interesting that over the past few years, the whole energy sector in Nigeria is undergoing some very deep transformation. There is a push to significantly improve, not only generation, but also transmission and distribution of power throughout the country. So, this is exciting. There is an increasing interest in renewable sources of energy and overall, I will say this whole situation creates a very interesting opportunity for companies like Eaton in the Nigerian market.

What has Eaton been able to do in the Nigerian market in the area of renewable energy?

Eaton has been engaged in the Nigerian market for a long time. We grew by acquisition; so a lot of our legacy brands are present in the Nigerian market. Our vision is to improve the quality of life and the environment through our power management technologies, and we are doing so within several industries. For instance, we have been present for a long time in the oil and gas sector; the whole idea for us is to make sure that we help people be in a more safe, energy-efficient and sustainable environment.

Renewable energy is a very exciting environment for us. Obviously, we have seen a decrease in the cost of renewable energy, including solar and wind power. But we have also seen very fast decrease in prices when it comes to battery storage because renewable energy represents an intermittent source of energy, and it is very important, from our perspective, to copulate with battery storage or other elements within the frame of a microgrid to extract the most value from it. Estimated 80 million people in Nigeria today do not have access to modern electricity. So, we really do believe that microgrids, as we position them, are part of the solution. We are not saying that is the only option but it is really part of the solution to provide electricity to many people in a cost-efficient and sustainable manner.

Can you explain further how the Eaton’s microgrid energy system can be used to bridge the electricity gap in Nigeria?

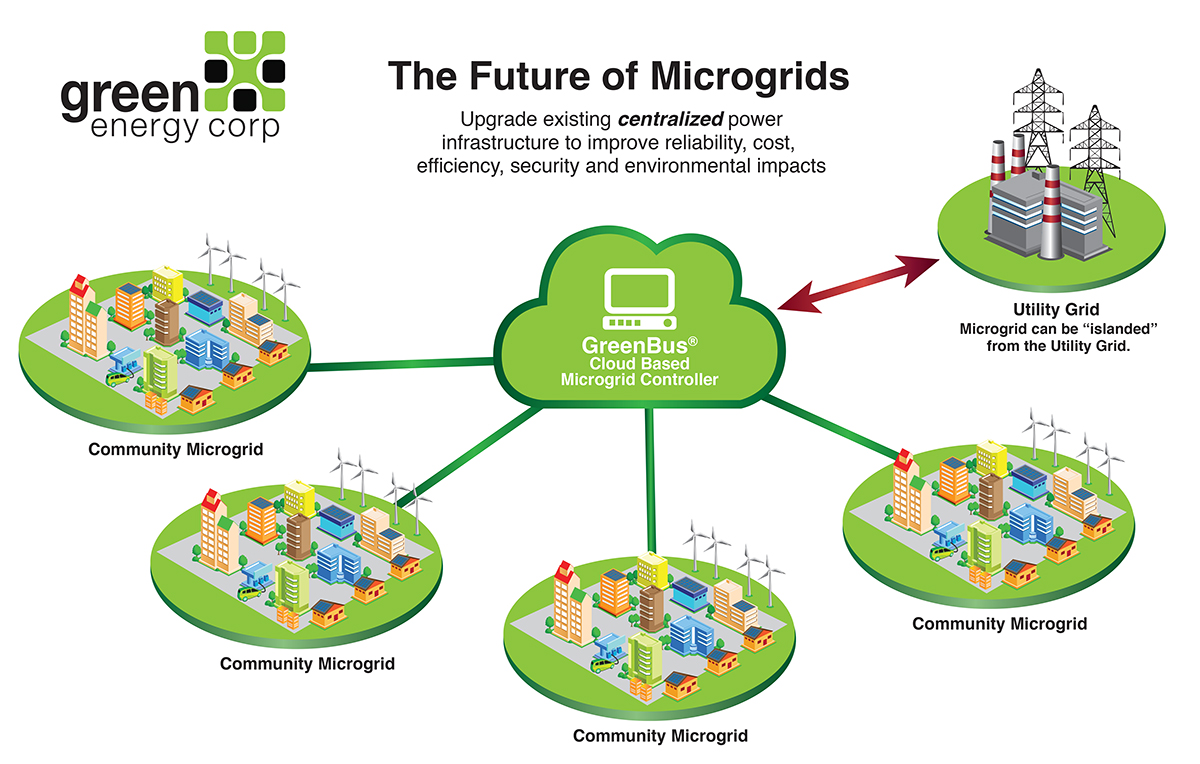

I do believe that the existing model of electrification, meaning one power generation centre and then you lay out the cables throughout the country to electrify your transmission cables and electrify the country, is one that will still exist. But that is extremely expensive and takes time. In Africa as a whole and Nigeria in particular, people want electricity right here and now. So, from that perspective, microgrid is clearly an opportunity in a market like Nigeria to bring very fast and cost-effective electricity to the biggest number. When we think about microgrid from an Eaton perspective, we look at it as an association of distributed energy that can work independently or in conjunction with the grid. So, from that perspective, there is already one of the elements of this microgrid that is present in Nigeria. If you add the solar option, and if you add the battery storage, you have all the components for a very interesting microgrid opportunity in Nigeria.

What are your plans for the Nigerian electricity market?

We are focused on investing in opportunities across the continent; and Nigeria, as the biggest economy on the continent, is clearly an area of big interest for us. So, we are driving to increase our market share in Nigeria. But we are also open to partnership and collaboration in order to fast-track the adoption of microgrid and other technologies that Eaton can bring into the market.

The microgrid, technically, doesn’t have any specific limitation. For instance, we deployed a microgrid of 5MW in Equatorial Guinea two years ago. Last month, we deployed one in our factory in South Africa; it is a microgrid of approximately 400 kilowatts. We are very flexible, and the microgrid is scalable. We can go from as low as a household and scale it to a utility or grid level. The microgrid offers fantastic opportunity to release the tension on the main grid. Some countries have allowed microgrids to pull power back into the national or regional grid. For that to happen, you need the regulation to be enabling in order to make microgrids flourish. You could see distributed energy as a complement, rather than a competition. I believe that microgrids are not new, but there is an acceleration now. There is a realisation that to prove electricity to the 600 million people that do not have access to electricity in Africa, the traditional grid is not enough. In a lot of countries in Africa, there is an opportunity for microgrid.

We have been in Nigeria for many years. We have an office in Nigeria and we are looking at opportunities to significantly grow that market. I do believe that despite the recent downturn in the economy, there are significant opportunities in the country. So, we will continue to work with our partners locally to improve and increase our presence. We are very excited about the new horizon that microgrids have opened for us, not only in Africa but also globally.

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Travel4 weeks ago

Travel4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Travel3 weeks ago

Travel3 weeks ago