- U.S. Consumer Spending Surges in March

The U.S. retail sales grew more than expected in March, making it the first gain in four months and suggested that consumer spending has started regaining steam on the back of tax cuts and refunds.

Retail sales surged by 0.6 percent in March, following a 0.1 percent decline in February, the Commerce Department showed on Monday. The number was higher than the 0.4 percent projected by economists.

The report showed eight of the thirteen retail categories increased in the month, with sales at health and personal-care stores rising by 1.4 percent, the most in 24 months. While auto sales climbed 2 percent, also, the most since September 2017. A separate but related report released last week showed sales of cars and light trucks climbed to 17.4 million year-on-year in March, the fastest this year.

“It’s nice to see the bounce-back here — to me it’s just on trend,” Societe Generale senior U.S. economist Omair Sharif said. “If you look at the quarter as a whole, we’re not breaking out from the kind of real spending numbers we’ve seen the last several years.”

However, sales dropped in categories such as building material stores, which declined by 0.6 percent, apparel stores, dropped by 0.8 percent and sporting goods, hobby, book and music stores dips by 1.8 percent, the most since December.

Strong labor market and rising wage growth amid lower taxes are fueling consumer spending in the U.S. and this is expected to continue in the second quarter due to tax returns. However, consumer spending is likely to grow at a slower pace in the first quarter due to weaker than expected numbers in January and February.

Overall, the U.S. economic fundamentals remain strong, but global trade wars and political uncertainty amid series of investigations regarding presidential election may continue to impact market outlook.

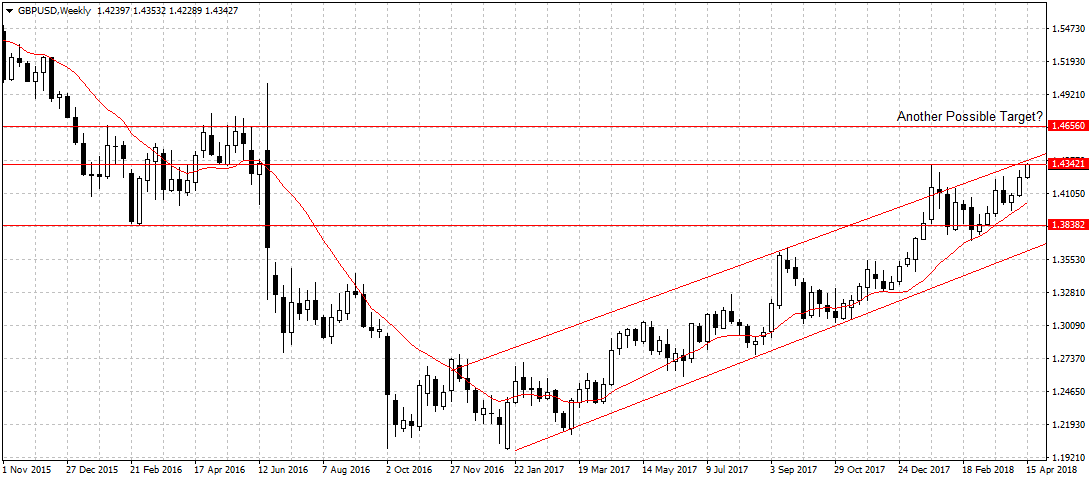

The U.S. dollar declined against the pound to break 1.4321 price level despite the better than expected number. Meaning, the growing uncertainty in the U.S. is hurting the U.S. dollar outlook even with the U.K. weak economic numbers, the pound continued to gain against the greenback. Therefore, I will expect a sustained break of 1.4388 resistance level to open up 1.4656 price level for the aforementioned reasons.