- Forex Weekly Outlook November 20-24

The US economy continued to churn out strong economic fundamentals but not enough to sustain dollar attractiveness amid rising tax concern. Retail sales rose 0.2 percent in October, indicating consumer spending remains healthy even with less desirable wage growth.

In the U.K, the economy has started showing signs of weakness following Prime Minister Theresa May failure to reach an agreement with the European Union. Retail sales dropped 0.3 percent year-on-year in October, while wage growth edge higher slightly to 2.2 percent in the third quarter. Still, this is below the 3 percent inflation rate that is eroding buying power.

In the Euro-area, the economy grew at 0.6 percent with consumer prices remaining steady at 1.4

percent, same as previous numbers.

This week, we will be reviewing six currency pairs as listed below;

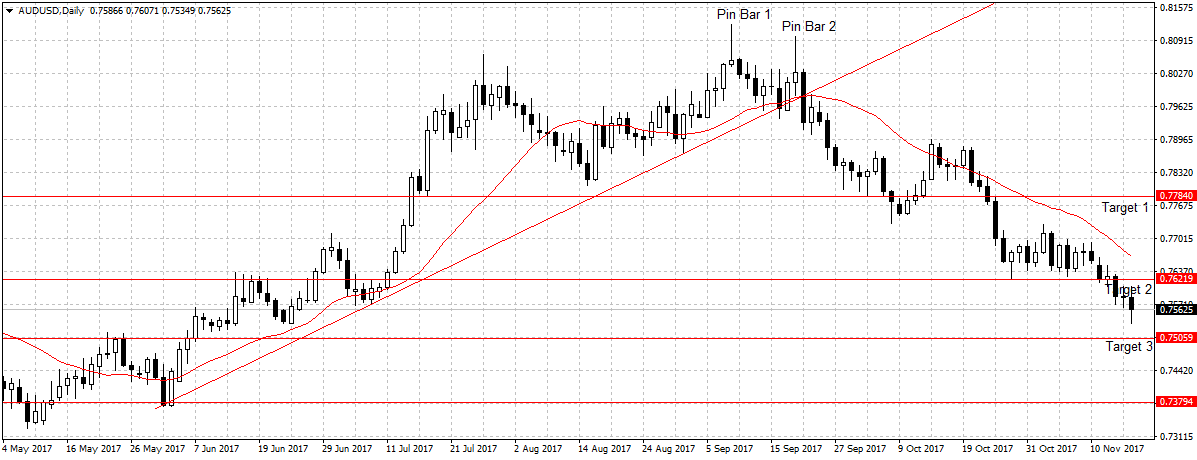

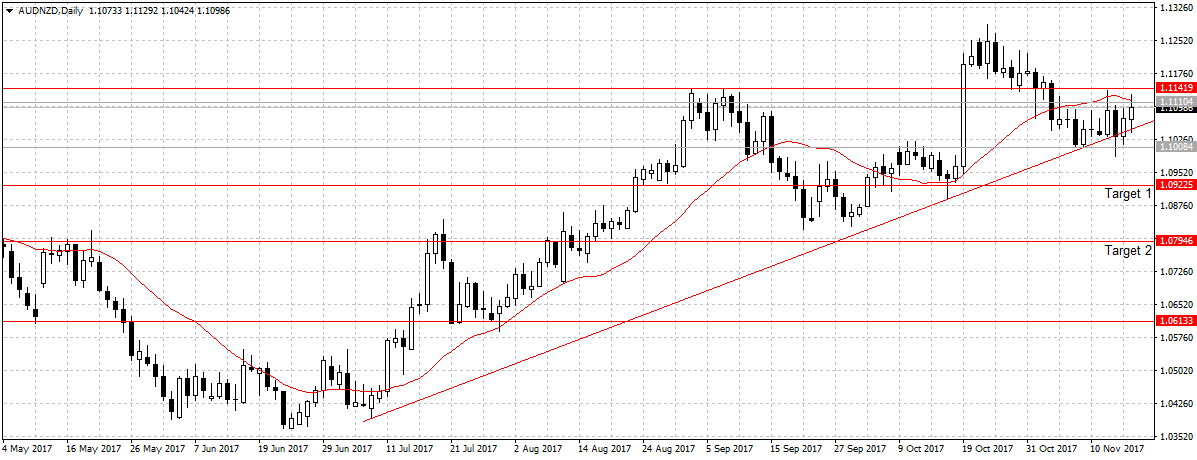

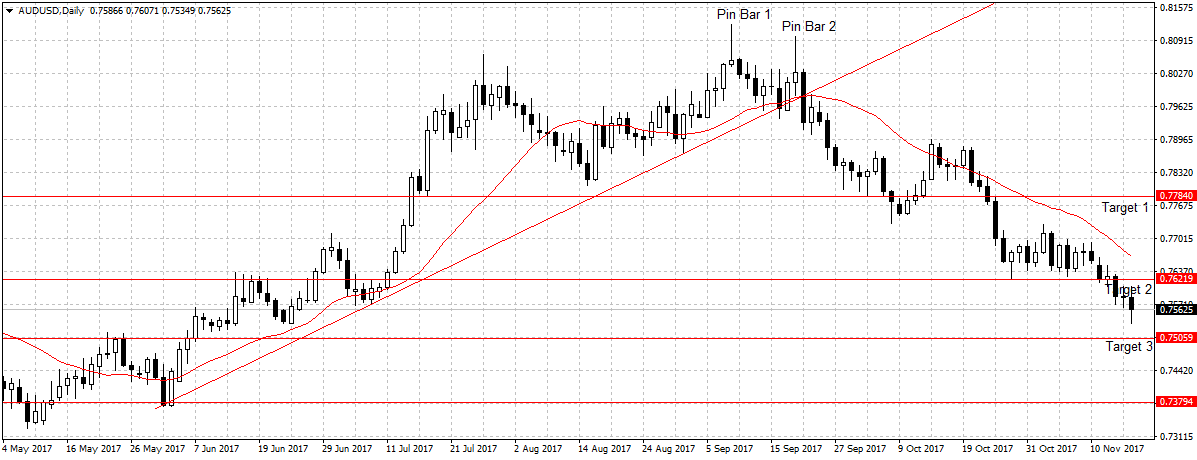

AUDUSD

Australia created fewer jobs than expected in October but unemployment rate improved to 5.4 percent. Meaning, drop in the participation rate was what plunged unemployment rate to more than 4-year low and not state of the economy.

As previously stated, the Australian economy is struggling with weak wage growth and low inflation rate, this we expect to continue into 2018. Especially, with retailers cutting prices to boost demand and housing debt rising.

Therefore, this week we remain bearish on AUDUSD and expect the success of House Republicans on tax reform to further aid AUDUSD towards our third target at 0.7505.

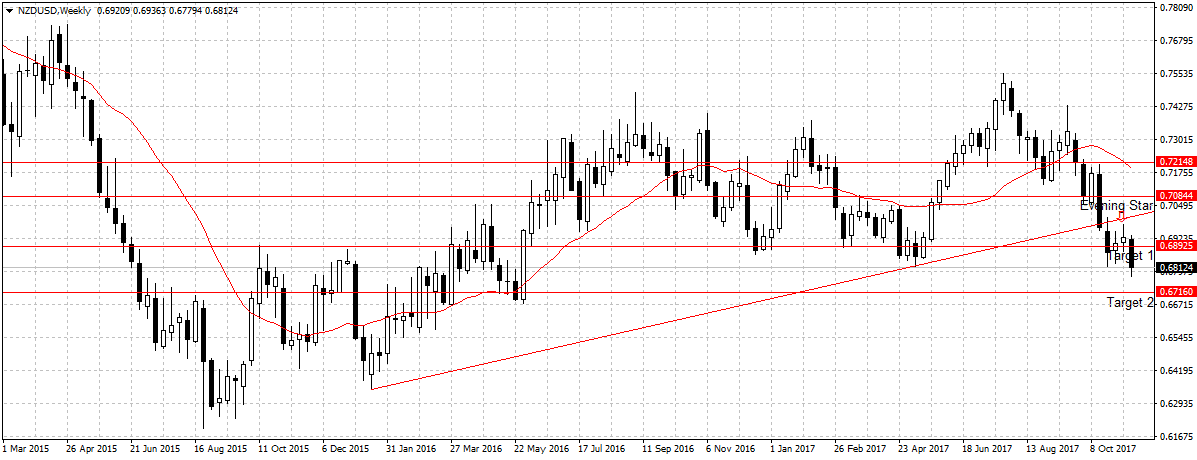

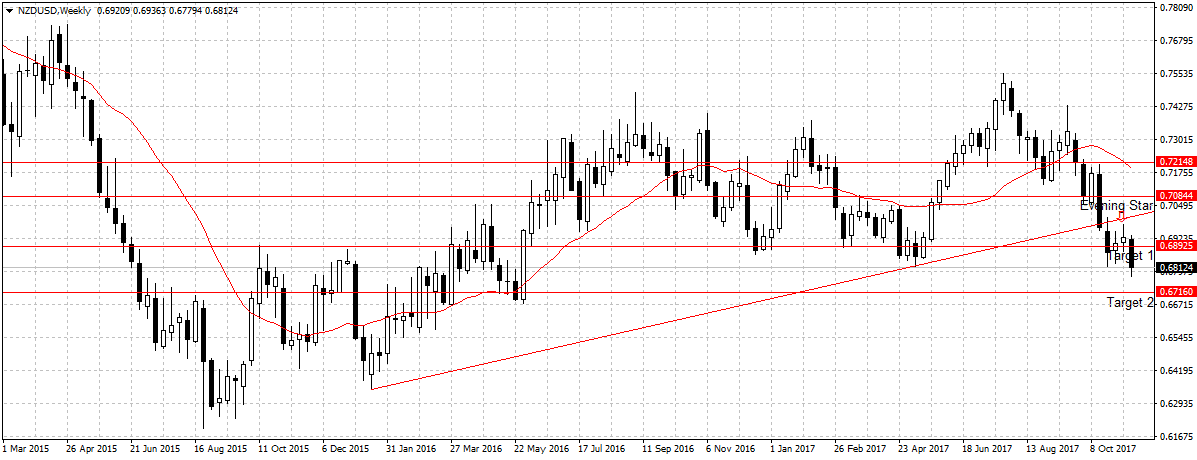

NZDUSD

Last week, data shows New Zealand’s producer price index, both input and output, rose less than expected in the third quarter. Suggesting that price pressures are still low and likely to impede the Reserve Bank of New Zealand from raising rates in 2018.

Even though inflation rate was better than expected in the third quarter, 1.9 percent year-on-year. It was just above the mid of 1-3 percent projected by the apex bank. This is partly due to the decline in global dairy prices and weak exports.

Again, while this pair rebounded after hitting our first target at 0.6892, the weak economic outlook due to change of government and poor economic fundamentals continued to hurt the Kiwi attractiveness against most currencies. Therefore, after establishing a bearish evening star below the ascending line, as shown above, the NZDUSD has reaffirmed bearish continuation. This week, we remain bearish on NZDUSD with 0.6716 (target 2) as the target.

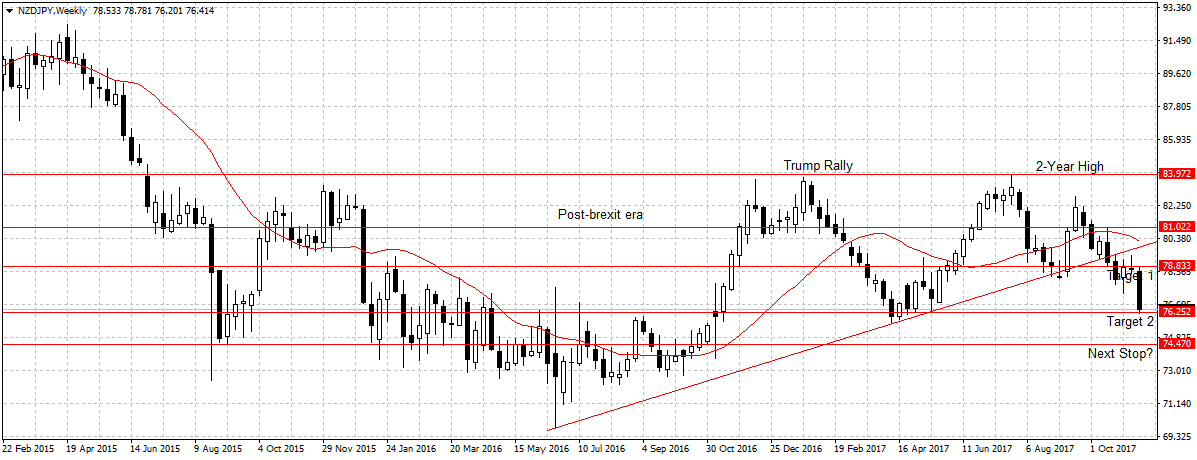

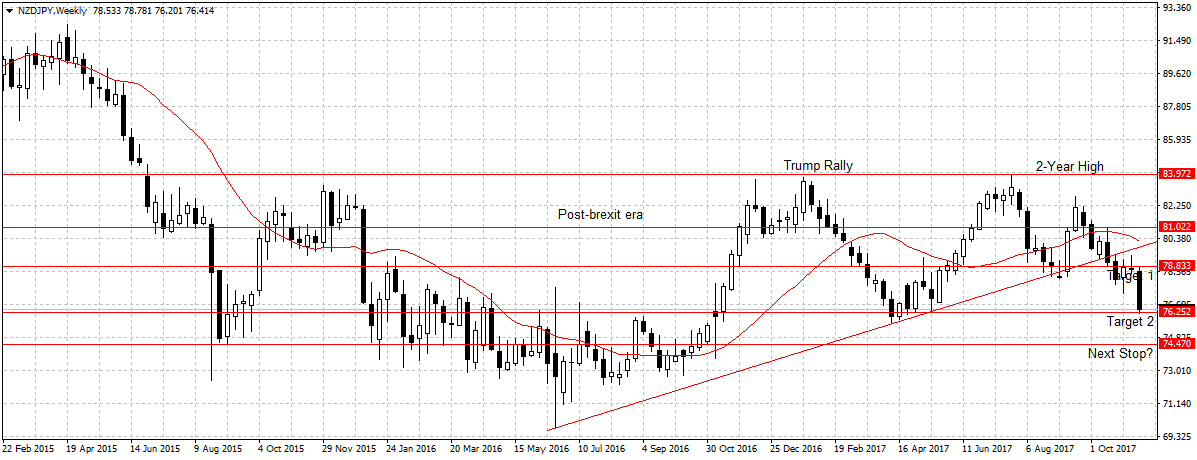

NZDJPY

The weak producer prices aided our NZDJPY projection last week but after NZDJPY hit our second target at 76.25 the pair slightly rebounded to close above that support level. While we are bearish on NZDJPY, we need a sustained break of 76.25 support level to validate bearish continuation for 74.47 targets.

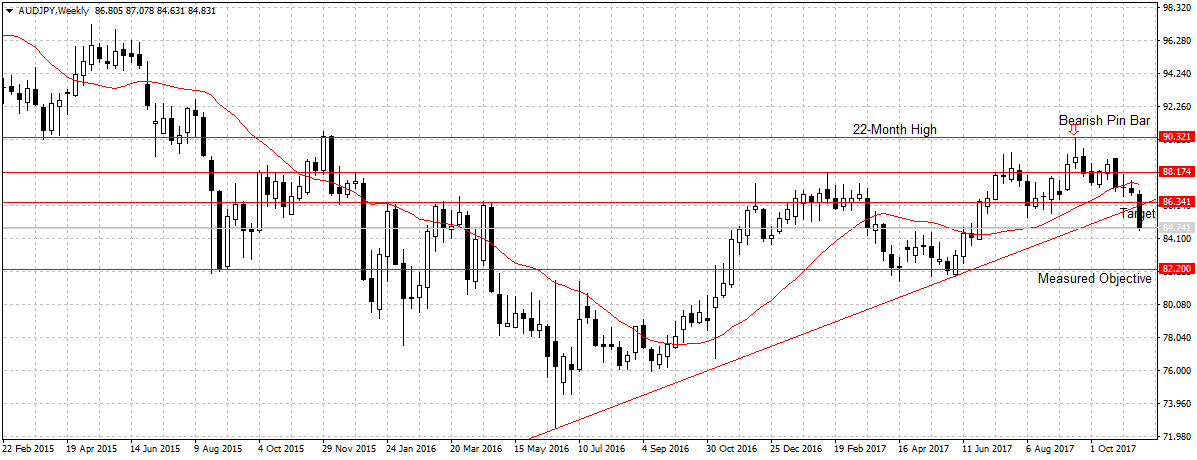

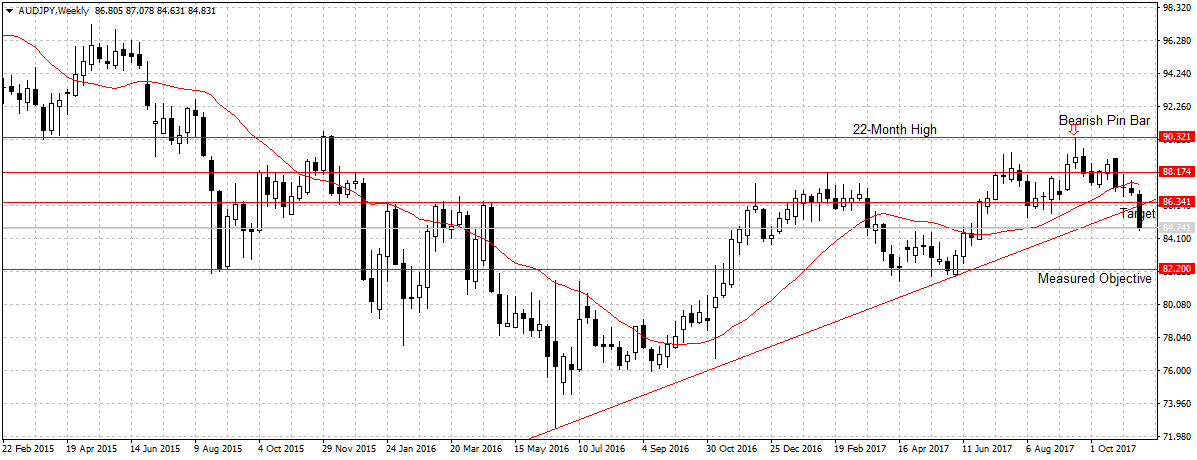

AUDJPY

As stated in the previous analysis, the Australian dollar is overpriced but the weak economic data and uncertainty surrounding the economic growth ahead of China’s credit control and steel reduction policies are key factors hurting Aussie dollar attractiveness against G10 currencies. After closing below our first target at 86.34 and below the ascending trendline, the AUDJPY affirmed bearish continuation towards 82.20 as shown above but a sustained break of 84.74 is needed to further validate downside movement. This week, we will be looking to add to our position below 84.74 support.

After closing below our first target at 86.34 and below the ascending trendline, the AUDJPY affirmed bearish continuation towards 82.20 as shown above but a sustained break of 84.74 is needed to further validate downside movement. This week, we will be looking to add to our position below 84.74 support.

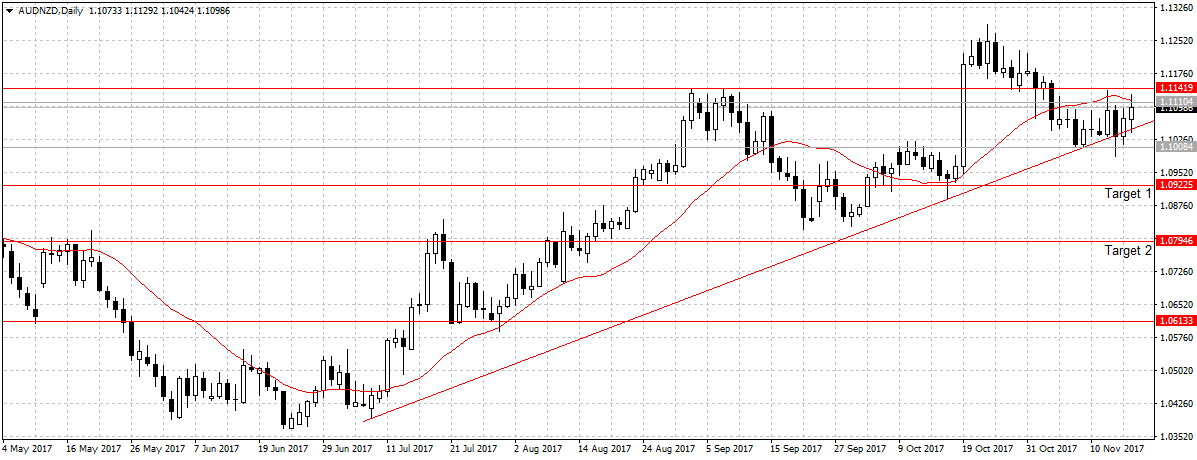

AUDNZD

While this pair rebounded last week, we do not see its sustainability going forward. Therefore, we attributed the upsurge in price to the weak producer prices data released on Friday and expect the market to attain a ‘balance’ next week. Especially, with the weak Australian economic outlook and the 1.1111 resistance level that doubled as 20-day moving average still intact.

Hence, we remain bearish on AUDNZD and expect a close below the ascending trendline and 1.1000 support level to reinforce sellers’ interest and push price towards 1.0922 as previously stated.

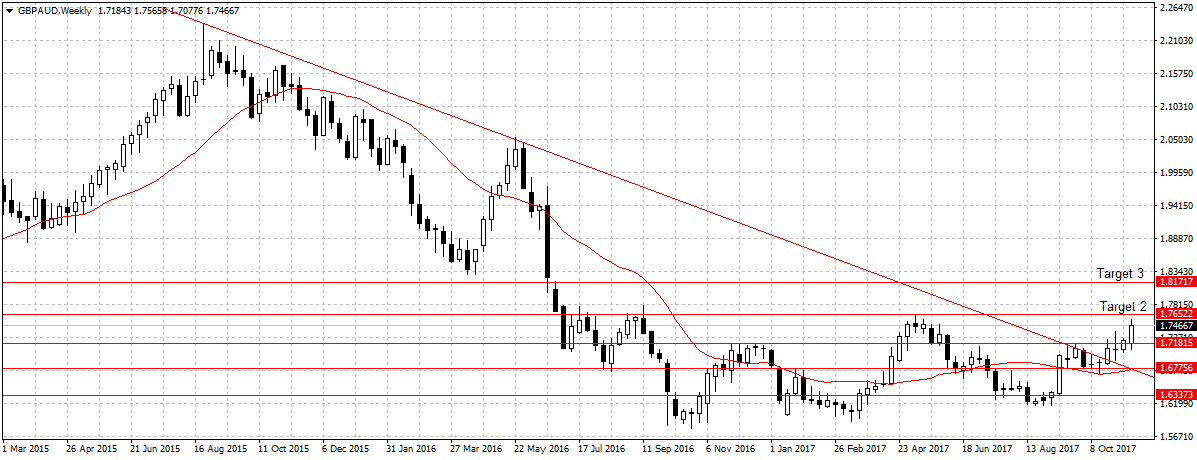

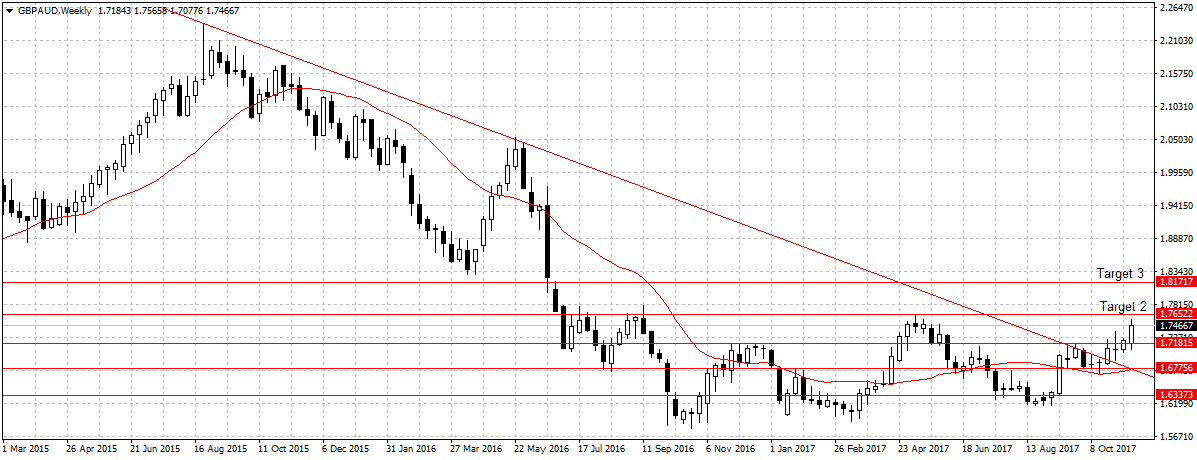

GBPAUD

Since we first mentioned this pair buy opportunity in September, it has gained significantly above our 1.6539 targets. However, after readjusting our psychological levels to accommodate the Bank of England’s new monetary policy stance, we think GBPAUD is ready for the upside for two reasons. One, while the Australian dollar is overpriced, Pound Sterling is undervalued and has suffered tremendously because of growing uncertainties surrounding Brexit. Two, the U.K. economic numbers remain positive and resilient even with the growing political and economic issues in the nation, while the reverse is the case for Australian economic numbers.

Similarly, between September 15 and November 17, this pair has gained 1080 pips to close at 1.7466 last week. That is a significant move for the Pound Sterling with all the economic uncertainties. Also, we believe a close above the 1.7181 validated sustainable bullish move and as long as that level holds, we are bullish on GBPAUD with 1.7652 as the target.

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago