- Forex Weekly Outlook October 30 – Nov 3

The US dollar sustained gains against its counterparts last week following the adoption of 2018 fiscal budget by the senate and the better than expected economic growth rate recorded in the third quarter. While consumer prices remain below the Fed’s 2 percent target and wage growth is yet to pick up substantially, the economy remains resilient and predicted to expand just below the 3 percent target of President Donald Trump in 2017.

Similarly, the possibility of the tax reform finally coming to fruition, after the adoption of 2018 fiscal budget, strengthens the US assets, and this is expected to continue through December 2017 and further bolster the US dollar outlook in the final quarter of the year.

Therefore, the US dollar is likely to sustain its gains in the fourth quarter if uncertainty, like missile threat and market surprise ahead of the Federal Reserve appointment remains minimal.

In Europe, the Euro common currency plunged against the G10 currencies last week even with growing economic outlook and improved new orders. This is partly because of the uncertainty surrounding Spain-Catalonia independence and the failure of the European Central Bank to meet market expectation during monetary policy meeting last week. The central bank announced it would cut down on asset purchase program to 30 billion euros from the current 60 billion euros starting from January 2018 through September.

However, it also warned this amount can be increased or the duration extended depending on the economic condition in the region, while at the same time saying seemingly growing price pressures is likely to subside in 2018 and predicted to remain below its 2 percent target up until late 2019.

This mixed economic outlook amid sluggish wage growth and weak inflation rate was interpreted by the market as ‘no interest rates hike anytime soon’. Hence, the fall in the Euro single currency.

Below are weekly forex projection;

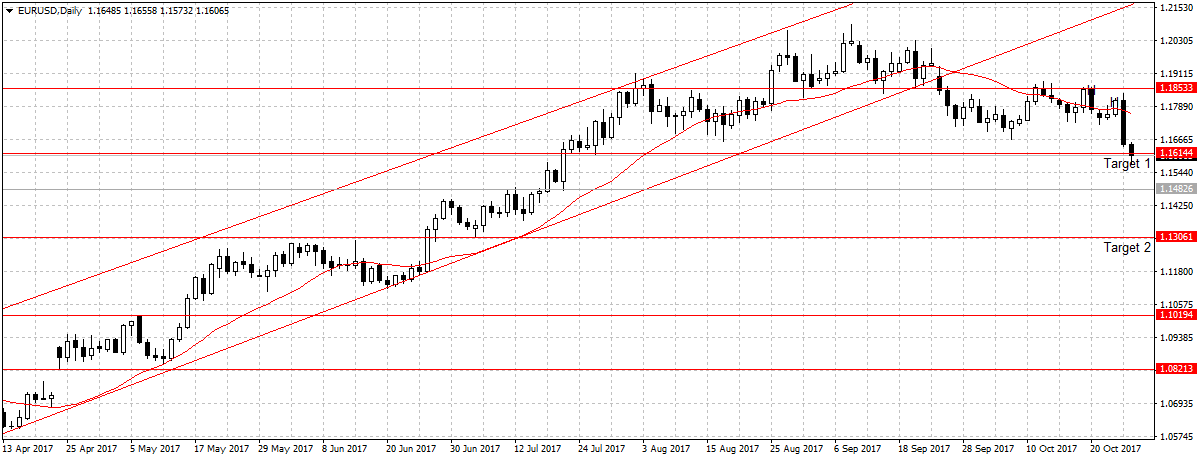

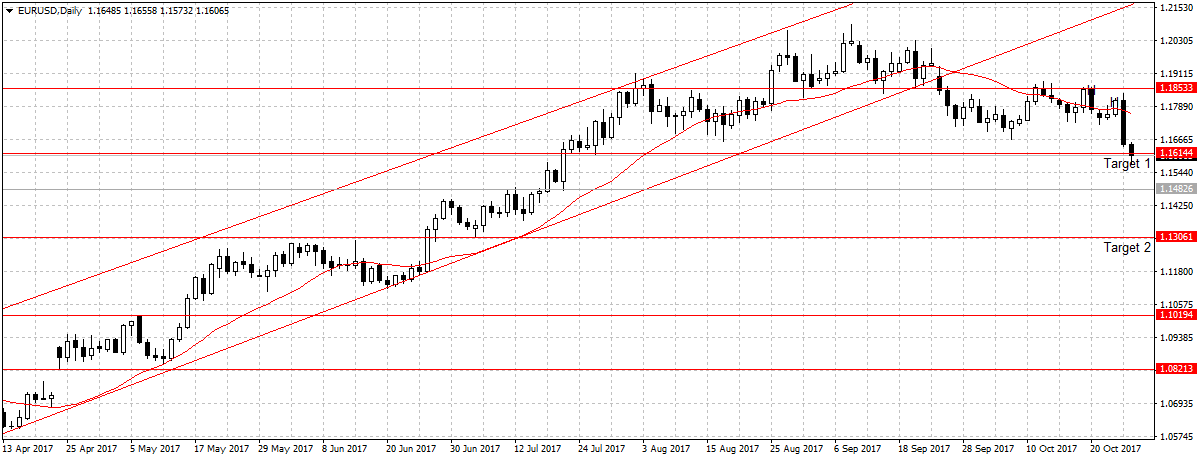

EURUSD

In an effort to increase economic productivity, the present administration is pushing for complete tax overhaul even though the tax bill would add as much as $1.5 trillion to the federal deficits over the next 10 years. The Donald Trump led administration has argued that improved productivity would compensate for the shortfall.

While most economists and policymakers have vouched never to support any bill that would add to the current $20 trillion debt, the Republicans have finally managed to pass the 2018 budget blueprint that will allow Republicans to bypass Democrats in tax decision and corporations to pay 20 percent income tax rate, down from 35 percent.

This, coupled with 3 percent economic growth rate in the third quarter will further boost business confidence and increase cash inflow as the Federal Reserve looks to raise interest rates for the last time this year. Therefore, improved US economic outlook and projected surge in corporate earnings would aid the attractiveness of the US dollar as that would translate to increased job creation and improved earnings in a time of weak wage growth and low inflation.

Technically, the EURUSD plunged to its lowest since July after GDP report on Friday, losing 239 pips within two days to close below the 1.1614 support level. Therefore, this week I will expect the improved US economic outlook to strengthen the US dollar against the Euro common currency and open up 1.1306 support level in coming days. However, a sustained break of 1.1482 support is needed to validate bearish continuation.

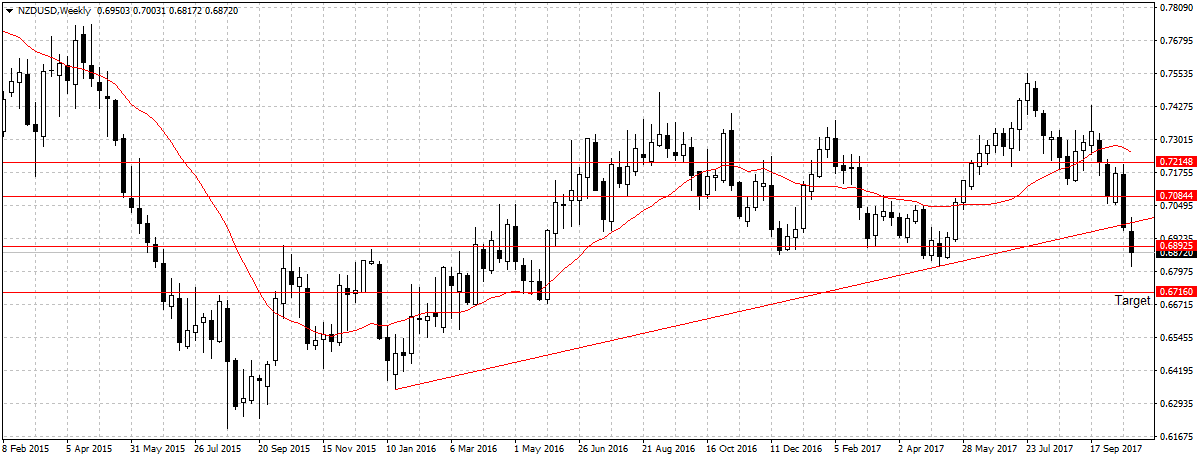

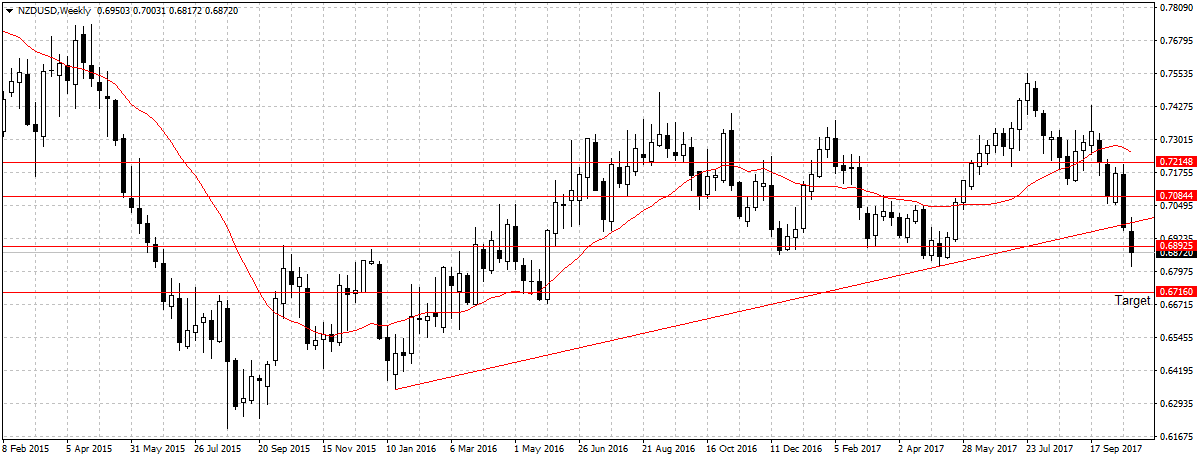

NZDUSD

The uncertainty surrounding the economic policy of the New Zealand First coalition party weighed on the Kiwi outlook and plunged business confidence in the nation.

Similarly, after meeting our first and second targets the past weeks, I think NZDUSD still have more on the downside, especially after the renewed interest in the US dollar and surged in capital flight following the coalition.

Again, this pair was a pip away from breaking 2017 low of 0.6816 price level established in May and closed below the 0.6892 key support, our target 2. Meaning there is an increase in sell orders during the week but with the US economy growing faster than the 2.6 percent predicted by experts. I expect the NZDUSD to sustain its bearish move towards our 0.6716 targets. Therefore, I remain bearish on this pair.

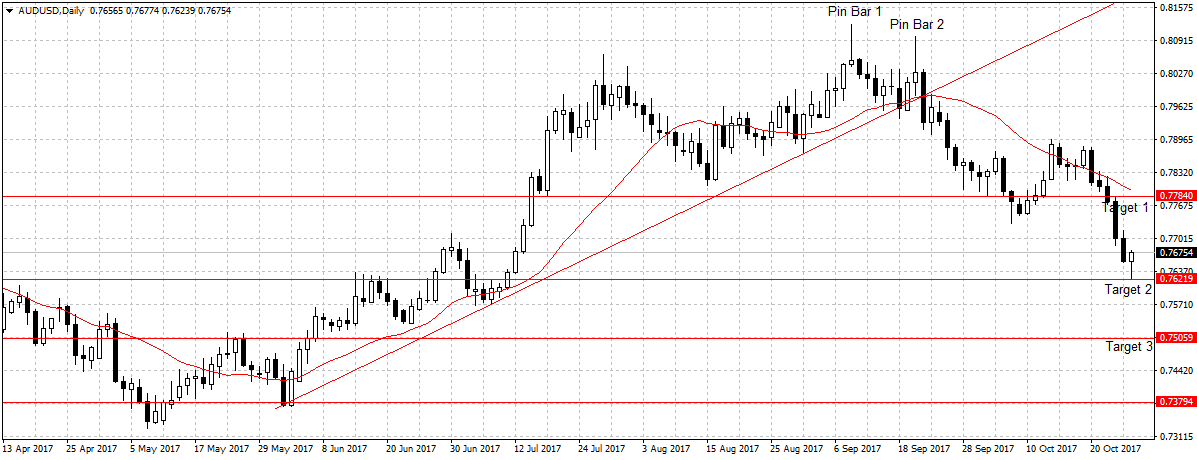

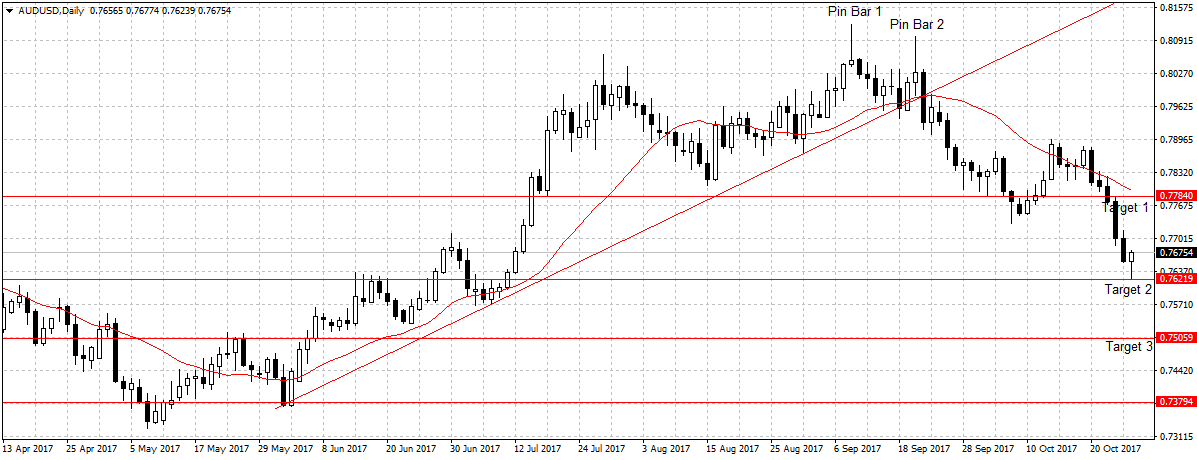

AUDUSD

As stated here, the Australian dollar is overpriced and with the weak consumer prices recorded in the third quarter amid fall in Iron Ore prices, the currency is expected to remain on the downside against the US dollar for the remaining of the year.

Last week, the pair was two pips short of our second target at 0.7621, but with the renewed interest in the US dollar following increased economic productivity, the AUDUSD is likely to continue its bearish move below the 0.7621 support level this week. A sustained break should open up 0.7505 as shown above. Therefore, I remain bearish on AUDUSD as first stated in September.

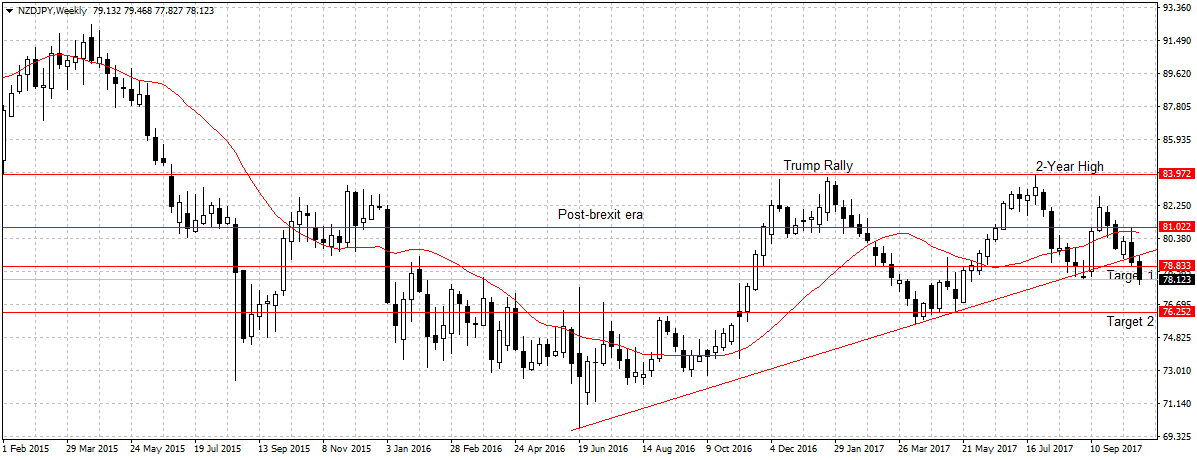

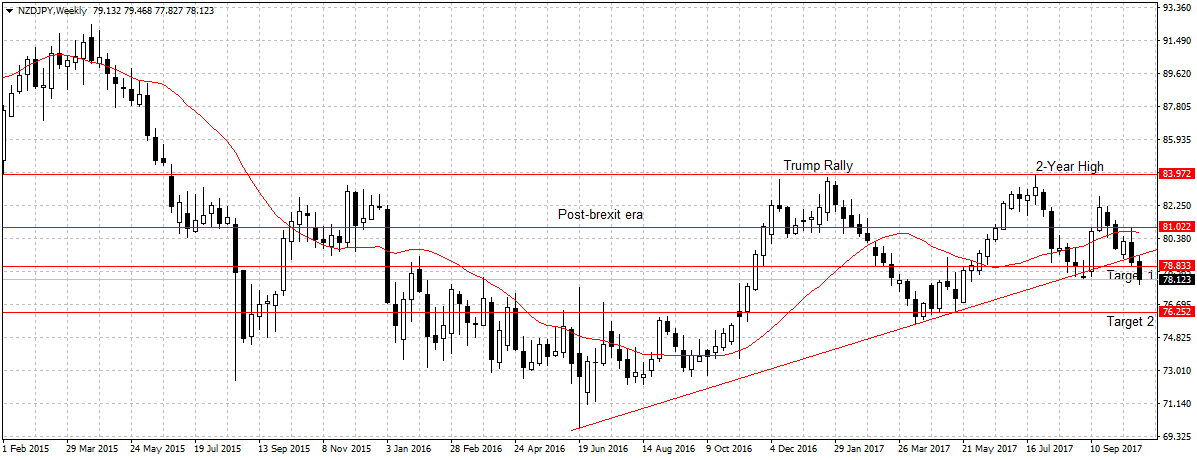

NZDJPY

As explained last week, the Yen gained on Prime Minister Shinzo Abe reelection and strong economic growth. But without economic growth plan from the New Zealand First coalition party, the uncertainty in the country remains and so is the NZDJPY bearish movement.

Again, if the new coalition party failed to present a holistic economic plan in coming days amid rising food prices and weak wage growth. NZDJPY may head towards 2017 low of 75.61 support level. An excerpt from October 19 analysis.

Therefore, with the NZDJPY closing below our first target last week to reach 5 months low of 77.82. This new low should reinforce sellers’ interest for 76.25 support level, our second target.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago