- Contributory Pension: Police Make a U-turn on Exit

Paramilitary organisations and some members of the National Assembly where on Thursday shocked when the Nigeria Police Force made a sudden U-turn and withdrew its earlier request to exit the Contributory Pension Scheme on Thursday.

Officers and men of the Nigeria Police Force, Security and Civil Defence Corps, Nigeria Immigration Service, Economic and Financial Crimes Commission, Independent Corrupt Practices and other related Offences Commission, National Drug Law Enforcement Agency, and other related agencies had sought to exit from the CPS.

But at the public hearing on a bill to amend the Pension Reform Act, 2014, at the House of Representatives in Abuja, the Police hierarchy said it was no longer interested in pulling out of the scheme.

The Inspector General of Police, Ibrahim Idris, said that the NPF already had a Pension Fund Administrator, which was taking care of retirees, who were contributors to the CPS.

“We don’t want to go back to the old Defined Benefits Scheme, we want to remain under the CPS because the welfare of the police will be better taken care of under the CPS,” he said.

The IG, who was represented by the Director, Legal, NPF, David Igbodo, however, stressed the need to improve the welfare package of retirees and relatives of deceased police officers.

Members of the paramilitary agencies and retired police officers present murmured loudly to express their disbelief over the statement.

The Chairman, House Committee on Pensions, Hassan Shekarau, assured them that they would also be given the chance to canvass their positions.

A member of the House, Oluwole Oke, who sponsored the exit bill that has already passed second reading, had earlier said the move was to improve the lots of pensioners and ensure their safety due to the risky nature of their profession.

“I am shocked to hear the police saying this, because we had already met with the necessary groups and discussed before making this move. Even if there was a new development that could warrant this change, it should not be this way,” Oke said.

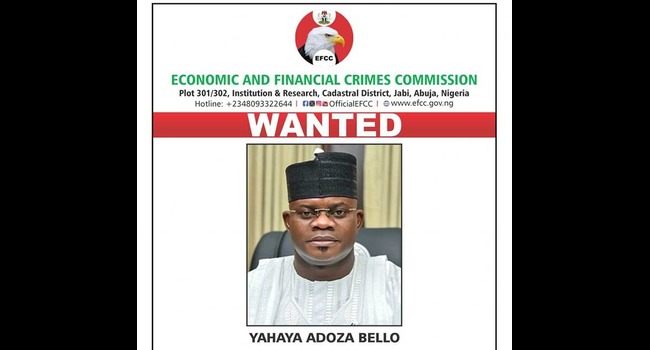

No representative showed up when the EFCC was called to present its position.

However, the representatives of the ICPC, NDLEA, NCS and NIS said they had submitted memoranda to the Senate and restated their stand to exit the CPS.

Some retired police and paramilitary officers said the nature of their work was similar to the military, which was granted permission to exit the CPS in 2011.

The Pension Transitional Arrangement Directorate, the regulatory body of the old pension scheme, which the paramilitary personnel were requesting to return to, dealt the agitators another blow when it said they were not welcome back.

The PTAD said it was still grappling with huge pension liabilities that it inherited, adding that the Federal Government should not be weighed down by additional financial burden.

The PTAD said that if the agitators felt they would earn more under the DBS, there were currently many retirees earning low pensions under the old scheme.

Other groups that kicked against the bill include the Nigeria Labour Congress, Nigeria Employers Consultative Association, Securities and Exchange Commission, National Insurance Commission, National Pension Commission, Nigerian Union of Pensioners and Pension Funds Operators Association of Nigeria, among others.

The President, NLC, Ayuba Wabba, faulted the provision of the proposed bill to raise the lump sum that retirees would be getting from 25 per cent to 75 per cent.

Forex4 weeks ago

Forex4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Commodities4 weeks ago

Commodities4 weeks ago