- U.S Adds 211,000 Jobs to Payroll in April

The U.S. labour market rebounded in April, after rising lower than previously projected in March.

The economy added 211,000 jobs to beat economists projection of 190,000 jobs, a Labour Department report showed on Friday.

While the unemployment rate is now the lowest since May 2007, wages were a soft spot in the report, climbing 2.5 percent from a year earlier.

The brighter figures follow a weaker-than-expected reading in March, when payrolls were partly depressed by a snowstorm that slammed the Northeast during the survey week. Strengthening business sentiment might be translating into hiring, and the data should keep Federal Reserve policy makers on track to raise interest rates in the coming months after officials declared the first-quarter slowdown to be temporary.

“Labor market conditions remain robust and continue to tighten,” said Ward McCarthy, chief financial economist at Jefferies LLC in New York, who had forecast a payrolls gain of 220,000. “This data will keep the Fed on track for a preferred 2017 normalization timeline of rate hikes in June and September and the first step toward balance-sheet normalization in December.”

The report showed revisions to the previous two months subtracted 6,000 jobs from payrolls. The first quarter saw a 176,000 average monthly increase after a 187,000 average pace in 2016.

Fed Forecast

The unemployment rate compares with economists’ projection for 4.6 percent. It’s now below the 4.5 percent level where Fed policy makers in March had forecast it would reach in the fourth quarter, based on their median estimate.

Employment gains were broad-based though concentrated in services in April. Leisure and hospitality registered a 55,000 increase, education and health services was up 41,000 and financial activities rose by 19,000. Retail rebounded with a 6,300 increase following a revised loss of 27,400.

Manufacturing and construction jobs rose but at a weaker pace than at the start of 2017. Factories added 6,000 jobs after a 13,000 gain, while construction workers rose by 5,000 following 1,000 in March.

Total private employment, which excludes government agencies, climbed by 194,000 in April, following a 77,000 advance the prior month. Government payrolls rose by 17,000 in April, including a 6,000 decline at federal agencies and 23,000 increase at state and local governments.

Wage growth accelerated on a monthly basis to 0.3 percent from a revised 0.1 percent gain in March. At the same time, the 2.5 percent year-over-year gain in average hourly earnings was the weakest since August, following a 2.6 percent rise in March.

The employment cost index increased 0.8 percent in the first quarter for the best performance since the end of 2007, a separate Labor Department report showed last week.

Healthy Outlook

Absent faster wage growth, consumers have retained a healthy outlook as they’ve largely socked away savings from income gains including stronger stock and housing prices. Weaker household purchases in the first quarter reflected a slowdown in automobile sales, which are easing to a more sustainable rate, and smaller home-heating bills owing to unusually warm weather.

“The underlying consumer fundamentals remain positive because the labor market remains positive,” said McCarthy of Jefferies.

Dwindling labor-market slack also is helping workers gain bargaining power. Beyond the broad unemployment rate, measures of spare workforce capacity that are favored by Trump administration officials showed further progress toward pre-recession levels in April.

The underemployment rate, a measure that includes those working part-time who would take a full-time job if it were available, dropped to 8.6 percent, the lowest since November 2007, just before the last recession began. It was from 8.9 percent in March.

The number of discouraged workers fell by 5,000 in April to 460,000, and was 363,000 the month the last recession started. The participation rate, which indicates the share of working-age people who are employed or looking for work, decreased to 62.9 percent from 63 percent the prior month.

The seasonally adjusted number of people working part-time who would prefer a full-time job fell to 5.27 million, the lowest since April 2008, moving closer to the 4.62 million reading from December 2007.

Naira3 weeks ago

Naira3 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

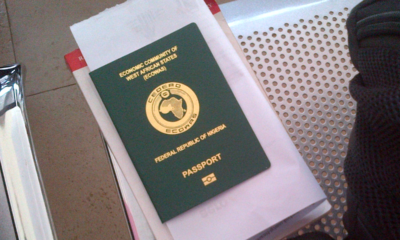

Travel4 weeks ago

Travel4 weeks ago

Naira4 weeks ago

Naira4 weeks ago