- Forex Weekly Outlook April 10-14

The US economy added fewer jobs in March than projected, adding just 98,000 people to the payroll but the unemployment rate improved to 10 years low of 4.5 percent from 4.7 percent recorded in February. While, the figure is disappointing and a lot of analysts have predicted possible change in the Federal Open Market Committee stand, there are other fundamental factors that says otherwise. For instance, wage growth was steady at 2.7 percent year-on-year, while the unemployment claims declined to a 5-week low of 234,000. Perhaps this explained why the U.S dollar gained against all its counterparts on Friday after the report was made public. Again, global uncertainty after the Syria attack continued to aid haven assets and has also boosted the Japanese yen against its counterparts.

On oil, crude oil prices rallied on Friday after the US launched a missile strike against Syria, sparking fears that an escalation of the conflict in the crude-rich Middle East could disrupt supplies and further aid OPEC strategy. However, Fitch Ratings in its latest report forecast crude oil prices would average $52.50 per barrel in 2017. This is $7.4 per barrel higher than $45.1 per barrel recorded in 2016.

Also, crude oil experts and analysts expect the surge in the US oil production to continue disrupting OPEC strategy until both the OPEC and non-OPEC member states reached another consensus on production cut later in the year.

In Canada, the labour market added 19,600 jobs in March but the rise in the number of people looking for a job increased the unemployment rate from 6.6 percent to 6.7 percent in March. Canada has so far created a total of 82,600 jobs in the first three months of the year. This was after weak manufacturing sector plunged job creation in 2016 and impact exports amid global oil glut.

However, the manufacturing sector has expanded from 2016 low to 55.5 in March after recording a 54.7 in February. Also, the manufacturing employment rose by 24,400 in March, making it the highest one-month increase since August 2002. Therefore, businesses and investors are projecting continuous gain in the labour market—especially with the newly signed Canada-EU Comprehensive Economic and Trade Agreement expected to add at least $25 billion a year to the economy.

In the UK, the services sector rose to 55 in March, pushing businesses to raise their prices at the quickest pace in over 8 years. Experts believed it’s going to be a tough year for consumers following the report that both the manufacturing and construction sectors shrank in February. This further added to signs that the economy is losing momentum.

Last week, the Governor of the Bank of England Mark Carney urged banks to get contingency plans for all potential Brexit outcomes. Signaling increase uncertainty and possible recession, especially with both consumer spending and housing price slowdown with demands.

Generally, the US economy remains strong with its uncertainty, while Canada’s economy is gradually improving with growing global economic outlook. Both the UK and the Euro-area remains uncertain ahead of Brexit.

This week I will be reviewing past analysis in relation to current happenings.

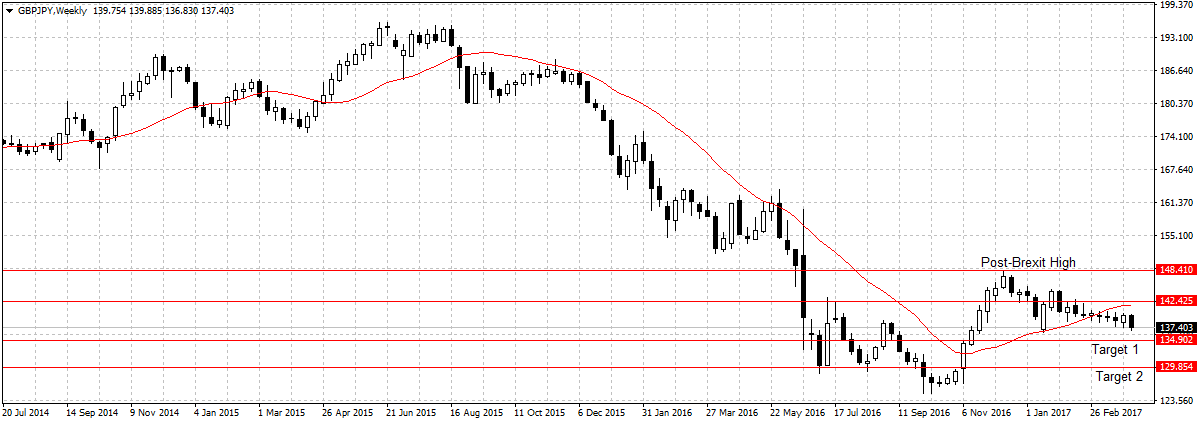

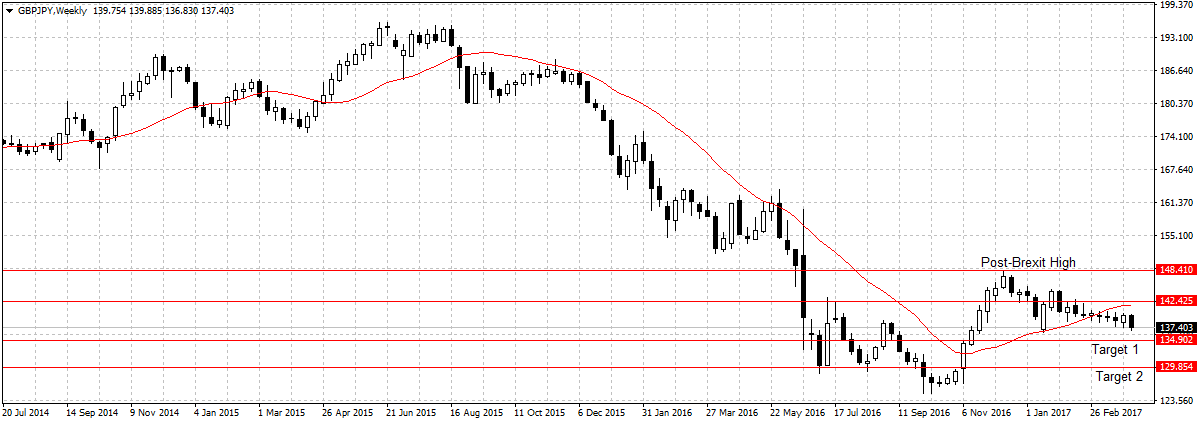

GBPJPY

In a sequel to my analysis three weeks ago, this pair has dropped 222 pips but yet to hit our first target at 134.90 support levels. But with both the construction and manufacturing sectors shrinking and housing price growth plunging to a 4-month low. I remain bearish on this pair as long as price remains below 141.47, I will expect a sustained break to expose 129.85 targets.

In a sequel to my analysis three weeks ago, this pair has dropped 222 pips but yet to hit our first target at 134.90 support levels. But with both the construction and manufacturing sectors shrinking and housing price growth plunging to a 4-month low. I remain bearish on this pair as long as price remains below 141.47, I will expect a sustained break to expose 129.85 targets.

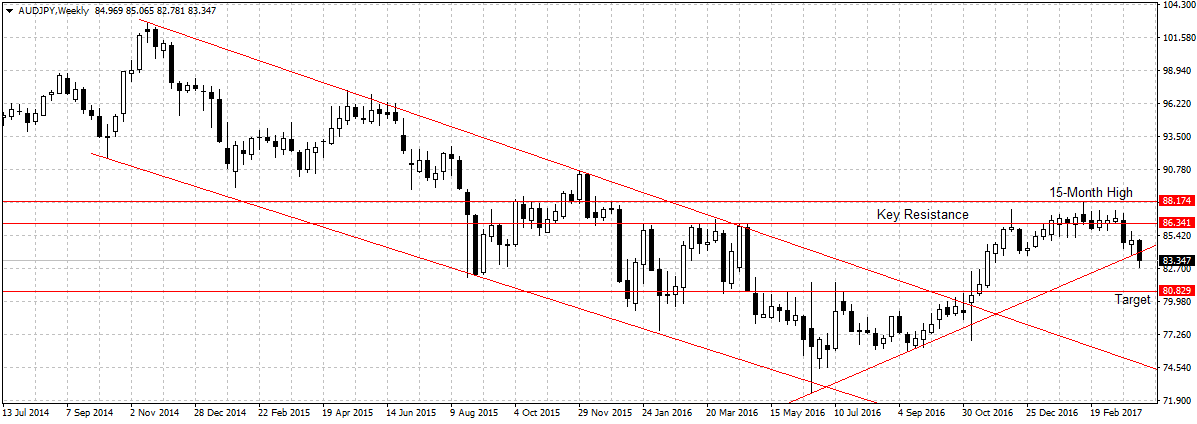

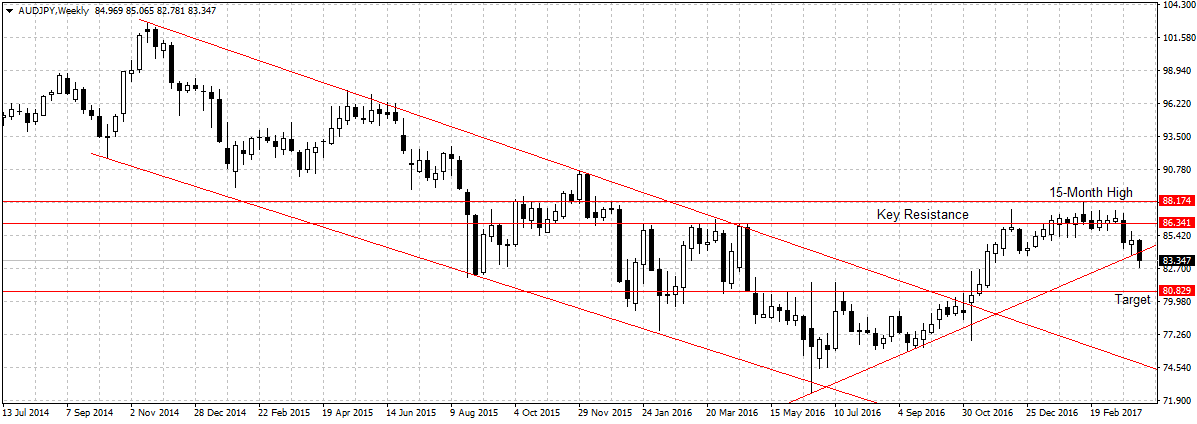

AUDJPY

Last week, this pair topped our list and has since plunged by 163 pips to close at around 83.34, which was below the ascending line called temporary reversal. Therefore, this week I expect the current surge in the yen attractiveness and Aussie weak economic outlook ahead of surging household debt and bubble housing sector to further aid bearish move of this pair towards our last week target of 80.82.

Last week, this pair topped our list and has since plunged by 163 pips to close at around 83.34, which was below the ascending line called temporary reversal. Therefore, this week I expect the current surge in the yen attractiveness and Aussie weak economic outlook ahead of surging household debt and bubble housing sector to further aid bearish move of this pair towards our last week target of 80.82.

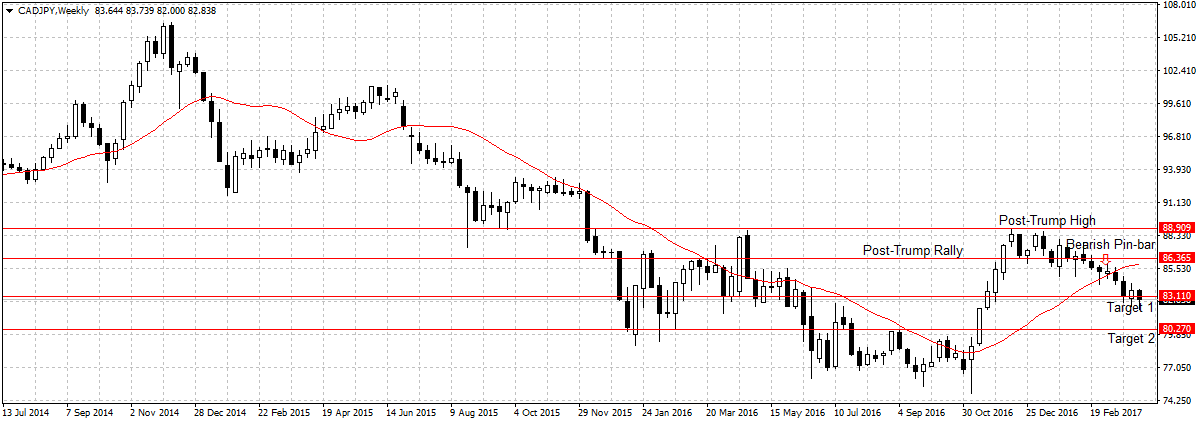

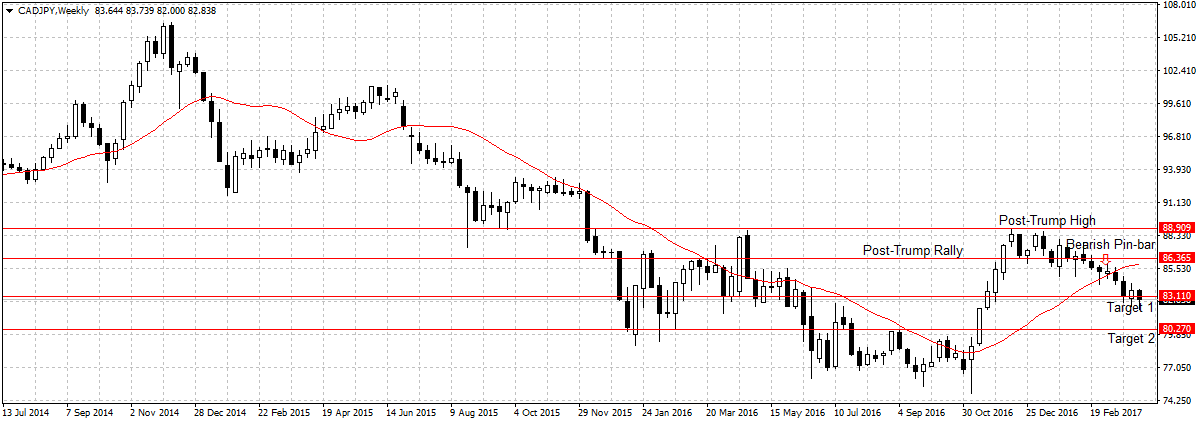

CADJPY

Since I mentioned this pair sell potential three weeks ago, it has failed to sustain its bearish move. Even after giving us about 133 pips and hitting our first target. However, due to the positive Canada’s economic outlook and growing manufacturing sector that has continued to support job creation. I will step aside this week to better assess the pair in relation to series of economic data due this week.

Since I mentioned this pair sell potential three weeks ago, it has failed to sustain its bearish move. Even after giving us about 133 pips and hitting our first target. However, due to the positive Canada’s economic outlook and growing manufacturing sector that has continued to support job creation. I will step aside this week to better assess the pair in relation to series of economic data due this week.

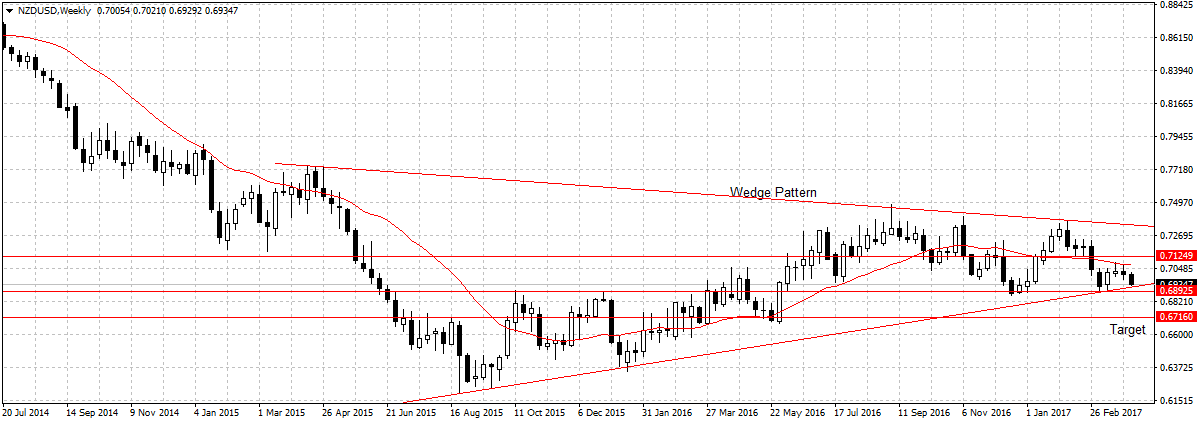

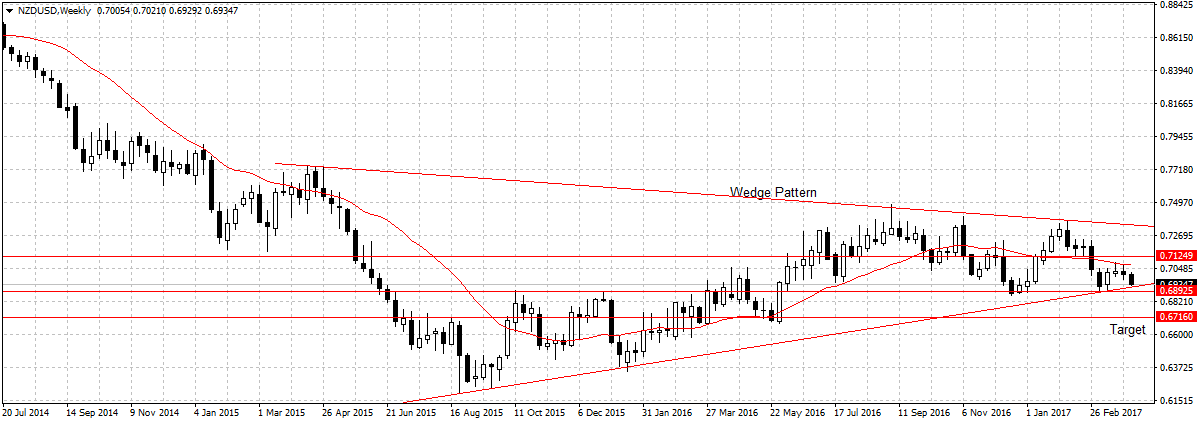

NZDUSD

This pair has plunged 71 pips since last week but far from our target of 0.6716. Therefore, as long as price remains below 0.7071 I am bearish on this pair and will be looking to add to my sell position below 0.6893 support levels for 0.6716 targets.

This pair has plunged 71 pips since last week but far from our target of 0.6716. Therefore, as long as price remains below 0.7071 I am bearish on this pair and will be looking to add to my sell position below 0.6893 support levels for 0.6716 targets.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago