- Forex Weekly Outlook April 3-7

The US economy expanded more than previously estimated in the final quarter of 2016, growing at 2.1 percent annualized rated instead of the previously reported 1.9 percent. However, despite a 3.5 percent expansion rate recorded in the third quarter, the total growth in 2016 remains the worst performance since 2011 — plunging to 1.6 percent following a 2.6 percent growth rate recorded in 2015.

Nevertheless, consumer sentiment rose to 96.9 in March, signaling that Americans are less upbeat about the long-term economic outlook. But consumer spending rose less than predicted in February even with the surge in wage growth. Suggesting that surge in inflation (2.1%) may be affecting consumer spending.

Accordingly, Federal Open Market Committee are expected to raise rates further this year to moderate consumer prices and proposed fiscal stimulus by the new administration. This optimism continued to aid the US dollar’s attractiveness against other pairs and bolstered bond market outlook.

In the UK, Prime Minister Theresa May officially triggered article 50 of Lisbon Treaty on Wednesday and stated that refusal of the European Union to accept the terms of the Brexit will have security implications. Compelling the European Union President Donald Tusk to declare on Friday that defense and security won’t be bargaining chips in Brexit negotiations.

In Canada, the Canadian economy expanded by a healthy 0.6 percent in January from December, indicating first-quarter growth will be stronger than expected as the country gradually recovers from the shock of low oil prices. The Canadian dollar improved against the US dollar to 75.24 U.S. cents

Generally, the US economy remains strong and so is the U.S dollar. However, the uncertainty surrounding the economic outlook remains.

This week NZDUSD and AUDJPY top my list

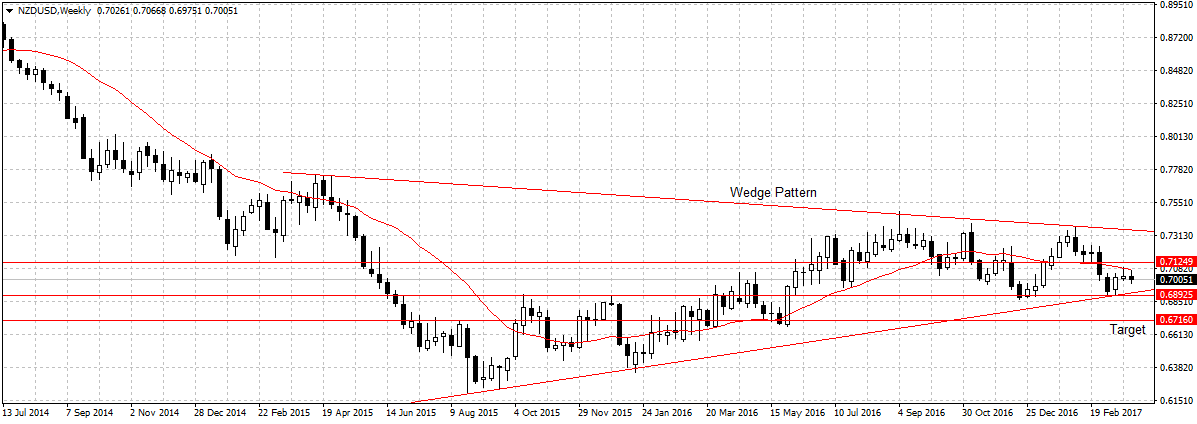

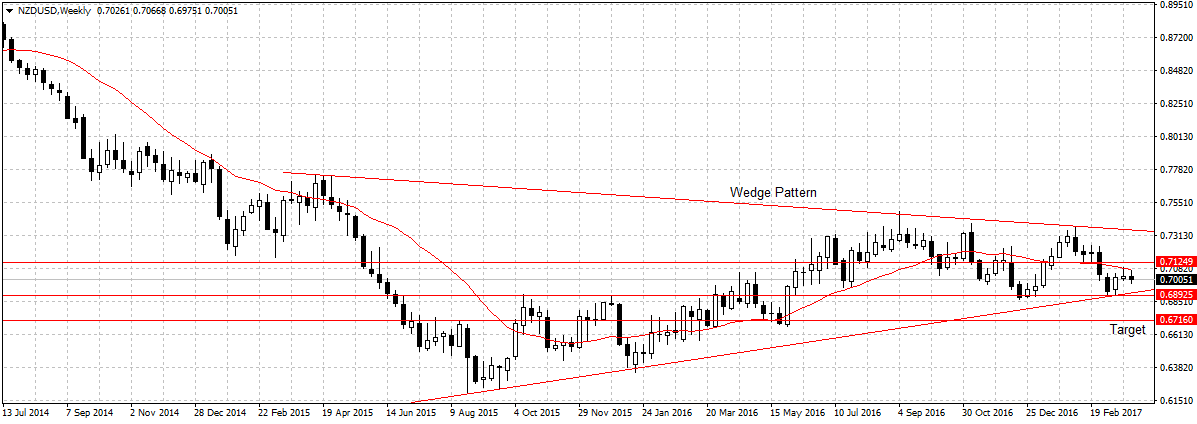

The NZDUSD pair reversed 814 pips after dropping 2640 pips to 0.6195 in 2015. This reversal has carved out a wedge pattern not only to affirm that the temporary bullish trend is waning but also to ascertain bearish continuation.

Similarly, the aforementioned correlates with our February projection that higher exchange rate would affect New Zealand consumer goods as it would have pushed the cost of goods higher and subsequently reduced consumer spending. However, inspite of this bearish view, this pair has traded moderately high against the Reserve Bank of New Zealand call for lower exchange rates.

But with the renewed US dollar’s attractiveness following policy-makers comments on three more rate hikes in 2017. I am expecting this pair to gain bearish momentum as a continuation of the long-term downward trend. A break below the wedge pattern should expose our first support of 0.6892 and sustained break of that level should give us 0.6716 targets.

AUDJPY

Considering Australia’s economic outlook and declining trade surplus that saw trade balance unexpectedly narrowed 61 percent to AUD 1.30 billion January from a downwardly revised AUD 3.33 billion surplus in December, 84.97 exchange rate is high and would hurt consumer spending further if not check. Also, I don’t see the Aussie breaking its 15-month high after dropping below 86.34 support turned resistance.

Technically, this pair has given 435 pips since peaking at 88.16 in February, its 15-month high but after plunging 3041 pips for the past 2 years. I will be treating the new upsurge as a temporary reversal and expect a break below upward trend to open up 82.70 support levels, while a sustained break should expose our target at 80.82 as shown above.

Last Week Recap

CADJPY

Last week positive economic growth (GDP) data aided the Loonie to recover mildly against the Japanese Yen. However, with the price below 85.86, 20-moving average, I remain bearish on this pair and expect a sustained break of 83.11 to open up 80.27 targets as more sellers jump on it. Hence, I will be looking to sell bellow 83.11 support levels.

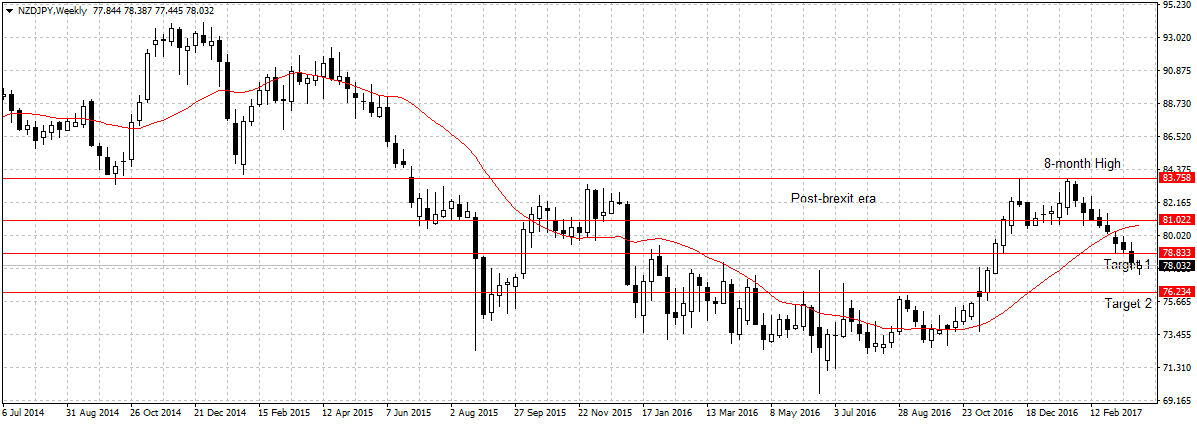

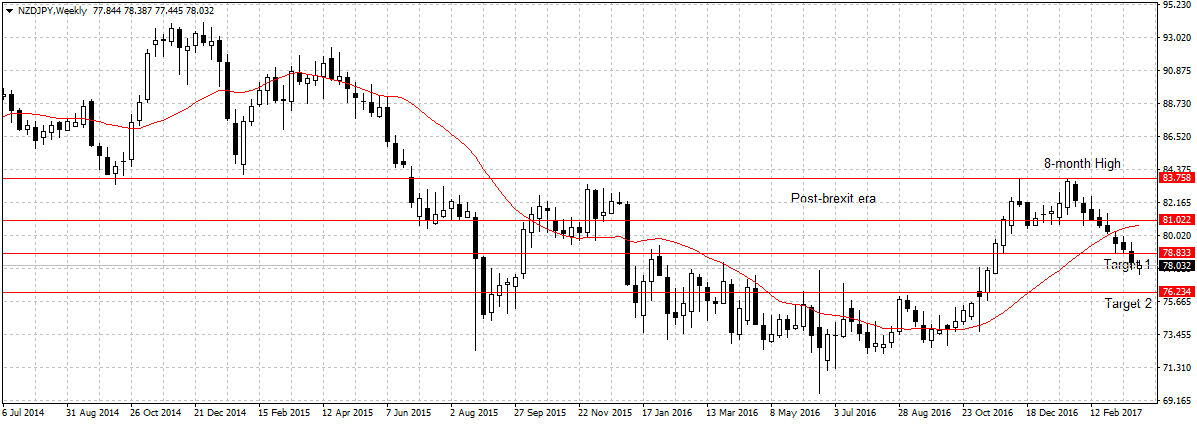

NZDJPY

Likewise, I remain bearish on this pair as long as 78.83 resistance holds and will be looking to add to my position.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago