- Nigeria’s Economy Contracts 1.51% in 2016

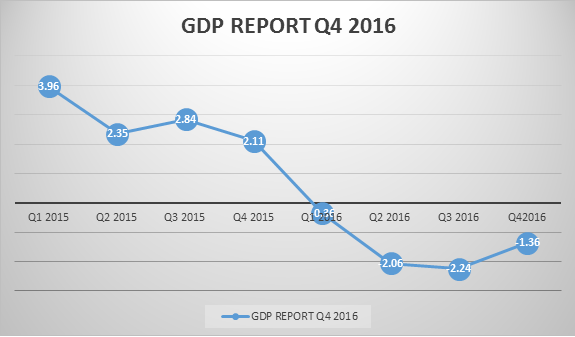

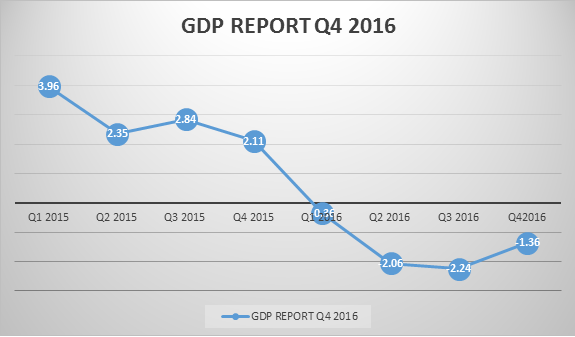

The Nigerian economy contracted in the fourth quarter of 2016 for the fourth consecutive quarters. However, the rate of contraction has started reducing following the Federal Government efforts at bolstering economic activities.

The economy contracted 1.30 percent in the fourth quarter of 2016 to N18,292.95 billion, from N18,533.75 billion recorded in the fourth quarter (Q4) of 2015, according to the National Bureau of Statistics (NBS) report released on Tuesday.

This was -2.24 percent less than the decline recorded in the previous quarter but lower than the 2.11 percent growth rate recorded in the final quarter of 2015.

On a quarterly basis, real GDP rose 4.09 percent following rise in the general price level.

However, on a yearly basis, the economy contracted 1.51 percent, indicating real GDP of N67,984.20 billion for 2016. This reduction in the economic activities reflects weaker inflation-induced consumption demand, an increase in pipeline vandalism, significantly reduced foreign reserves and a weaker currency.

Also, it showed series of problems in the energy sector – lower electricity generation and struggling banking sector.

Oil Sector

According to the NBS, Oil output was estimated at 1.9 million barrels per day (mbpd) in the fourth quarter of 2016. Which was about 0.27 million barrels per day higher than output in the previous quarter, but lower than production in the same quarter of 2015 by 0.25 million barrels per day, when output was recorded at 2.16 mbpd.

“For the full year 2016, oil production was estimated to be 1.833 mbpd, compared to 2.13 mbpd in 2015. This reduction has largely been attributed to vandalism in the Niger Delta region. As a result, the sector contracted by -13.65 percent; a more significant decline than that in 2015 of -5.45 percent. This reduced the oil sectors share of real GDP to 8.42 percent in 2016, compared to 9.61% in 2015.

“In the fourth quarter of 2016 this sector declined by -12.38 percent in real term (year-on-year). This was an improvement relative to the previous quarter, when the sector declined by -22.01 percent, but nevertheless was a more severe decline than in the fourth quarter of 2015, when a contraction of -8.23 percent was recorded.

“Quarter-on-Quarter, real oil GDP grew 8.07 percent. As a share of the economy, the Oil sector represented 7.15% of total real GDP, compared to 8.06 percent in Q4 2015 and 8.19 percent in Q3 2016.”

Non-oil Sector

“The non-oil sector declined by -0.33 percent in real terms in the fourth quarter of 2016. This was 0.36 percent points lower than growth of 0.03 percent recorded in Q3 2016, and 3.46 percent points lower than the 3.14 percent growth recorded in Q4 2015. Given that the growth rate was stronger than in the oil sector, the non-oil sector increased its share of GDP to 92.85 percent, from 91.94 percent in the fourth quarter of 2015.

“The sector to weigh on non-oil growth the most was Real Estate, which declined by -9.27 percent and contributed to –0.77 percent points to year on year growth in total real GDP. However, Manufacturing, Construction and Trade also made significant downwards contributions, ameliorated slightly by continuing strong growth in Agriculture (especially Crop Production).

“For full year 2016, the non-oil sector declined by -0.22 percent in real terms, compared to a growth rate of 3.75 percent in 2015, a difference of 3.97 percent points.”

The figures showed the pace of contraction has started cooling from the third quarter of 2016 and on track for economic recovery by the second quarter of 2017.

Similarly, for the past 4 months, the pace of increase of inflation rate has been reducing, indicating consumer prices are beginning to adjust to a series of policy been implemented by the Central Bank of Nigeria. This further validated CBN projection that economic recovery plan would start manifesting by the second quarter of 2017 following successful OPEC consensus in November 2016.

The Naira has gained N95 against the US dollar since the CBN introduced new forex policy last week and continued to do so as importers can now access dollar at a moderate exchange rate. Experts have said the continuous gain in the Naira value will curb surge in consumer prices and boost activities in the manufacturing sector.

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Startups4 weeks ago

Startups4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

News4 weeks ago

Bitcoin4 weeks ago

Bitcoin4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Forex3 weeks ago

Forex3 weeks ago

Treasury Bills4 weeks ago

Treasury Bills4 weeks ago