- Global Trade Eyes $1tn Annually as WTO Endorses Trade Facilitation Agreement

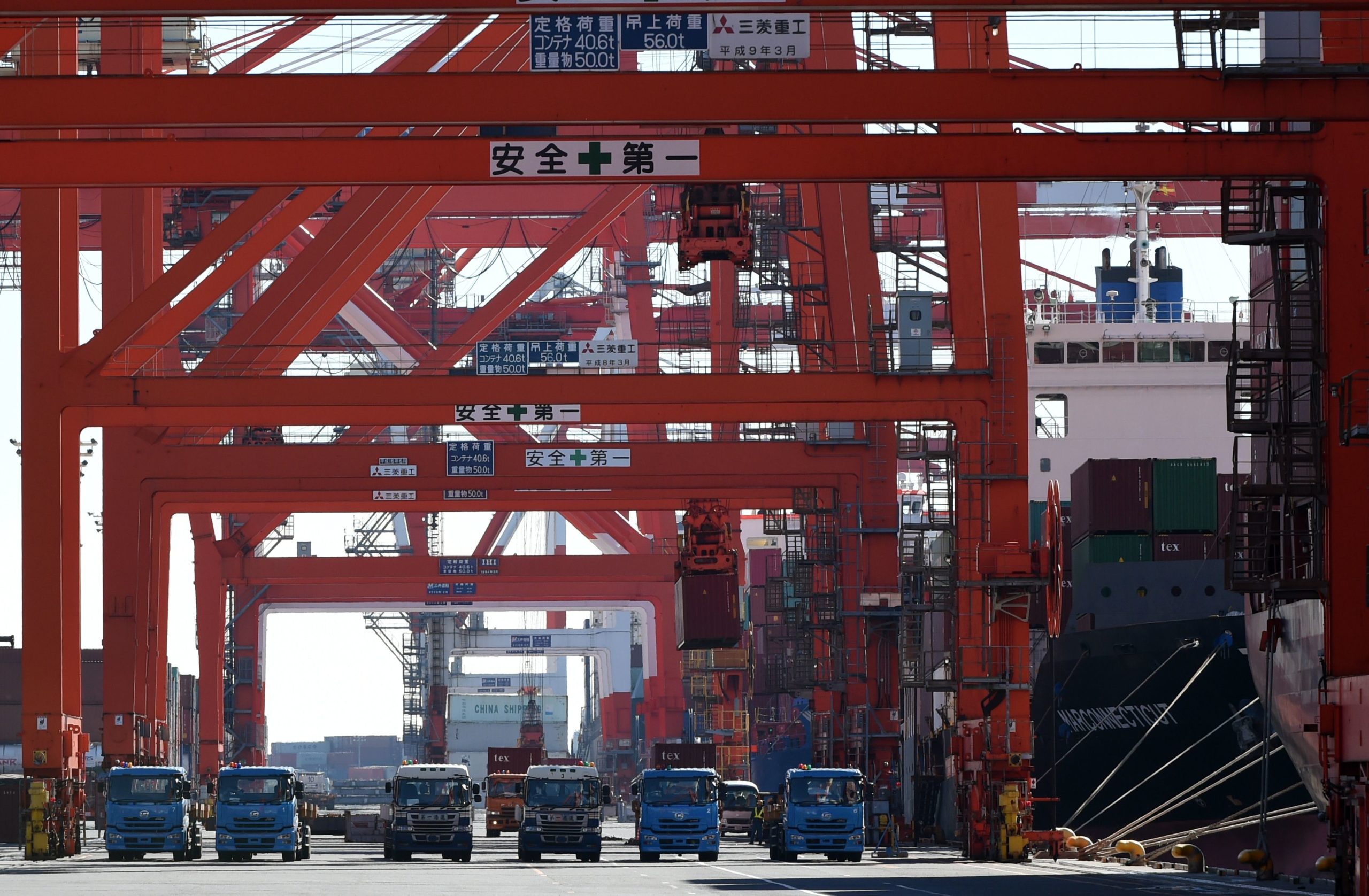

The global trading infrastructure received a landmark push yesterday as the first multilateral deal- the Trade Facilitation Agreement (TFA) came into force after being approved by two-thirds of the 164-member-countries of the World Trade Organisation (WTO).

The WTO Director General, Roberto Azevedo, said the agreement would boost global trade by up to $1 trillion annually, with the biggest gains going to the poorest countries.

He said: “The impact will be bigger than the elimination of all existing tariffs around the world.”

The entry into force of the agreement, seeking to quicken the movement, release and clearance of goods across borders, ushers a new phase for trade facilitation reforms all over the world and creates a significant boost for commerce and the multilateral trading system as a whole.

The Minister of Industry, Trade and Investment, Dr. Okechukwu Enelamah, who was at the historic event, embraced the agreement.

He said: “This is indeed, a major milestone in the multilateral trading system and ties into our Ease of Doing Business agenda. As countries proceed to implement the Trade Facilitation Agreement (TFA), Nigeria would like to see a WTO that is more supportive of domestic policy reforms in developing countries like Nigeria and particularly supportive of the private sector and business to drive growth.”

The TFA is expected to improve the country’s access to the international market, make it competitive and boost the acceptance level of Made-in-Nigeria goods across the world among other benefits.

Nigeria had on January 20 ratified the TFA when it deposited the instrument of acceptance with WTO DG, Roberto Azevedo, in Davos, on the sidelines of the World Economic Forum (WEF).

Also, Rwanda, Oman, Chad and Jordan submitted their instruments of acceptance to bring the total number of ratifications over the required threshold of 110.

Essentially, the full implementation of the TFA is forecast to slash members’ trade costs by an average of 14.3 per cent, with developing countries having the most to gain, according to a 2015 study carried out by WTO economists.

The TFA is also likely to reduce the time needed to import goods by over a day and a half and to export goods by almost two days, representing a reduction of 47 per cent and 91 per cent respectively over the current average.

Implementation is also expected to help new firms export for the first time while developing countries are predicted to increase the number of new products exported by as much as 20 per cent-and least developed countries (LDCs) likely to see an increase of up to 35 per cent, according to the WTO study.

Meanwhile, Azevedo who also welcomed the TFA’s entry into force, noted that the agreement represented a landmark for trade reform.

He said: “This is fantastic news for at least two reasons. First, it shows members’ commitment to the multilateral trading system and that they are following through on the promises made in Bali. Second, it means we can now start implementing the Agreement, helping to cut trade costs around the world. It also means we can kick start technical assistance work to help poorer countries with implementation.

“But this is not the end of the road. The real work is just beginning. This is the biggest reform of global trade in a generation. It can make a big difference for growth and development around the world. Now, working together, we have the responsibility to implement the Agreement to make those benefits a reality.”

The acceptance process involves WTO members ratifying a Protocol of Amendment to insert the TFA into Annex 1A of the WTO Agreement. Members who have not done this are still required to do so.

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago