- FG, Shelter Afrique, REDAN Sign $2bn MoU to Build 20,000 Annually

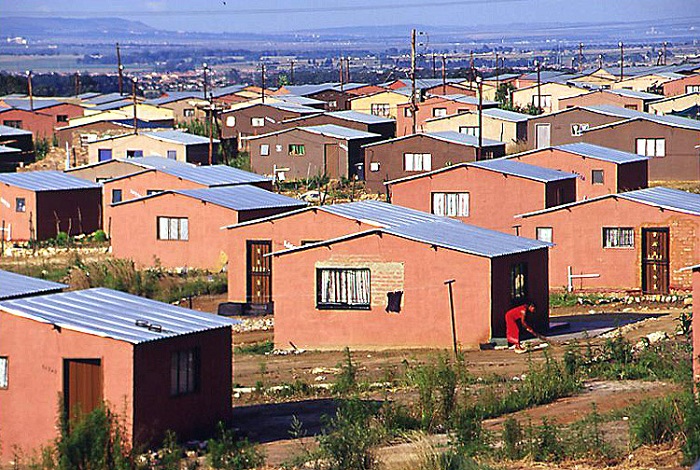

The federal government through the Federal Mortgage Bank of Nigeria (FMBN), the Pan African Finance Institution: Shelter Afrique, and the Real Estate Development Association of Nigeria (REDAN), has signed a $2 billion Memorandum of Understanding (MoU) to build 20,000 houses annually in the next 10 years.

At the signing ceremony in Abuja, the Minister of Power, Works and Housing, Mr. Babatunde Fashola said the money would be provided by Shelter Afrique through FMBN to housing developers.

This, he said represented a strategic partnership that should deliver housing through mortgages at low interest rates.

The minister, who was represented by his Special Adviser on Housing, Mr. Abiodun Oki, said the collaboration for housing delivery through REDAN must, as a necessity, also create jobs for Nigerians within the sector.

Fashola, assured that government was doing its best to recapitalise the apex mortgage institution, so that it could effectively deliver on its mandate, adding that government would provide conducive environment for both Shelter Afrique and the private sector, through REDAN to deliver affordable housing within the framework of the national housing model.

Speaking, the acting Managing Director of FMBN, Mr. Richard Esin admitted that a lot of work has gone into making the MoU a reality, stressing that FMBN has moved from its deficit financial status to operating surplus within the last one year.

He said the bank, through innovation, created 734 mortgages for home ownership and mortgage finance, saying, “There is no doubt that through this strategic partnership and with effective utilisation of the resources, FMBN and REDAN will deliver 20,000 housing stock annually.

“This intervention will be spread across the six geopolitical zones using the national housing model.”

Esin was optimistic that 150,000 jobs would be created through the deal, adding that the MoU, represented the first critical step in the journey to make shelter affordable and accessible to Nigerians.

The National President of REDAN, Reverend Ugochukwu Chime said the collaboration was a welcome development and that it was an intervention needed to provide solution to the housing needs of every Nigerian.

While calling for recapitalisation of the apex bank, he said government should wade into the stock market and pension funds with the aim of making both available to developers to access for housing delivery, adding: “the present poor capitalisation of FMBN, cannot move the sector forward.”

In his contribution, the Managing Director, of shelter Afrique, Mr. James Murgerwa said the investment into the country’s housing sector was a mutual and strategic alliance between his organisation, FMBN and REDAN, targeted at building quality and affordable housing.

While advocating for partnership between the public and private sector to move the sector forward, he said no one single institution had solution to the housing demands in the continent.

He said: “The end to end solution in housing delivery in Africa is to work together and leverage on individual’s strength and expertise to produce effective solution to the myriads of problems confronting the sector.”

He said Nigeria is the largest sovereign member and that 43 other African countries contribute to the fund, with African Development Bank (AfDB) owning 25 per cent stake.

The President, Trade Union Congress (TUC), Mr. Boboi Kaigama said the beneficiaries of the $2 billion in the sector should be the ordinary Nigerians who cannot afford shelter.

He said it was worrisome that there is a deficit of 17 million housing, adding that the ones being built were out of the reach of majority of Nigerians. He charged REDAN and FMBN to deploy the funds to build affordable and sustainable houses in the country.

Kaigama called on the 36 State Governors and FCT Minister, to make land available for the project, which is the first of its kind in the country, adding that with proper deployment of the resources, Nigeria’s housing deficit could be reduced to 5 million.

Naira4 weeks ago

Naira4 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Jobs4 weeks ago

Jobs4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago