- Nigeria Leads South Africa, Others in Online Shopping

A recent survey has shown that Nigerians shop more online than other sub-Saharan African (SSA) countries.

According to GeoPoll, which conducted the survey on five African countries including Nigeria, South Africa, Uganda, Kenya and Ghana, said though there have been significant growth in online shopping on the continent, but SSA still don’t trust e-commerce sites.

GeoPoll is the world’s largest mobile survey platform, with a network of 200 million users in Africa and Asia.

According to the survey, 66 per cent of Nigerians buy items online every few months compared with 60 per cent in South Africa and 45 per cent in Kenya.

However, at least 55 per cent of Ghanaians and 51 per cent of Ugandans have never bought anything online.

The report discovered that many of those who had tried online shopping had only tried it once.

Among the top reasons cited for not frequently using online shopping sites were lack of trust, shipping costs, unsupported payment methods, or because a friend had a bad experience.

The GeoPoll revealed that many complained of unreliability of some sites, poor delivery and the purchase process. Others felt that there is no need for online purchases as the items were readily available at their local store.

The majority of shoppers in Kenya, Nigeria and Uganda paid on delivery for items bought online. However, in South Africa, 50 per cent of shoppers preferred to pay using their debit card and a further 26 per cent use their debit card for online purchases. Cash on delivery in South Africa is also the preferred mode of payment at 20 per cent compared to mobile money.

Already, eCommerce sub-Sector in Nigeria is estimated to worth $10 billion with some 300,000 online orders expected each day. The worth is projected to hit $13 billion by 2018.

Indeed, despite the economic gloom in Nigeria, eCommerce players claimed about 20 per cent growth in traffic at the just concluded ‘Black Friday’ sales.

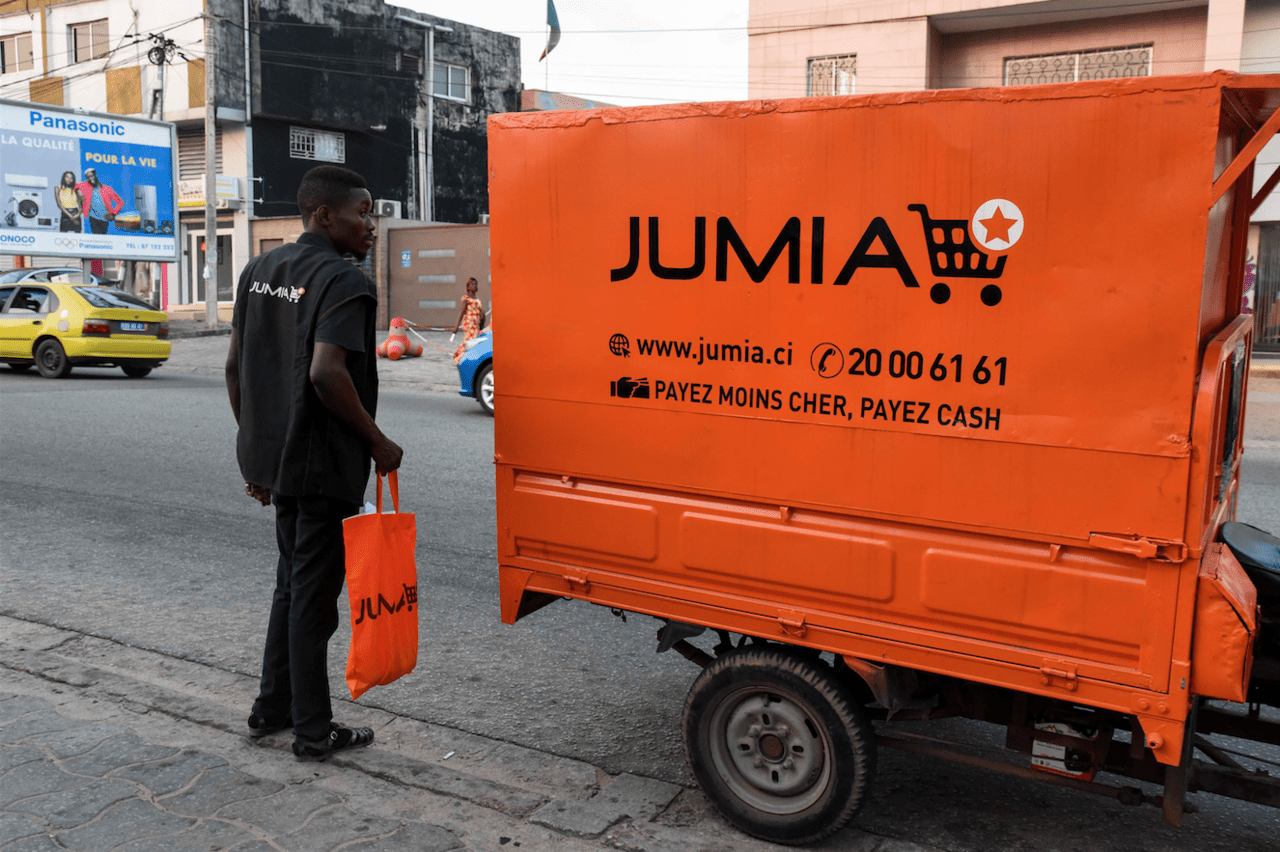

The Black Friday, which ran between November 23 to 29, across different eCommerce platforms including Jumia, Konga, Yudala, Spar, Dealdey, Kaymu among others in Nigeria, is usually the Friday after the American Thanksgiving, and it is one of the major shopping days of the year in the United States.

Konga, through its Yakata 2016 sales, claimed to have witnessed the company’s biggest shopping period in its four year history. The online ecommerce giant revealed that it processed 155,000 orders totaling N3.5 billion within the sales period.

Konga Chief Executive Officer (CEO) Shola Adekoya, said: “Yakata 2016 has exceeded all of our expectations in terms of sales; we had been cautiously optimistic that we would improve on last year’s period, but with the Nigerian economy as it currently is, we had been conservative with our projections. However, it seems that there are hundreds of thousands of savvy shoppers keen to make their Naira go a little bit further at the moment; hence they came to Konga to find the very best deals.

Statistics from Jumia showed higher growth. The firm said it recorded 219.13 per cent session that is 4,919, 331 against 1, 538, 578 of last year. In terms of users, Jumia claimed 158.61 per cent (2, 117, 840 vs 818,929) and 93.3 per cent page views within the period.

Yudala also claimed to have witnessed huge traffic on the plaftrom, stressing that within the first 12 hours of its Black Friday, it recorded a sales of about N450 million.

Speaking to The Guardian, Vice President, Yudala, Prince Nnamdi Ekeh, said people took advantage of the opportunity to shop immensely.

He pointed out that some people actually shopped ahead of the Christmas period.

Ekeh pointed out that between December 2015 and November 2016, prices of electronics rose by 60 per cent and some other items because of currency issues among others, “so people just latched on the opportunity of this Black Friday to shop ahead.”

CEO Jumia Nigeria, Juliet Anammah, said Nigerians have not stopped buying but have instead, re-prioritised their shopping needs “and so retail stores are seeing more purchases in household items and children’s items rather than the regular impulse buying of clothing items.

According to a recent KPMG report, in seven sub-Saharan countries, e-commerce makes up one to three per cent of the gross domestic product, GDP, which is the total value of goods produced and services provided in a country annually. It is predicted to make up 10 per cent of total retail sales in key markets by 2025, with 40 per cent yearly growth over the next 10 years. The total retail economy is projected to grow rapidly, along with the population as a whole and its spending power per capita.

Naira3 weeks ago

Naira3 weeks ago

News4 weeks ago

News4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Jobs3 weeks ago

Jobs3 weeks ago

Travel3 weeks ago

Travel3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Investment4 weeks ago

Investment4 weeks ago