Finance

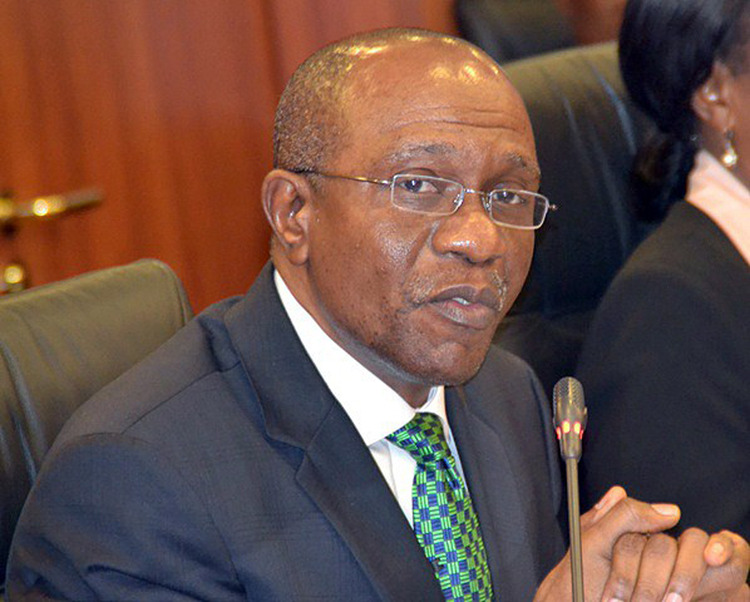

CBN Stops Forex Sale to BDCs, Cash Deposit Allowed

Loans

Akinwumi Adesina Calls for Debt Transparency to Safeguard African Economic Growth

Banking Sector

UBA, Access Holdings, and FBN Holdings Lead Nigerian Banks in Electronic Banking Revenue

Loans

Nigeria’s $2.25 Billion Loan Request to Receive Final Approval from World Bank in June

-

Forex3 weeks ago

Forex3 weeks agoZiG to the Rescue: Zimbabwe Shifts Gear with New Currency Backed by Gold

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira2 weeks ago

Naira2 weeks agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

-

Naira1 week ago

Naira1 week agoDollar to Naira Black Market Today, April 17th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 1st, 2024

-

Naira4 weeks ago

Naira4 weeks agoNigerian Naira Surges to N1,350 per Dollar in Parallel Market