Decline in oil production, insecurity ahead of 2023 general elections and high inflationary pressure remain the major areas of concern for Nigeria.

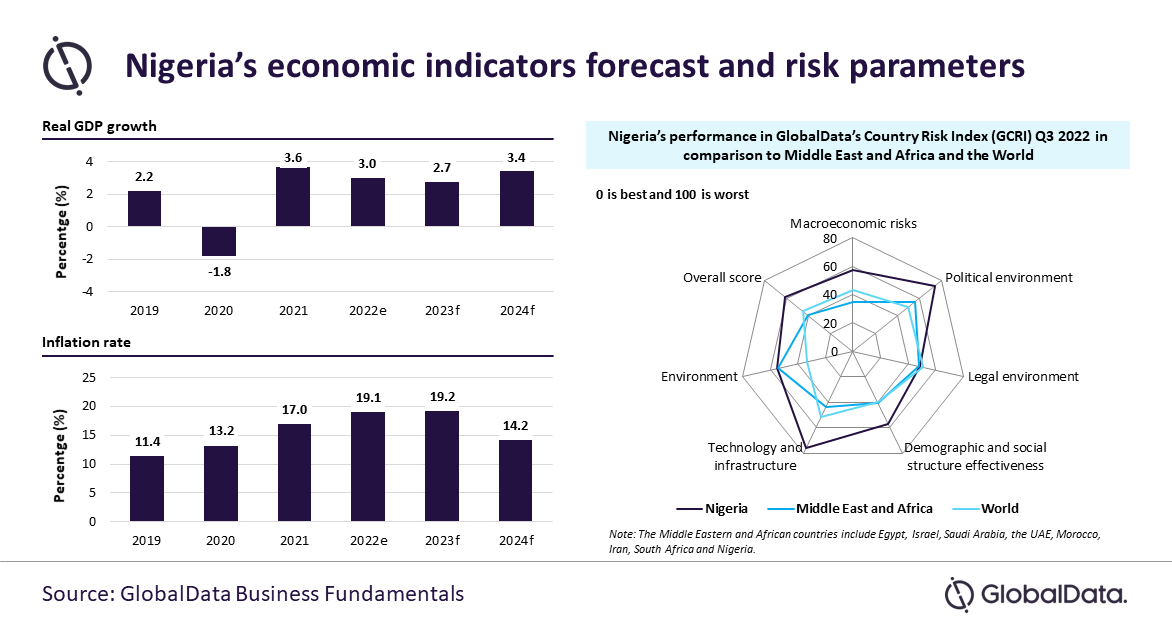

Against this backdrop, the real GDP growth of the country is forecast to slow down from 3% in 2022 to 2.7% in 2023, reveals GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Macroeconomic Outlook Report: Nigeria,” reveals that broadening inflationary pressure had triggered a cost-of-living crisis. Inflation rate is projected to further rise to 19.2% in 2023 from 19.1% in 2022. According to the National Bureau of Statistics, Multidimensional Poverty Index Survey (2022), as of 17 November 2022, 133 million people, equivalent to 63% of the nation’s population, were experiencing multidimensional poverty in the country.

Nigeria is categorized as a high-risk nation and ranks 133rd out of 153 nations in GlobalData Country Risk Index (GCRI Q3 2022). The country’s risk score is higher in the parameters of political environment, macroeconomic, social, technological, and environmental risk when compared to the average of Middle East and African nations.

Puja Tiwari, Economic Research Analyst at GlobalData, comments: “Nigeria’s oil output rose to 1.4 billion barrels per day (bpd) in December 2022 from below one bpd in August 2022, according to Nigerian Upstream Petroleum Regulatory Commission. However, it is significantly below what it was last decade ago (above two million bpd). Oil theft and prolonged repair work at Forcados, a key oil terminal which is expected to continue till September 2023, will result in Nigeria’s under production of crude oil in 2023. Meanwhile, the violent attacks on the election commission offices raise questions on the security in the country ahead of elections.”

According to GlobalData, agriculture, industry and services sectors contributed 23.6%, 32.2% and 44.2%, respectively, to the gross values added (GVA) in 2022. The three sectors are forecast to grow by 12.2%, 14% and 12.2% in 2023, compared to 13%, 14.9% and 12.9%, respectively, in 2022.

In October 2022, the country allocated a budget of NGN20.5 trillion ($51.5 billion) for the 2023 fiscal year, of which more than 60% will be used to finance debt repayments. This will curtail the expenditure on other developmental sectors.

The naira per US dollar depreciated by 8.7% year-on-year on 2 January 2023. Furthermore, GlobalData estimates the exchange rate to depreciate to NGN420.6 per $ in 2023 from 415.3 per $ in 2022. Nigeria’s foreign exchange (forex) remained depressed amid the dwindling crude oil production and lower exports revenue.

Tiwari concludes: “Introducing measures to reduce poverty as well as monetary measures to curb the mounting prices continue to be the need of the hour for the Nigerian economy. Moreover, the government also needs to work towards policies to control rising gross debt, depreciating currency, and increasing unemployment to reactivate the economy.”