China appears to be blinking in the face of slowing growth next year, trimming 5 basis points of its 1-year Loan Prime Rate (LPR) to 3.80%, while leaving the 5-year LPR unchanged. Far more loans are based on the 1-year LPR than the 5-year, so the move is a concrete signal that China is moving into supportive monetary policy. That was reinforced by yet another notably weaker than expected Yuan fixing versus the US Dollar this morning.

Over the weekend S&P moved Evergrande into default joining Fitch, and along with Kaisa, this story, and the wider property sector are not going away anytime soon. Additionally, officials in China said that more work was required on monopolistic behaviour by corporate China, and online brokerages are apparently next in their sights. So, the “shared prosperity” policies are also still fully in play as expected. News that China’s Sinovac vaccine appears to be ineffective against the omicron variant means that China’s Covid-zero policy will keep the gates closed to the outside world for all of 2022.

With all of that in mind, it is no real surprise that China is moving quickly to a targeted supportive monetary policy setting. Challenges remain though and the deluge of articles in the press saying that many China equities are at bargain levels is as big a warning sign of trouble ahead as any. They won’t look so cheap in three months’ time if they’re half of what they are today. In this context, it is unsurprising that the rally in Mainland stocks after the LPR cut, ran out of steam within minutes, as they joined the rest of Asia in the red.

The weekend has been a steady stream of negative headlines, with the Grinch who stole Christmas probably thinking he won’t be needed this year. Omicron dominated the headlines with a UK study suggesting it was no less vicious than delta. Exploding case numbers in the UK and Western Europe had governments on the continent tightening entry restrictions and the Netherlands has gone into full lockdown. Similar warnings about impending case numbers were made by US officials as well.

If that wasn’t enough, Democrat Senator Joe Manchin appears to have blindsided the White House and his own Congressional caucus by announcing he won’t support President Biden’s $2 trillion Build Back Better spending programme. That effectively leaves it dead in the water now and the Biden legislative agenda in disarray. Goldman Sachs has already trimmed next years US growth forecast in response.

Of course, a positive headline regarding omicron could hit the wires and temporarily hand-brake turn sentiment once again. With the holidays nearly upon us, liquidity will sharply reduce anyway, exacerbating intra-day moves. Markets this week and next will be for day traders with steely nerves and deep pockets, not for trend followers. As I have repeatedly said, the winner in December is V for Volatility, nothing has changed on that front. Be careful out there.

Omicron and US Politics send Asia stocks lower.

As outlined above, a combination of increasing omicron nerves, particularly in the UK and Europe, and the failure of President Biden’s spending plan to past must with Senator Manchin, has seen Asian equities head directly South in sympathy with Wall Street’s Friday finish. The China LPR cut rally lasted just minutes in Mainland China, highlighting the path of least resistance in Asia today.

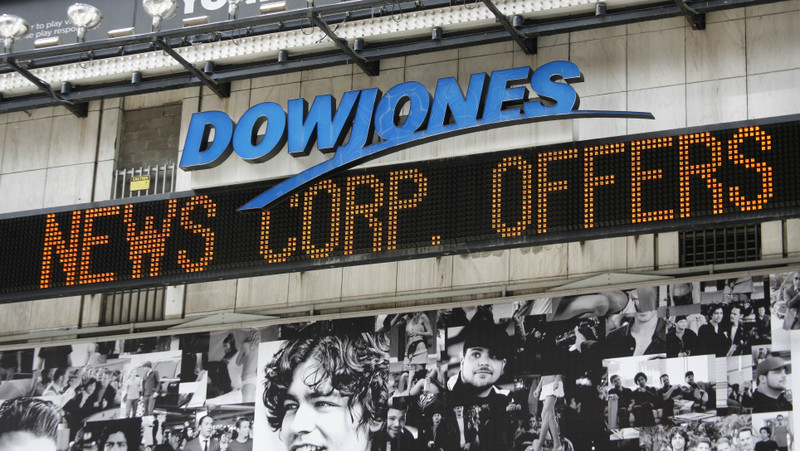

On Friday, hawkish comments from Fed officials and omicron nerves sent Wall Street lower. The S&P 500 fall by 1.03%, with the Nasdaq holding its own, edging just 0.07% lower. Value took a bashing on Friday, the Dow Jones tumbling by 1.48% as the schizophrenic tail-chasing of the FOMO-gnomes showed no sign of waning this month. The Build Back Better failure has torpedoed US index futures today. S&P 500 futures are 1.0% lower, Nasdaq futures have plummeted by 1.15%, while Dow futures have fallen by 0.80%.

That sees Japan’s Nikkei 225 tumbling by 1.85% with South Korea’s Kospi lower by 1.50%. Mainland China’s LPR rally lasted minutes before risk aversion internationally, and fears of more government clampdowns domestically sent equities sharply lower. The Shanghai Composite is just 0.40% lower now, but the CSI 300 is down by 1.0%. China’s “national team” may be “stabilising” today. Hong Kong, by contrast, has recovered some early losses, but is still looking fragile, down 1.10% thus far.

Regional markets look no better. Singapore has fallen by 1.05%, complicated by Singtel losing a taxation case in Australia. Taipei has fallen by 0.85% while Kuala Lumpur is 0.40% lower, and Jakarta has retreated by 0.65%. Manila is 1.30%, also suffering a typhoon discount today after the weekend’s landfall, with Bangkok 1.10% in the red. By contrast, Australian markets are holding their own, helped perhaps by a lower Australian Dollar. The ASX 200 is just 0.15% lower, while the All Ordinaries has fallen a relatively modest 0.35%.

Risk aversion lifts the US Dollar.

There’s something to be said for being the least-ugly horse in the glue factory, and the US Dollar seems to be that horse right now. On Friday, risk aversion saw the dollar index soar by 0.65% to 96.67, before edging lower to 96.60 in Asia. Chief losers were the low yielders, notably the Euro and the Yen. The incipient rally in the world’s most popular sentiment indicators, the Canadian, Australian and New Zealand Dollars, was also quickly snuffed out. US treasury yields are falling in Asia today, indicative of haven flows continuing in US bonds, and that alone should limit US Dollar pullbacks. 96.00 and 97.00 should contain the dollar index nicely this week, with a daily close above or below signalling the US Dollars next directional move.

With virus restrictions ramping up in Europe, EUR/USD’s recovery rally ended as soon as it began on Friday, falling 0.70% to 1.1235, before short-covering lifted it to 1.1248 today. The single currency has failed several times above 1.1360 last week, and weekend developments do not give much reason to change that opinion. Rallies are there to be sold with a failure of 1.1200 opening the downside to 1.1000. EUR/USD has multi-decade support at 1.0700.

USD/JPY has support at 113.00 and with the Bank of Japan reiterating the last 30 years of guidance this morning, that is it is not time to start withdrawing stimulus, the topside remains the weakest link. Having failed ahead of 1.3400, and with virus and political woes mounting, Sterling will be challenged to even rally back to 1.3300 now. The 200-day moving average (DMA) at 1.3145 is immediate support.

As global sentiment barometers, the CAD, AUD, and NZD were stretchered of the field on Friday and have eased further today to 1.2896, 0.7120 and 0.6725 respectively. NZD/USD looks like the ugliest duckling, but all three are now back to approaching 2021 lows. Her Majesty’s Commonwealth Dominions need some good omicron news and fast.

Asian currencies have had a mixed performance. The Yuan continues to strengthen despite weaker fixes from the PBOC. With China borders likely closed for all of 2022, the trade surplus flows will continue underpinning Yuan strength. The SGD, THB, PHP, and IDR have all performed well post-FOMC, most likely because omicron has been discounted as a risk factor by investors. Although the INR and KRW have failed to rally, they are still holding steady. Both currencies are likely to feel the heat of fast-money outflows into the year-end, limiting gains.

Rather surprisingly, Asian currencies remain mostly resolute in the face of a souring sentiment environment and a strong US Dollar. The main exception is the stagflation-ista Indian Rupee which is also likely suffering fast-money outflows into the year-end, having been the major beneficiary of the shared prosperity clampdowns in China. The main reason for Asian FX fortitude lies with the Chinese Yuan I believe. Despite the PBOC setting weaker Yuan fixes of late, the Yuan is refusing to play ball in open markets. Part of this is the China trade surplus being recycled, and not offset by open borders allowing movement. The solidity of the Yuan has acted as a stabilising influence on regional Asian currencies. Whether this continues, is open for debate.

Oil gets an Omicron/Manchin bath.

Omicron nerves are getting more frazzled by the day, especially in Europe and the UK where the spectre of tighter restrictions loom. Additionally, with Senator Manchin torpedoing the Build Back Better bill, US growth will likely take a small haircut next year. Taken in totality, oil markets are pricing in lower consumption into 2022 and Friday’s sell-off has continued with vigour in Asia this morning.

Brent crude fell by 2.20% on Friday, tumbling another 2.65% in Asia today to $71.00 a barrel. WTI has fared even worse, falling 2.25% on Friday and then dropping another 3.65% to $68.10 a barrel in the Asia session. Ominously, both contracts closed below their respective 200-DMAs on Friday.

Although the short-term outlook for oil is being sunk by negative virus and US legislative sentiment, we should not discount OPEC+ from the equation. OPEC+ left their last meeting open precisely to manage this type of situation. If Brent crude continues to head south from here, I wouldn’t discount OPEC+ stepping in to roll back their recent production increases. Given that compliance is over 100%, this would process would be easy to achieve right now.

Brent crude has resistance at $72.50 and then the 200-DMA at $73.20 a barrel. Support notionally appears at $70.20 a barrel followed by $68.00. WTI has resistance at $69.40 and then the 200-DMA at $70.50 a barrel. Support lies at $66.00 a barrel.

Gold lacks momentum either way.

Gold spiked higher on Friday, touching $1814.00 an ounce intraday, before falling back to an unchanged level at $1798.00 an ounce. In Asia, a slightly softer US Dollar and lower US 10-years have seen gold record a modest 0.23% gain to $1802.20 an ounce.

Gold’s attempts to stage a meaningful recovery do not distil confidence, with traders cutting long positions at the very first sign of trouble intra-day. Gold lacks the momentum, one way or another, to sustain a directional move up or down. In all likelihood, gold will remain a forgotten asset class and face another week of choppy range trading.

Gold has formed a rough double top around the $1815.00 region which will present a formidable barrier t$1840.00. Support lies at $1790.00, followed by $1780.00 an ounce. $1790.00 to $1815.00 could well be the range for the week.