Binance, the world’s leading blockchain ecosystem and cryptocurrency platform, has launched a $1 billion Growth Fund for Binance Smart Chain, to accelerate the adoption of digital assets and blockchain technology.

In the span of the next few months multiple programs will be set up under its umbrella to empower the growth of cryptocurrencies worldwide. Designed to incubate rising blockchain-crypto projects the fund will also run advanced technological development programs.

“BSC’s growth has attracted 100M+ DeFi users with just an initial funding of $100 million,” said Changpeng Zhao (CZ), CEO at Binance. “With the new contribution of $1B, it can disrupt traditional finance and accelerate global mass adoption of digital assets to become the first-ever blockchain ecosystem with one billion users,” he added.

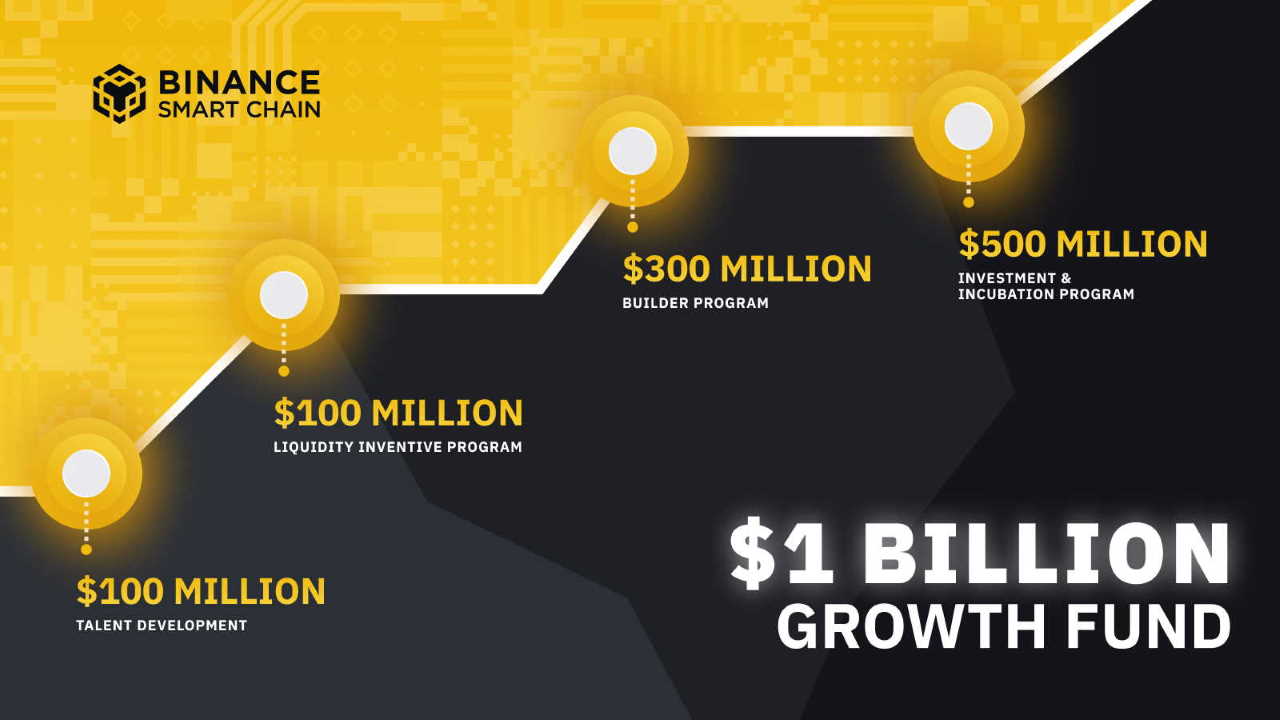

The $1 billion fund will be divided into 4 broader categories:-

Talent Development – Innovation

A total of $100M funds are reserved for Talent Development which includes mentoring developer communities, educating new crypto investors, providing academic scholarships to institutions, running bootcamps and supporting R&D around Cryptography, High-performance Consensus protocol, Cross-chain/Multi-chain infra, RegTech & Deep Analytics and more.

Liquidity Incentive Program – Trading

The Liquidity Incentive initiative will run sub-programs to encourage participation from traditional financial markets as well as crypto. It will provide flexibility and support for professional traders and institutions to provide more liquidity in DeFi protocols. For instance, more contribution in liquidity pools in Automated Market Makers, borrowing and lending in money markets, yield farming in vaults, higher arbitrage gains and more. This will be targeted in developing compliant relationships between investors and evolving emerging digital asset markets. A total of $100M funds are reserved under the Liquidity Incentive initiatives.

Builder Program – Technological startups

The Builder Program will be boosted with an additional $300 million. Of which, $100 million will be utilized to conduct regional and global hackathons, joint bug bounty programs, developer conferences and will support existing mainstream development programs. The remaining $200 million will be used to incubate 100 innovative dApps/infra buildings on top of BSC who will receive mentoring from top Venture Capitalists and infrastructural support from the BSC core community.

Investment/Incubation Program for Industrial development

To accelerate mainstream adoption and bring disruption to financial infrastructures a total of $500 million will be reserved. This fund will be utilized to grow decentralized computing, gaming, metaverse, virtual reality, artificial intelligence and blockchain-based financial services. With collaborations from industry-leading organizations, the investment fund will target scaling blockchain technology for real-life use cases and will bridge the gap between crypto-blockchain and the current technical-financial sectors.

“The thriving blockchain startup ecosystem has encouraged us to invest our time, efforts and resources in helping companies build from 0 to 1. With the $1 billion initiative, our focus will be widened to building cross-chain and multi-chain infrastructures integrated with different types of blockchains. We’re gearing up to bolster the adoption of crypto and blockchain to accelerate its growth globally.” said Gwendolyn Regina, Investment Director, BSC Accelerator Fund

With a concentrated focus on blockchain-rich regions such as Russia, India, South East Asia, Europe, US and South America; the BSC community will lead the growth of BSC regionally. The BSC core community will work closely with leading fintech companies, crypto advisors, blockchain researchers and influential people across the globe to spread the basic vision of financial inclusion and sovereignty.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago