Nigerian Stock Exchange Declines Marginally Last Week

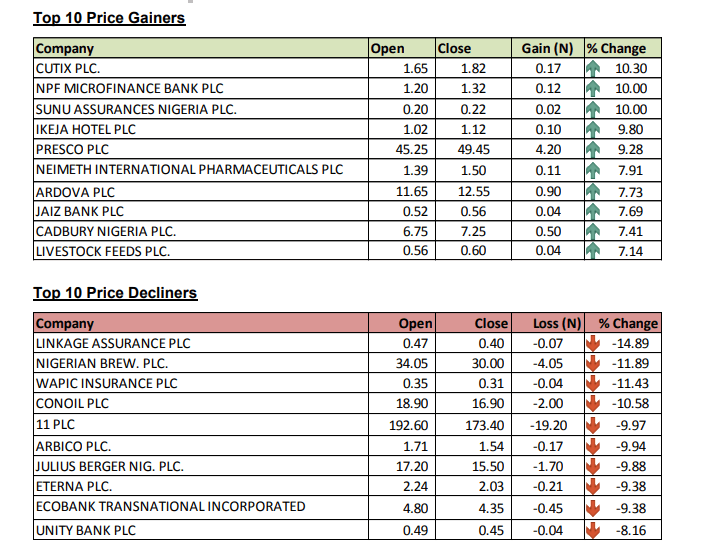

The Nigerian Stock Exchange (NSE) once again closed in the red last week as stocks of Wapic Insurance, Nigerian Breweries, Conoil, 11 Plc (formerly Mobil), Ecobank, etc dragged down The Exchange.

Activities on the trading floor rose during the week as investors traded 1.016 billion shares valued at N7.436 billion in 18,092 transactions, against a total of 901.542 million shares worth N13.453 billion exchanged in 18,676 deals in the previous week.

In terms of volume traded, the financial services sector led with 784.322 million shares worth N3.305 billion that were exchanged in 10,592 deals. Therefore, the sector contributed 77.23 percent and 44.45 percent to the total equity turnover volume and value, respectively.

This was followed by the oil and gas industry with 61.822 million shares worth N418.191 million in 984 transactions.

The consumer goods sector came third with a turnover of 42.999 million shares valued at N1.102 billion in 2,848 deals.

Sterling Bank Plc, FCMB Holdings Plc and FBN Holdings Plc led equities traded as they accounted for a combined 416.989 million shares worth N791.078 million traded in 2,752 deals.

The NSE All-Share Index and Market Capitalisation depreciated by 0.08 percent or 18.70 basis points from 24,306.36 bps it closed in the previous week to 24,287.66 bps last week.

The market capitalisation of listed equities also declined slightly to N12.670 trillion last week. Bringing the year-to-date decline to 9.52 percent.