Oil Prices Sustain Bullish Run As More OPEC Plus Members up Compliance Level

Global oil prices sustained bullish run on Friday after OPEC and allies, known as OPEC Plus, reports revealed an improvement in compliance level across the board.

The group had agreed to cut crude oil production by 9.7 million barrels per day but member states were finding it hard to abide by the agreement following the impact of COVID-19 on most economies.

A report published by Reuters revealed that Nigeria only complied with 19 percent in May while Iraq managed to comply with just 38 percent.

However, member states have pledged to comply henceforth and warned that any countries found doing otherwise would have to cut the extra in subsequent months.

In the meeting held on Thursday, OPEC plus ministerial panel met to review Iraq and Kazakhstan compliance level to better support prices and rebalance the global oil market.

“You’re going to see more OPEC compliance,” said Phil Flynn, senior oil analyst at Price Futures Group in Chicago. “I think we’d be a lot higher if it weren’t for these coronavirus fears.”

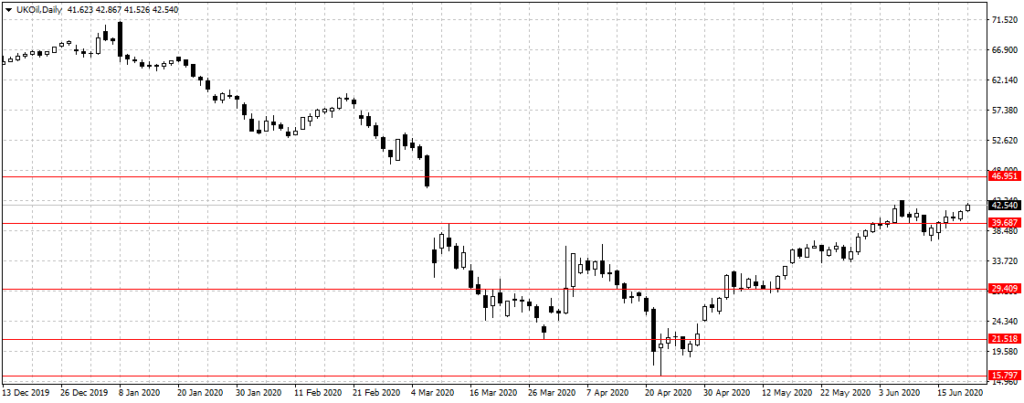

Brent crude oil, against which Nigerian oil is measured, rose to $42.54 per barrel on Friday during the London trading session at 10:43 am Nigerian time.

The US West Texas Intermediate oil also appreciated, gaining 2.6 percent to $40 per barrel.

The US West Texas Intermediate oil also appreciated, gaining 2.6 percent to $40 per barrel.

Meanwhile, JPMorgan, in a shocking move, said oil price could hit $190 per barrel by 2025 even with the current global pandemic.

“The reality is the chances of oil going toward $100 at this point are higher than three months ago,” said Christyan Malek, JPMorgan’s head of Europe, Middle East and Africa oil and gas research.

Without breaking down how the $190 per barrel projection will materialise, Malek said JPMorgan’s $190 bullish projection of March still stands and in fact, thinks its more realistic now than three months ago.