Here is Why Bitcoin Can’t Sustain $10,000 Level

Since Bitcoin, the flagship cryptocurrency broke through a globally anticipated $10,000 resistance level on May 8, 2020, it has failed to sustain that level despite Bitcoin Halving of May 12.

Even with the reports of Whales accumulating substantial bitcoins and a recent report by Santiment that the number of wallets holding more than 100 BTC has been on the rise in the past week, the dominant cryptocurrency remained deviant.

In May, Investors King perused why the digital currency may not attract enough buyers to sustain the expected bullish run.

Here is Why Bitcoin continues to disappoint even with the projected supply short-fall that normally trailed Bitcoin Halving.

Regardless of what Bitcoin traders and investors think, the demand for the coin has always been bolstered by retail traders and investors, among which it is the most popular.

The activities of these retail traders and investors are presently limited given the current price of a unit Bitcoin. Meaning, even though the Bitcoin supply has dropped following halving, the number of miners exchanging their rewards to fund operation and the available Bitcoin within the system is more than the present demand.

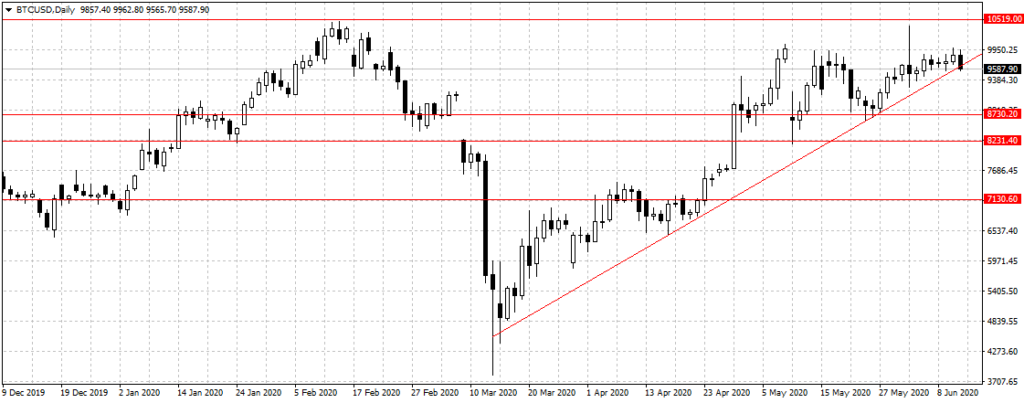

Therefore, while the ongoing acquisition by Whales will help establish strong support for the coin above $9000, it won’t be enough to force a bullish run and sustain it above $10,519 resistance levels until institutional investors or outside fund flow into the system.

However, with the surge in global uncertainty, the expected fund may not flow into the system in the near-term as predicted in our analysis in May. Also, with the renewed interest in US assets following the surprise rebound in the job market and the 12 percent of GDP worth of stimulus being pumped into the US economy, institutional investors may not look the way of Bitcoin or the entire crypto market uncertain global risk normalise.

Still, we are long-term bullish on Bitcoin and expect a sustained break of $10,519 resistance level to open up $11,463 before the $12,900 needed to confirm bullish continuation.

Still, we are long-term bullish on Bitcoin and expect a sustained break of $10,519 resistance level to open up $11,463 before the $12,900 needed to confirm bullish continuation.

On the downside, a break of $8,730 support level will open up $8,231 and turn the momentum bearish as shown above.