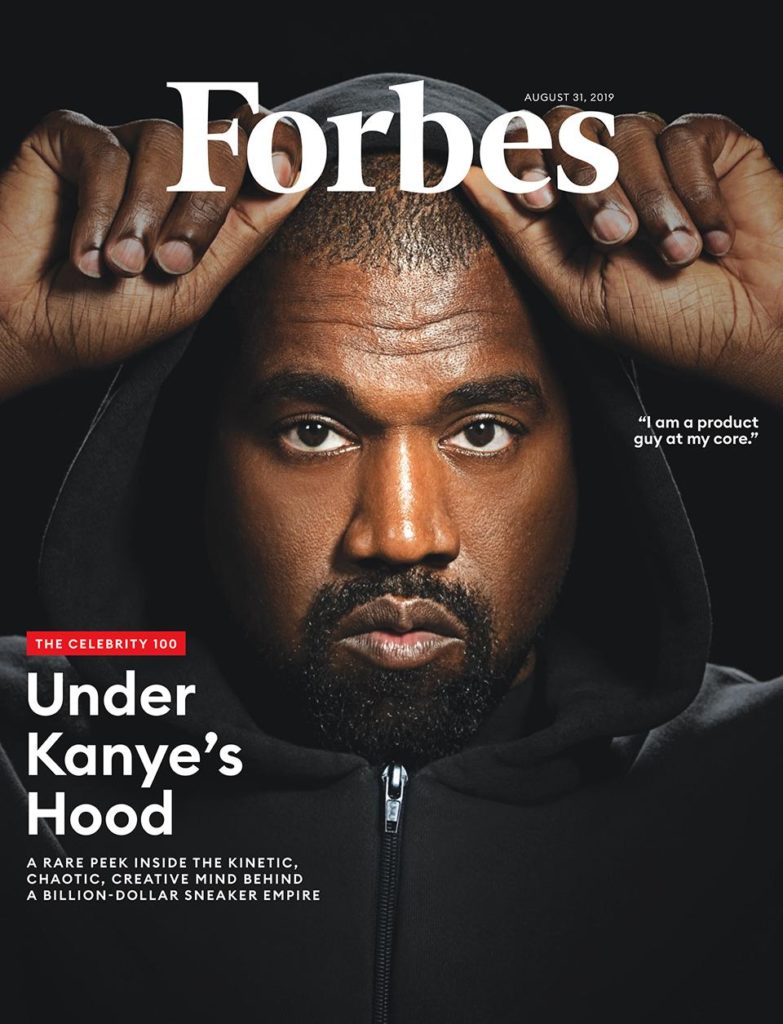

- Kanye West is Now a Billionaire, Thanks to Yeezy

Kanye West, the popular hip-hop rapper turned shoe magnate, is the latest billionaire in town, according to Forbes magazine.

The new billionaire had attacked the magazine for not listing him in its March edition of global billionaires, West claimed he was snubbed because he was black.

Forbes, however, responded that it could not call or address Kanye West a billionaire without sufficient documentation to back his unusual claim. After weeks of back and forth, Kanye West directed his team to provide Forbes his financial details.

In a lengthy process that factored in West’s assets, debt and expenses, Forbes established that truly the rapper net worth has risen substantially in recent years and now stood at $1.3 billion, about $300 million more than Kylie Jenner, his 22-year old sister-in-law.

In 2014, West left Nike following the company’s refusal to pay the new billionaire royalties on his shoe designs rather asked him to pick a favourite charity for the said amount to be donated to. A decision West disagreed with despite admitting Nike gave him a platform.

In 2015, Adidas agreed to produce Yeezy’s products, gave him royalties and allowed him enough control over the designs of shoes and apparel. Adidas released Yeezy season 1 on October 29th, 2015, three months before Kanye West’s now-famous tweets to Mark Zuckerberg, the CEO of Facebook Inc. West had tweeted to Zuckerberg in February 2016, begging for financial assistance after claiming he was in $53 million debt due to his Yeezy dream.

Since then Yeezy’s success has been exponential despite Nike not truly believing in it or completely understand why it sells, according to insiders. Yeezy is now in a position to challenge Nike’s air Jordan for the number one spot in the sneakers niche.

Still, the Forbes disagreed with West’s $3.3 billion evaluation, saying he is officially a billionaire but not worth over $3 billion.

“It’s not a billion,” West texted Forbes prior to publication, they report. “It’s $3.3 billion since no one at Forbes knows how to count.”

According to Forbes, Yeezy is complicated considering that West owns 100 per cent of the company but its operations is tied to Adidas, at least for five years based on the documents the rapper’s team provided.

“Yeezy is a complicated asset. West owns 100% of it. But it’s functionally tied, at least for five-plus years based on the documents we saw, to Adidas, which produces, markets and distributes the shoes. There’s also a separate apparel division that we don’t believe makes money. Last year, our sources projected the shoes would finish 2019 with revenue north of $1.5 billion (Adidas would not comment then, or now)—per recent conversations and internal documents, we believe the final revenue number ended up closer to $1.3 billion,” Forbes explained.

Kanye West and his wife, Kim Kardashian.

Kanye West’s agreement with Adidas was a 15 percent royalty on revenue sales but because other expenses are cut off the actual amount, the rapper royalties stood at about 11 percent or over $140 million from sales of Yeezy products in 2019.

“Upon closer inspection, it appears some expenses are carved out of that slice, bringing his actual cut closer to 11%. At that rate, he would have received royalties of over $140 million from Yeezy sales last year.”

The magazine, however, said “West’s aggressive $3 billion self-appraisal is clearly based on the idea that the business is infinitely portable. It’s not. Taking Yeezy away from Adidas seems almost prohibitively cumbersome, if not contractually impossible. A safer way to value it: as a royalty stream, like music publishing or film residuals. Multiples, based on services like Royalty Exchange or in large private transactions, can be as low as three for something faddish like Cardi B’s “Bodak Yellow” to 17 for an evergreen asset like the Eddie Murphy film Trading Places.”