- Coronavirus: Economic Implications as Nigeria Battles First Case

Nigeria, Africa’s largest economy, on Thursday reports the very first case of Coronavirus despite the Federal Government disbursing N386 million to health agencies a week ago to prevent and monitor tourists arriving in one of the world’s most populous and limited nations.

The Nigerian Stock Exchanged (NSE) responded as expected, closed in the red, and on Friday opened lower as investors look to decipher the extent of damage done or could be done giving how limited Nigeria’s health system is.

The International Monetary Fund (IMF) had lowered the nation’s growth projection for the year from 2.1 percent previously predicted to 2 percent a week ago, citing slow recovery, falling foreign reserves and declining global oil prices.

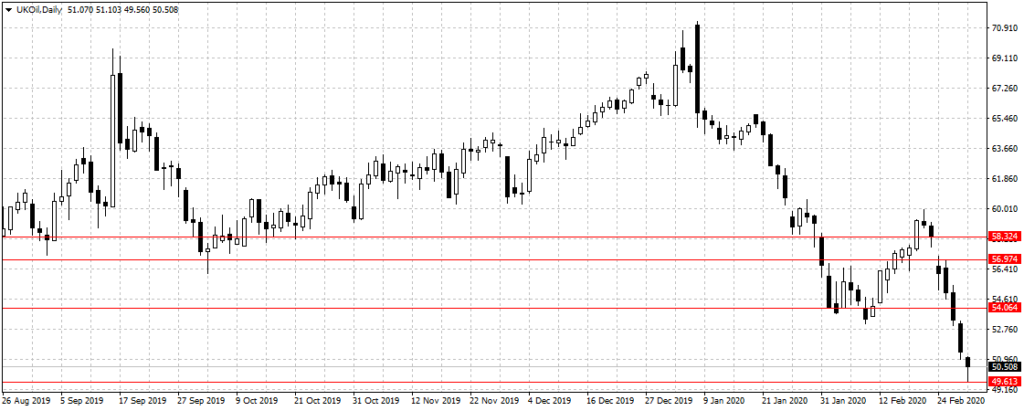

Since the report, Brent crude, against which Nigerian oil is measured, has dropped from $57 a barrel to $49.56 on Friday after many countries like Nigeria, Lithuania, Wale, etc reported their very first case of infection.

At $49.56 per barrel, Nigeria’s earning per barrel is $7.44 below the $57 a barrel benchmarked by the Federal Government for the 2020 budget. However, at an assumed production level of 2.18 million barrels per day, the nation would be losing $16,219,200 per day.

At $49.56 per barrel, Nigeria’s earning per barrel is $7.44 below the $57 a barrel benchmarked by the Federal Government for the 2020 budget. However, at an assumed production level of 2.18 million barrels per day, the nation would be losing $16,219,200 per day.

But with coronavirus fast-spreading outside China, the world’s economy is predicted to slow down with China, the world’s largest importer of crude oil, expected to suffer the most.

This means Nigeria’s foreign reserves could plunge further from the current level of $36 billion as the Central Bank of Nigeria struggles to ensure availability of dollar for importers amid projected rise in capital flight as reports of coronavirus crystalizes.

Foreign investors are likely to abandon Nigerian assets and suspend new investment plans in the near-term, leaving the nation without capital importation to complement the little from crude oil sales. Therefore, Nigeria may struggle to fund the 2020 budget and meet other financial obligations as access to the US dollar dropped with the rising cases of coronavirus outside China.

According to a recent OPEC report, Nigeria’s crude oil production dropped to 1.57 million barrels per day in December, suggesting that the nation has not pumped near the assumed 2.18 mbpd in 2020 as available reports are pointing to a nation struggling to up production despite OPEC capping its production quota at 1.75 mbpd and expecting to fund 31.35 percent of its N10.59 trillion budget with oil revenue.

Also, rising consumer prices is another issue that could hurt consumer spending in 2020. President Muhammadu Buhari had closed the nation’s border in August 2019 to force decorum across the land borders without ensuring local manufacturers can service the 200 million nation of pure consumers. This has led to the continuous rise in inflation rate to 12.13 percent in January, the highest in 21 months, and expected to even rise further if the Open Market Operations (OMO) policy of the Central Bank of Nigeria is not reversed.

This, combined with the new Finance Act mandating Nigerians to pay 7.5 percent Value Added Tax (VAT) amid weak wage growth and poor consumer buying power could worsen the nation’s job creation and unemployment in 2020. Nigeria’s unemployment presently stood at 23.1 percent or 20.9 million people with youths unemployment/underemployment at 55.4 percent, the nation faces not just coronavirus in 2020 but weak growth, rising unemployment rate, low new investment and rising consumer prices as neighbouring countries would no longer welcome the idea of an open border with a coronavirus infected nation.