The Nigerian economic crisis is getting deeper and there seem to be no succinct plans in sight to curb the continuous degradation of the economy. Nigeria is one of the largest crude oil-producing nations and 90 percent of its foreign exchange earnings are generated from crude oil sales.

In June 2008, crude oil peaked at $147.42 a barrel, the highest in the history of the world. Nigerian foreign reserve likewise grew from $45 billion to $63 billion in September 2008 before the global economic recession hit the embattled nation in November 2008, when the oil price dropped to $32.40 a barrel.

The problems of Nigeria’s economy were further compounded when U.S oil production increased, and therefore stopped importation from Nigeria in 2014. In December 2014, India (who had replaced the U.S) also reduced its importation by 38 percent to 5.3 million barrels — from 13.7 million in October and 12.4 million in November. China did not import a single barrel for the said month after initially reducing its importation by 50.3 percent.

There were several effects on the economy of Nigeria (home to over 170 million people) for two reasons: firstly, Nigeria only had contractual agreements with a few countries and as such sell on “spot”. Two, the country overly depends on crude oil to finance capital expenditures and with crude oil price trading at $48.08 a barrel from last year’s peak of $107.64 a barrel, the question is how would Nigeria avert her economic rout with falling oil prices?

Since the drop in global oil prices, the Central Bank of Nigeria (CBN) has adjusted its exchange rate five times, even after the introduction of tight forex controls in February. The latest was on Thursday, July 23rd, ahead of Monetary Policy Committee (MPC) meeting. The currency exchange rate is presently N197 to the United States dollar and CBN promised it would be sold to customers through the interbank at N198. It’s a different story at the parallel market where Naira is being exchanged at N244 to a U.S dollar.

Data was partly gotten from the National Bureau of Statistics (NBS) Economic Review and Outlook Report.

In the past months, over 20 states have reportedly failed to pay their worker’s salaries, a situation termed a disgrace by President Muhammadu Buhari who was forced to devise a bailout of $3.4 billion to offset the deficit of the affected states — in an effort to curtail further civil actions from civil servants.

Excessive focus on crude oil has created a one-way foreign revenue channel, that any slight fluctuation in the global oil price (beyond Nigeria’s control) impacts the entire nation.

Nigeria’s GDP rose to $594.3 billion for the first time in 2014 and became the biggest economy in the whole of Africa, according to a report from the National Bureau of Statistics (NBS).

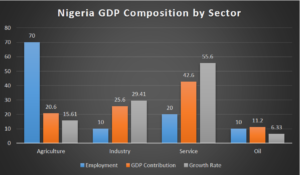

The service sector contributed the most, 42.6 percent to the total GDP, while industry was 25.6 percent, agriculture and oil sectors made up 20.6 and 11.2 percent respectively.

The report shows that service is the fastest-growing sector followed by the industrial sector. The agricultural sector growth rate has been hindered by lack of finance and limited skilled labour — many preferring to work in the lucrative oil sector of the country.

The economy has been impeded, limited and contained by its lack of effective diversification strategy that could leverage its vast resources and manpower for growth. Excessive focus on crude oil has created a one-way foreign revenue channel, that any slight fluctuation in the global oil price (beyond Nigeria’s control) impacts the entire nation. It is obvious that Nigeria cannot continue to depend on oil for growth.

The NBS report has shown that oil growth was a mere 6.3 percent and contributed only 11.2 percent to the entire GDP —the lowest among the sectors. The truth is Nigeria is currently surviving on sectors with less attention, but one wonders why due diligence is not done to elevate those sectors in order to create a permanent solution to oil’s unpredictable nature?