Business

Why I Sold the Linkedin to Microsoft – Linkedin CEO

Published

9 years agoon

The Chief Executive Officer of LinkedIn Corp., Jeff Weiner in his emotional letter to employees on Monday shared some ideas on why Linkedin’s services could be better with Microsoft’s products.

The CEO said the company would remain a fully independent entity within Microsoft organization.

Below is the full letter posted by the CEO to Linkedin on Monday:

December 15th, 2008, marked the first day of the best job I’ve ever had. My rationale for joining LinkedIn was simple: The opportunity to work with Reid Hoffman, a founder I greatly admired and respected; to join an extremely talented and dedicated team; and to massively scale LinkedIn’s membership and business, both of which had the potential to fundamentally transform the way the world connects to opportunity. Never in my wildest dreams, could I have imagined what would happen in the next 7½ years. Our team has grown from 338 people to over 10,000, our membership from 32M to over 433M and our revenue from $78M to over $3 billion.

Despite those accomplishments, we’ve only just begun to realize our full potential and purpose: Our mission to connect the world’s professionals to make them more productive and successful, and our vision to create economic opportunity for every member of the global workforce.

Today’s announcement, that LinkedIn will be combining forces with Microsoft, marks the next step in our journey together, the next stepping stone toward realizing our mission and vision, and in remaining CEO of the company, the next chapter in the greatest professional experience of my life.

No matter what you’re feeling now, give yourself some time to process the news. You might feel a sense of excitement, fear, sadness, or some combination of all of those emotions. Every member of the exec team has experienced the same, but we’ve had months to process. Regardless of the ups and downs, we’ve come out the other side knowing beyond a shadow of a doubt, this is the best thing for our company.

Let me explain why.

Every day I come to work, I’m primarily guided by two things:

First, realizing our mission and vision. While this has always been top of mind for me, it’s never been more so than now. Remember that dystopian view of the future in which technology displaces millions of people from their jobs? It’s happening. In the last three weeks alone, Foxconn announced it will replace 60,000 factory workers with robots, a former CEO of McDonald’s said given rising wages, the same would happen throughout their franchises, Walmart announced plans to start testing drones in its warehouses, and Elon Musk predicted fully autonomous car technology would arrive within two years.

Whether it’s worker displacement, the skills gap, youth unemployment, or socio-economic stratification, the impact on society will be staggering. I’ve said it on multiple occasions and believe it even more so every day: creating economic opportunity will be the defining issue of our time. That’s why I’m here and why I can’t imagine doing any other job. Simply put, what we do matters, and matters more than ever.

The second thing I focus on every day is making our culture and values come to life. Ten years ago, had you asked me about culture and values I would have rolled my eyes and recited a line from Dilbert. But when I started as CEO I began to appreciate just how important they were. Culture and values provide the foundation upon which everything else is built. They are arguably our most important competitive advantage, and something that has grown to define us. It’s one thing to change the world. It’s another to do it in our own unique way: Members first. Relationships matter. Be open, honest and constructive. Demand excellence. Take intelligent risks. Act like an owner.

That’s who we are. That’s LinkedIn.

I primarily focus on these two things, because that’s all I ever wanted when I was in your shoes: A clear sense of purpose and the opportunity to be successful in pursuit of that purpose. Thankfully, in my current role, I can actually do something about that.

In order to pursue our mission and vision, and to do so in a way consistent with our culture and values, we need to control our own destiny.

That, above all else, is the most important rationale behind today’s announcement.

At this point, some of you may be thinking this sounds completely counterintuitive: How will we be more likely to control our own destiny after being acquired? The answer lies in both the way in which the world has been evolving and the unique way in which this deal will be structured.

Imagine a world where we’re no longer looking up at Tech Titans such as Apple, Google, Microsoft, Amazon, and Facebook, and wondering what it would be like to operate at their extraordinary scale — because we’re one of them.

Imagine a world where we’re not reacting to the intensifying competitive landscape — we’re leading it with advantages most companies can only dream of leveraging.

Imagine a world where we’re not pressured to compromise on long-term investment, hesitant to disrupt ourselves, or hamstrung in the way we can reward and acquire new talent due to stock price concerns, but consistently investing intelligently toward the realization of our mission and vision.

And imagine a world where a global economic downturn doesn’t limit our ability to execute, but reinforces the essential quality of our purpose and actually strengthens our resolve when people need us most.

With today’s news, we won’t need to imagine any of it because it’s now our reality.

Some of you may be asking “Why Microsoft?”

Long before Satya and I first sat down to talk about how we could work together, I had publicly shared my thoughts on how impressive his efforts were to rapidly transition Microsoft’s strategy and culture. After all, it’s extremely rare to see a company of that scope and scale move so quickly to make fundamental changes.

The Microsoft that has evolved under Satya’s leadership is a more agile, innovative, open and purpose-driven company. It was that latter point that first had me thinking we could make this work, but it was his thoughts on how we’d do it that got me truly excited about the prospect.

When Satya first proposed the idea of acquiring LinkedIn, he said it was absolutely essential that we had alignment on two things: Purpose and structure. On the former, it didn’t take long before the two of us realized we had virtually identical mission statements. For LinkedIn, it was to connect the world’s professionals to make them more productive and successful, and for Microsoft it was to empower every individual and organization in the world to achieve more. Essentially, we’re both trying to do the same thing but coming at it from two different places: For LinkedIn, it’s the professional network, and for Microsoft, the professional cloud.

Both of us recognized that combining these assets would be unique and had the potential to unlock some enormous opportunities.

For example:

- Massively scaling the reach and engagement of LinkedIn by using the network to power the social and identity layers of Microsoft’s ecosystem of over one billion customers. Think about things like LinkedIn’s graph interwoven throughout Outlook, Calendar, Active Directory, Office, Windows, Skype, Dynamics, Cortana, Bing and more.

- Accelerating our objective to transform learning and development by deeply integrating the Lynda.com/LinkedIn Learning solution in Office alongside some of the most popular productivity apps on the planet (note: 6 of the top 25 most popular Lynda.com courses are related to Microsoft products).

- Realizing LinkedIn’s full potential to truly change the way the world works by partnering with Microsoft to innovate on solutions within the enterprise that are ripest for disruption, e.g., the corporate directory, company news dissemination, collaboration, productivity tools, distribution of business intelligence and employee voice, etc.

- Expanding beyond recruiting and learning & development to create value for any part of an organization involved with hiring, managing, motivating or leading employees. This human capital area is a massive business opportunity and an entirely new one for Microsoft.

- Giving Sponsored Content customers the ability to reach Microsoft users anywhere across the Microsoft ecosystem, unlocking significant untapped inventory.

- Redefining social selling through the combination of Sales Navigator and Dynamics.

- Leveraging our subscription capabilities to provide opportunities to the massive number of freelancers and independent service providers that use Microsoft’s apps to run their business on a daily basis.

And these are just some of the ideas that have been discussed since our first meeting.

Turning from purpose, we focused our attention on potential structure. I had no idea what Satya was going to propose, but knew how difficult acquisition integrations could be if not established the right way from the start.

Long story short, Satya had me at “independence.” In other words, his vision was to operate LinkedIn as a fully independent entity within Microsoft, a model used with great success by companies like YouTube, Instagram and WhatsApp. I would remain as CEO and report directly to him instead of a board. Together, along with Reid, Bill Gates, my former colleague Qi Lu, and new partner Scott Guthrie, we would partner on how best to leverage this extraordinary combination of assets while pursuing a shared mission. This, we both agreed, might not only be a structure that could work, it would be one in which both companies could thrive.

Now onto the most important question: What does this mean for you specifically as an employee of LinkedIn?

Given our ability to operate independently, little is expected to change: You’ll have the same title, the same manager, and the same role you currently have. The one exception: For those members of the team whose jobs are entirely focused on maintaining LinkedIn’s status as a publicly traded company, we’ll be helping you find your next play. In terms of everything else, it should be business as usual. We have the same mission and vision; we have the same culture and values; and I’m still the CEO of LinkedIn.

I wanted to conclude on a familiar note. One of the most memorable moments I’ve experienced at LinkedIn was ringing the bell at the NYSE. I remember the All Hands we had following the event like it was yesterday. During that meeting, we reinforced the fact that becoming public was not the end game, but rather a stepping stone in the process of our ultimate objectives. We finished the All Hands with two words that have become LinkedIn’s unofficial mantra: “Next play.” In other words, don’t dwell on the past, lingering for too long on a lesson learned, or the celebration of a special accomplishment, but rather focus on the task at hand. It’s a mantra that’s served us well.

So, here’s to the next stepping stone.

Next play.

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

US Embassy Mandates Two Visits for Visa Applicants in 2025

-

Amid Insecurity, Nigerians Forsake Nation’s Military, Embrace US Armed Forces To Gain Citizenship

-

Firearms, Tax Convictions: Biden Recants, Pardons Son Weeks To Exiting Office

-

Social Security Benefits Set to Increase by 2.5% in 2025: How to Adjust Your Retirement Strategy

-

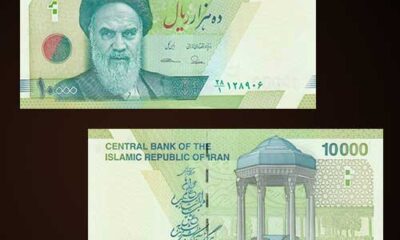

Iran’s Currency Plummets to Historic Low Amid Trump’s Return to the White House

-

Donald Trump Projected To Occupy White House, Congratulated By Nigerian President