- UK Inflation Rate Increases to 2.7% in August

Cost of goods and services in the world’s fifth largest economy, U.K., unexpectedly rose in August, following the surge in the cost of theater shows, transport fares, computer games and clothing.

Consumer prices, which measures inflation rate, rose from 2.5 percent in July to 2.7 percent in August despite the Bank of England raising interest rates last month.

The central bank had raised interest rates to curb price pressures, and widely expected to slow down inflation rate to about 2 percent by the end of the year.

However, with inflation rate rising faster than expected, investors now believe the Bank of England would be forced to raise interest rates earlier than previously anticipated.

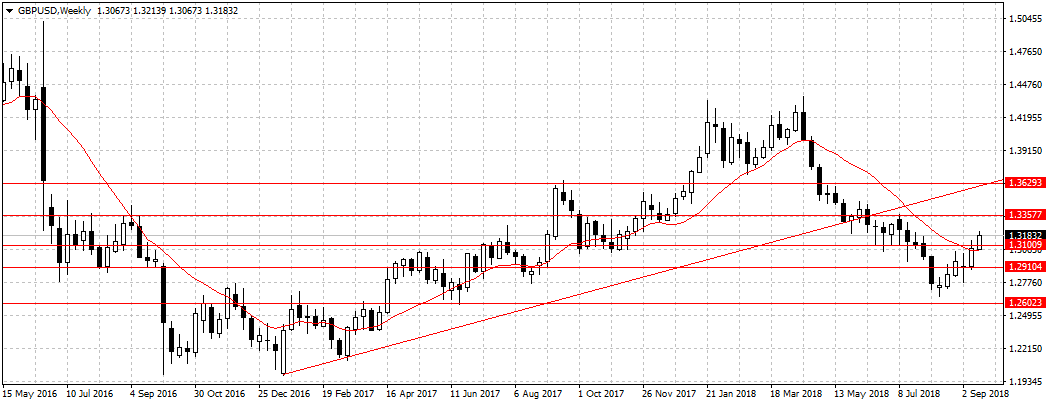

The pound jumped after the report was released by the Office for National Statistics on Wednesday to gain 0.4 percent against the US dollar. The rise in the odds of the BOE rising interest rates by the mid of 2019 boosted pound attractiveness to 1.3183.

Experts expect the rise in consumer prices to impact consumer spending going forward. This is because of the weak wage growth despite the labour market nearing full employment.

Therefore, a no deal Brexit may further worsen economic productivity as foreign investors are likely to look elsewhere.