- Apple Hits $1 Trillion in Market Cap

Apple became the second corporation to ever reached $1 trillion in market value on Thursday.

Before Apple attain $1 trillion in market value, there was a Chinese company, PetroChina, which reached the same milestone in 2007 but quickly lost more than 70 percent of its value during the global economic recession in 2008 to $260 billion, making it the largest destruction of shareholder wealth in history, according to Bloomberg.

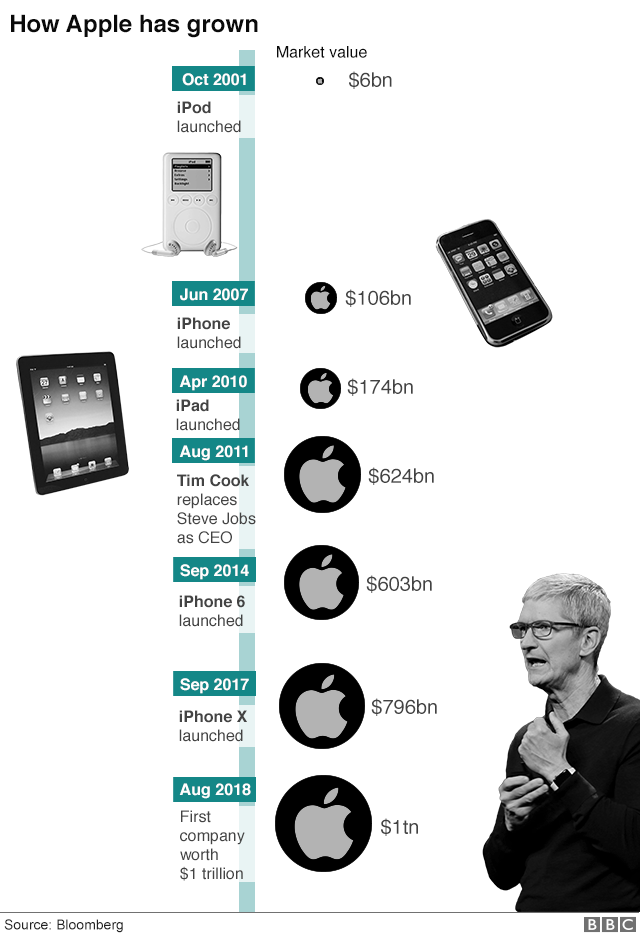

Apple shares rose 2.9 percent on Thursday to close at $207.39 a share, pushing its market capitalization to $1 trillion and the first U.S. publicly traded company to reach the mark.

Since iPhone was launched in 2007, Apple shares have risen by 1,100 percent and jumped almost one third in the past year.

In total, Apple has now gained 50,000 percent since it was first listed in 1980, more than the 2,000 percent increase for the S&P 500 index over the same period.

The company traced its success to the garage of co-founder Steve Jobs in 1976 when its Mac personal computers became mainstream before its globally embraced smartphone paved the way for the economy of the company.

Before the iPhone, Apple had sales of less than $20 billion and posted profits slightly less than $2 billion in 2006. However, that has changed as the company generated $229 billion in sales in 2017 alone, with $8.4 billion in profits, making it the most profitable public traded company in the US.

Still, despite Apple reaching $1 trillion mark, analysts do not view Apple’s shares as expensive given that they traded at about 15 times expected profits, especially when compared with 82 for Amazon and 25 times for Microsoft.