Economy

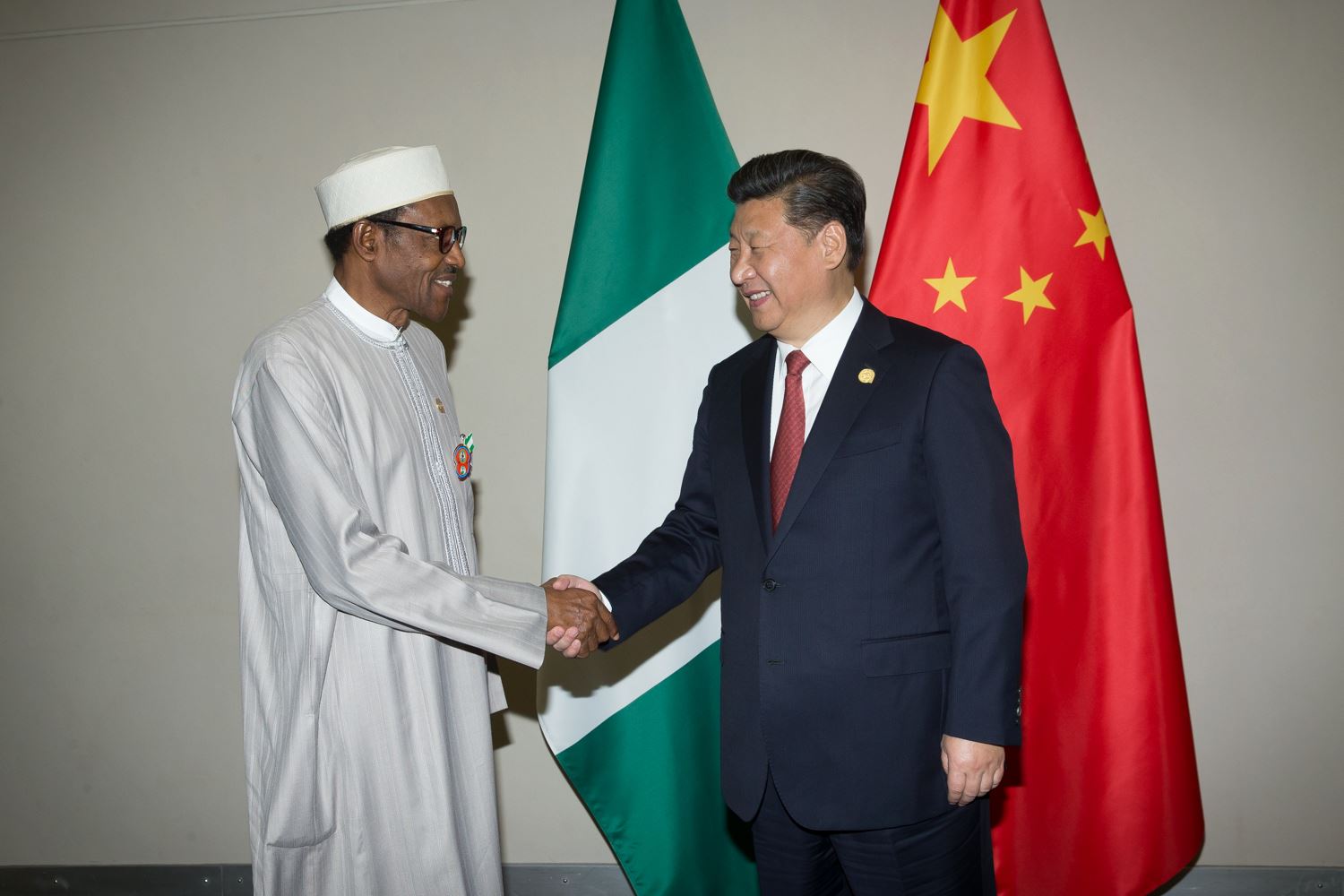

Boost for Nigeria, China Trade

Published

7 years agoon

- Boost for Nigeria, China Trade

Since the inclusion of the Chinese currency among basket of reserve currencies that have special drawing rights (SDR), by the International Monetary Fund (IMF), the government of China has continued to see it as a reflection of the importance of its currency in the world’s trading and financial systems.

The country’s expanding role in global trade and the substantial increase in the international use and trading of the Renminbi (RMB) has seen it increasingly enter into currency swap agreements with a lot of countries.

Some of the countries include the United Kingdom, Belarus, Malaysia, South Africa, Australia, Armenia, Surinam, Hong Kong, Pakistan, Thailand, Kazakhstan, South Korea, Canada, Qatar, Russia, the European Union, Sri Lanka, Mongolia, New Zealand, Argentina, Switzerland, Iceland, Albania, Hungary, Brazil, Singapore, Turkey, Ukraine, Indonesia, Uzbekistan, and the United Arab Emirates, with the deal totalling over RMB3.137 trillion. And last week, it finalised its currency swap agreement with Nigeria, valued at $2.5 billion.

Central Bank of Nigeria’s (CBN) spokesman, Mr. Isaac Okorafor, who announced this, said the CBN Governor, Mr. Godwin Emefiele, led CBN officials while PBoC Governor, Dr. Yi Gang, led the Chinese team at the official signing ceremony. He said the deal was sealed the preceding Friday after over two years of painstaking negotiations by both central banks.

According to the CBN, the transaction, which was valued at 16 billion RMB, was aimed at providing adequate local currency liquidity to Nigerian and Chinese industrialists and other businesses, thereby reducing the difficulties encountered in the search for third currencies.

The CBN said among other benefits, the agreement is expected to provide naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses respectively, thereby improving the speed, convenience and volume of transactions between the two countries.

“It will also assist both countries in their foreign exchange reserves management, enhance financial stability and promote broader economic cooperation between the two countries.

“With the operationalisation of this agreement, it will be easier for most Nigerian manufacturers, especially small and medium enterprises (SMEs) and cottage industries in manufacturing and export businesses to import raw materials, spare parts and simple machinery to undertake their businesses by taking advantage of available RMB liquidity from Nigerian banks without being exposed to the difficulties of seeking other scarce foreign currencies.

“The deal, which is purely an exchange of currencies, will also make it easier for Chinese manufacturers seeking to buy raw materials from Nigeria to obtain enough naira from banks in China to pay for their imports from Nigeria.

“Indeed, the deal will protect Nigerian business people from the harsh effects of third currency fluctuations.

“With this, Nigeria becomes the third African country to have such an agreement in place with the PBoC,” it explained.

Checks revealed that First Bank of Nigeria Limited, Stanbic IBTC, Standard Chartered Bank (SCB) and Zenith Bank Plc had been appointed the settlement banks for the bilateral currency swap agreement.

With their appointment, the four banks will be responsible for settling the trade transactions between importers and exporters from both countries, likely to take off just before next month.

The reason the four financial institutions were chosen was because StanChart and Stanbic already have operational offices in China, while Zenith and FirstBank have representative offices in Beijing.

However, whereas StanChart and Stanbic can start operations immediately as settlement banks, Zenith and FirstBank will be required to upgrade their representative offices to full operations in China.

While SCB already has a presence in China through its Standard Chartered Bank (China) Limited, Stanbic has been trading in the country through its affiliate, the Investment and Commercial Bank China (ICBC).However, FBN and Zenith Bank were also appointed because they already have representative offices in China.

So, while SCB and Stanbic can start immediately, it would take FBN and Zenith Bank some time to join the settlement arrangement because they would have to convert their representative offices to operational offices.

The settlement banks are expected to handle the trade obligations that would enable an importer in Nigeria, after filling the required documentation, to easily exchange the naira for the Renminbi (RMB) instead of resorting to third currencies such as the U.S. dollar, while the reverse will be the case for importers in China that trade with Nigerian businesses.

Commenting on the bi-lateral agreement, Research Analyst at FXTM, Lukman Otunuga, pointed out that sentiment towards the Nigerian economy was elevated after the nation finally signed the agreement with China.

According to him, the move will not only improve the speed, but also the convenience of transactions between both nations.

“There is a possibility that the naira will strengthen from the currency swap deal, as the demand for dollar drops,” he said.

To analysts at Cowry Assets Management Limited, the currency swap deal wouldfacilitate trade between the two countries, by providing adequate local currency liquidity to Nigerian and Chinese industrialists and other businesses, thereby sidestepping a third currency -the US dollar.

“We expect the arrangement to ease pressure on the limited dollar supply at the Investors’ & Exporters’ forex window (I&E)and hence, enhance stability of thenaira/dollar exchange rate,” the firm added.

But the Head, Global Research, Standard Chartered Bank, Razia Khan, said she does not expect the bilateral agreement to have any immediate impact on Nigeria’s forex reserves.

“Even if the swap were to be drawn on in the future, it would likely show up as a liability on the CBN’s balance sheet. However, the swap is still significant in that it provides greater international liquidity to the CBN, reducing the need for the CBN to hold an especially high level of precautionary USD FX reserves.

“Given the rebound in oil earnings, Nigeria’s reserves are at an increasingly comfortable level. With the swap arrangement in place, it will however be possible for the CBN to draw on this in order to provide the CNY liquidity needed to support Nigerian import demand from China, without having to convert that to US dollar demand first.

“So, in all, this should support expectations of forex stability in Nigeria, even as importer demand recovers. It is a small positive, which is reinforced by the greater positive of rising forexreserves because of the rebound in oil prices and exports,” Khan said.

Also, the Director General of the Lagos Chamber of Commerce and Industry (LCCI), Mr. Muda Yusuf, said the deal would positively impact trade and investments between Nigeria and China.

“It will impact on trade positively between Nigeria and China, because it would make the payment system easier. However, it can only last if the exchange rate remains stable. This is because if there are issues with the exchange rate, it may affect it,” he added.

CBN Governor, Mr. Godwin Emefiele had explained that Nigeria was not the only country that had agreed to a currency swap with China, as several other countries – developed and emerging markets – with growing trade volumes with China had entered into similar currency swaps with the Asian country.

“The agreement on the currency swap with China will definitely benefit Nigeria because the essence of the mandate is to ensure that Nigeria is designated as the trading hub with China in the West African sub-region for people who want the Renminbi as a currency denomination.

“Also for us, we believe that using the renminbi will improve trade with China, as this will encourage importers to open L/Cs in the Chinese currency for the importation of raw materials, equipment and machinery from China, rather than other trading regions, so the agreement will encourage trade between both countries,” he had explained.

This arrangement is also expected tocontribute towards stabilising the country’s balance of payments (BoP) position.

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

Nigeria’s GDP Records 3.46% Growth in Q3 Spurred by Non-Oil Sector

-

President Tinubu Presents N47.9trn 2025 Budget As Debt Servicing, Security, Infrastructure Take Lion Shares

-

I’m Not Nigeria’s PR, UK Party Leader, Kemi Badenoch, Tells Shettima

-

Nigeria and France Forge Strategic Alliance to Boost Solid Minerals Sector

-

Zhongshang Fucheng Moves to Auction Nigerian Properties in UK Following $70M Arbitration Award

-

Nigerians and Indians Lead UK Job Market Growth Amid Post-Brexit Migration Shifts