- U.K. Manufacturing PMI Expands at 8-month Low; Pound Dips

UK manufacturing activities grew at an 8-month low in February as companies struggle to cope with an increase in demand due to suppliers inability to meet raw material demands.

Manufacturing Purchasing Managers’ Index declined marginally from 55.3 in January to 55.2 in February, the IHS Market reported on Thursday. The slowest PMI reading since June.

But, experts attributed the weak growth rate to disruption in supply chain during the month.

Duncan Brock, director of customer relationships at the Chartered Institute of Procurement and Supply, said “Amidst these signs of a moderate slowdown, it was supply chain disruptions that were largely at fault,” he said. “Suppliers underperformed not only on the timely delivery of goods but in their inability to meet the demand from makers for some raw materials.”

However, employment in the sector rose for the 19th consecutive month as businesses struggle to meet rising demands despite raw material shortages and rising costs.

Also, both domestic and overseas orders expanded at a healthy pace in the month, with exports rising for 22 consecutive months.

“New export business rose for the 22nd successive month in February,” said Markit. “Where an increase was reported, this was linked to improved sales to clients in the USA, China, Europe, Brazil and East Asia.”

While the manufacturing sector remained healthy, continuous disruption of the supply chain may lead to inflationary pressures. Therefore, growing new investment in the sector is needed to sustain growth.

The Pound Sterling

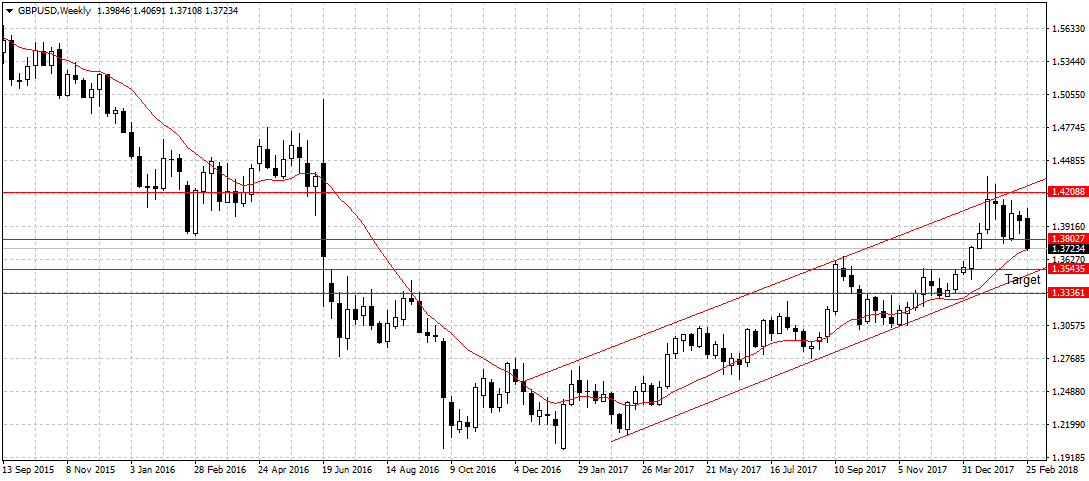

The pound sterling closed below 1.3802 support level against the U.S dollar on Wednesday for the first time since January 17th.

This was because of the disagreement between the U.K. and the European Union on North Ireland’s border control stated in the 118 page ‘Brussels’ draft Brexit’ treaty released by the European Union on Wednesday.

U.K. Prime Minister Theresa May has voiced her disagreement and reiterated that EU cannot keep North Ireland under EU’s customs area as that would split the U.K. into two.

According to Mrs. May, the EU draft would “threaten the constitutional integrity of the UK” by creating a border down the Irish Sea.

The inability of the two to reach a concrete agreement ahead of Theresa May’s Brexit speech due on Friday is likely to increase Brexit uncertainty and further weigh on the embattled pound.

However, because of the uncertainty surrounding the U.S. international trade policy following President Trump’s 25 percent and 10 percent tariff increment on steel and aluminum, and threats from affected nations to retaliate. It is advisable to trade GBPUSD with caution.

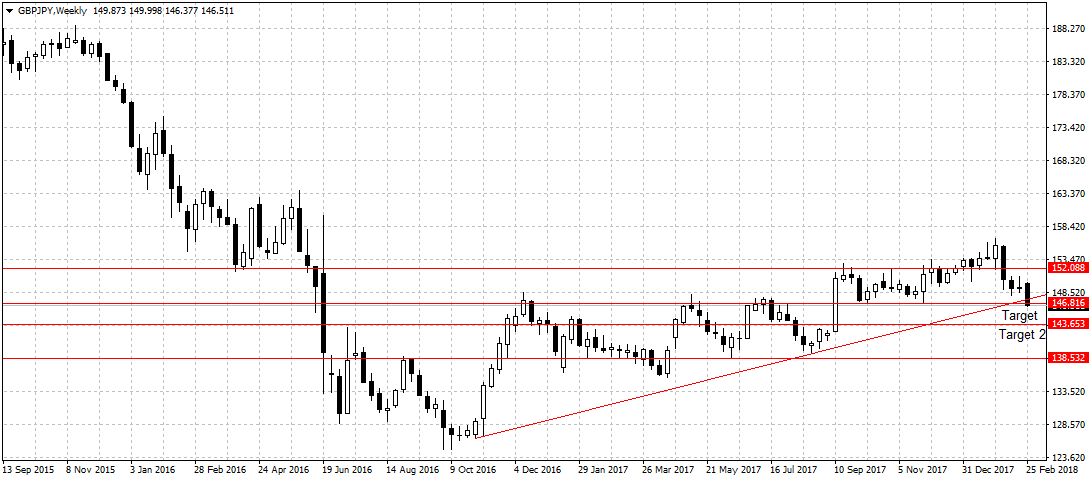

A unique alternative will be GBPJPY as projected in the forex weekly outlook. A close below our first target at 146.81 price level should open up 143.65 support level in days to come. Especially with the uncertainty surrounding Brexit.