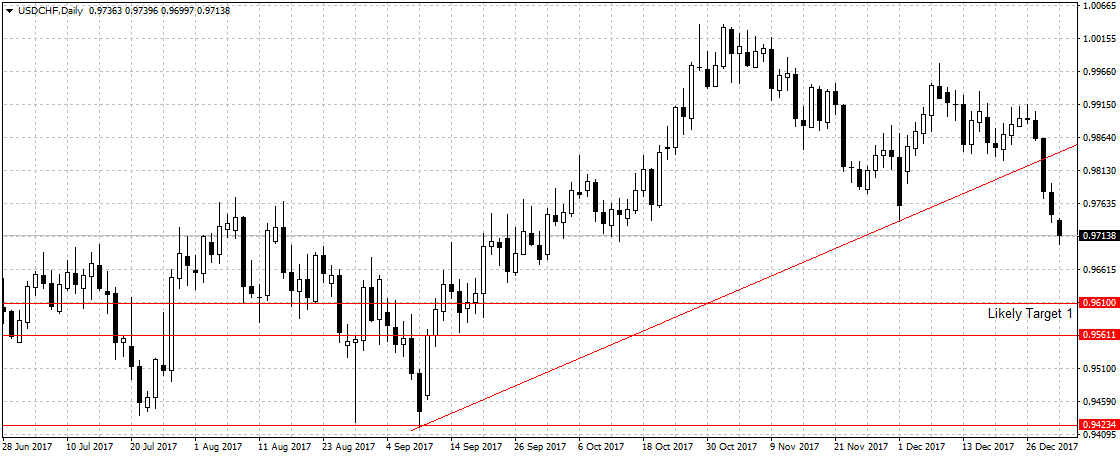

- US Dollar Selloff Plunges USDCHF

Since attaining parity in October, the US dollar has dropped 325 pips against the Swiss Franc to 0.9712 price level. While this seems like a perfect sell opportunity, it also reflects the US dollar end of the year broad selloff and Swiss Franc’s haven status.

While the Switzerland economy is struggling with job creation and the Swiss National Bank stated its overvalued currency is hurting economic activity. The US fundamental remained strong, with the unemployment rate currently at a record-low of 4.1 percent and the economy growing at 3 percent rate in the third quarter, suggesting that the US dollar is clearly undervalued against a haven currency with weaker economic fundamentals.

Therefore, while the chart reads sell, the fundamental call for caution as USDCHF’s bearish continuation depends largely on when sellers will call it a day and start taking profits. However, retail traders might capitalize on short-term sell opportunity before the US dollar rebounds as 2018 economic projection becomes clearer.