- Forex Weekly Outlook December 18-22

The ongoing U.S. tax reform continued to dictate global financial markets. However, with the reform likely to go through this week, the U.S. dollar is poised for a substantial gain against most currencies. Especially after the Reserve Bank raised interest rates by 25 basis points last week as projected and the economy continued to create jobs with further improvement of 3.9 percent unemployment rate projected for 2018.

But with the consumer prices and wage growth below expectations, the central bank may be compelled to review its policy stance in 2018 and not expect tightening labor market to eventually boost wage growth.

In the UK, the consumer prices rose to 3.1 percent, higher than the expected 3.0 percent while wages climbed 0.2 percent in the three months through October, suggesting that the weak pound sterling and the uncertainties surrounding the Brexit negotiation are weighing on prices in the U.K. and subsequently impacting the economic growth. Also, the while manufacturing surged on growing overseas orders in October, activities in the services sector slowed in the month. Services sector contribute about 80 percent of the total U.K. economy.

Here is our weekly pick, EURUSD, AUDUSD, CADJPY GBPUSD and EURNZD.

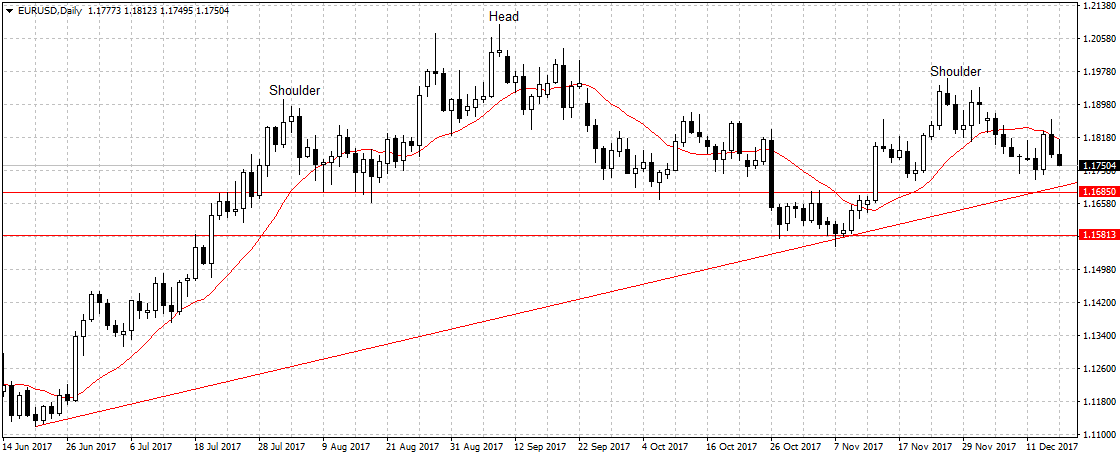

EURUSD

The lack of monetary direction from the European Central Bank impacted the Euro outlook, especially the decision of the central bank to maintain record-low interest rates even with growing economy.

However, the US dollar, on the other hand, was bolstered by the Federal Reserve decision to raise interest rates has projected and the plan to further complement this with a robust fiscal policy.

Therefore, this week the US dollar is expected to further gain against the Euro single currency towards the ascending channel at 1.1698, a sustained break below the 1.1685 should open up 1.1581 if the tax reform eventually goes through. Hence, we are bearish on EURUSD.

AUDUSD

The Australian dollar rebounded last week against the US dollar, however, this is likely a temporary upsurge due to better than expected retail sales and job numbers. This is because the Australian economy remains weak; growing at 0.6 percent rate in the third quarter and retail sales that rebounded in October has been down for three previous months due to growing household debt and weak consumer spending.

This week, the strong US economic fundamentals and tax reform possibility are likely to boost the US attractiveness against the Aussie dollar. Therefore, we remain bearish on AUDUSD as explained previous, and expect a break below the ascending channel at 0.7515 to open up 0.7385 (new target).

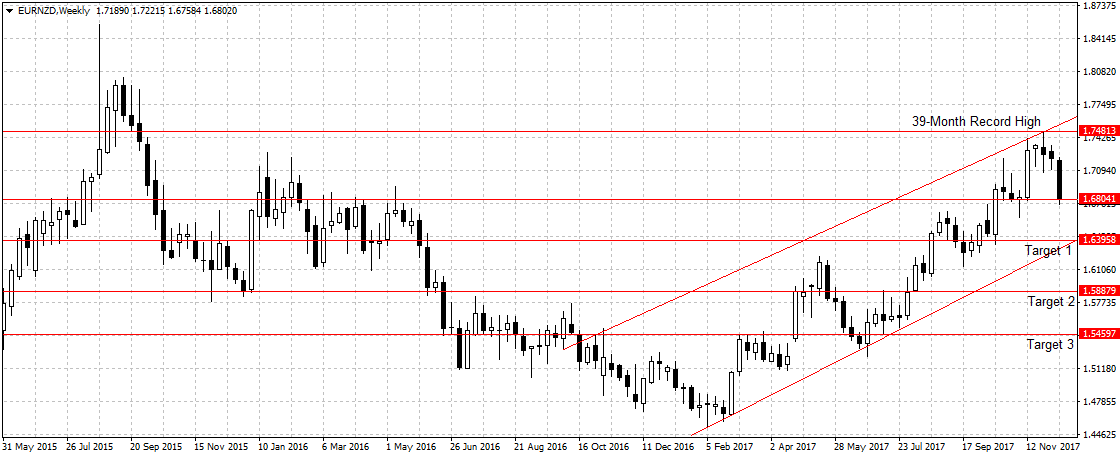

EURNZD

After peaking at a 39-month record three weeks ago, this pair called the top at 1.7481 price level and dropped 677 pips. Meaning, the European Central Bank’s monetary stance plunged the euro against the New Zealand dollar.

This week, the weak euro is expected to dip further against haven currency, Kiwi. A sustained break of 1.6804 price level should open up 1.6395, target 1.

GBPUSD

As previously explained, even though construction sector expanded more than projected in November, new investment remained weak, suggesting that investors are holding back due to growing economic and political uncertainty in the region. Therefore, a positive Brexit agreement or meeting is necessary to boost business confidence and sustain economic activities.