- Forex Weekly Outlook October 23-27

The US dollar rebounded last week after the senate adopted 2018 fiscal budget. However, the weaker than expected inflation rate, 0.5 percent, and retail sales, 1.6 percent, remain concerns as the Federal Reserve prepares to start unwinding its balance sheet in October.

In Europe, the Brexit got a huge support from German Chancellor Angela Merkel in a move believed by most to have broken Brexit deadlock. Merkel refuted the general assertion that Brexit negotiation won’t succeed, she said “there is zero indication that Brexit talks won’t succeed and she “truly” wants an agreement rather than an “unpredictable resolution.”

This week, I will be reviewing our last week’s pick, AUDJPY, NZDUSD, AUDUSD, NZDJPY, and USDJPY.

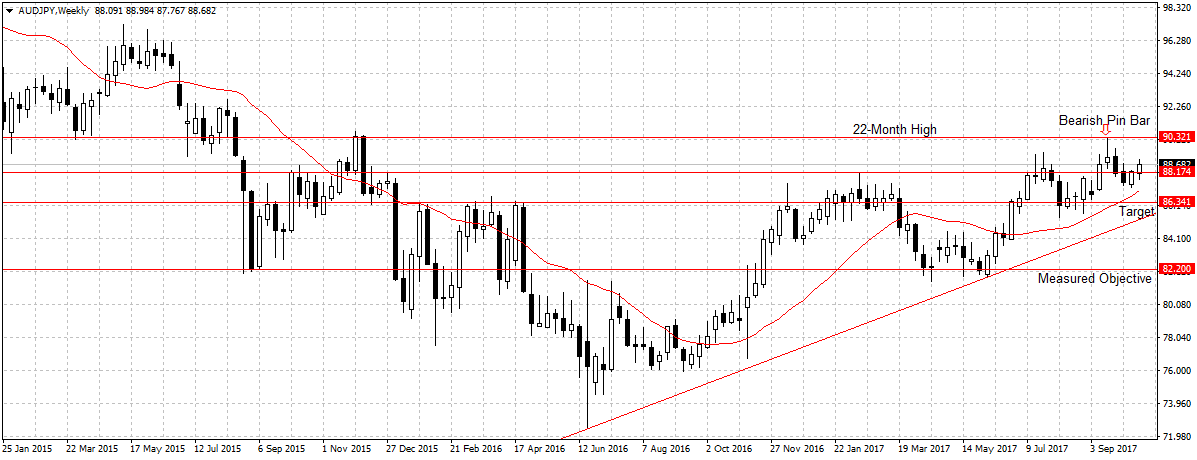

AUDJPY

The Australian dollar gained against the Japanese Yen last week to close above the 88.17 price level.

This was because of the uncertainty surrounding the Japanese Yen prior to the October 22 election as explained in the weekly outlook. However, with Prime Minister Shinzo Abe winning the election and securing a two-thirds parliamentary majority. He now has the mandate to go ahead and revise Japan’s pacifist constitution and sustain his Abenomics.

Therefore, the strong Japanese economy and growing export amid likely surge in investment inflow this week should aid the attractiveness of the Japanese Yen against the overpriced Australian dollar. This week, I remain bearish on AUDJPY pair and will look to sell below the 88.17 support level for 86.34 targets.

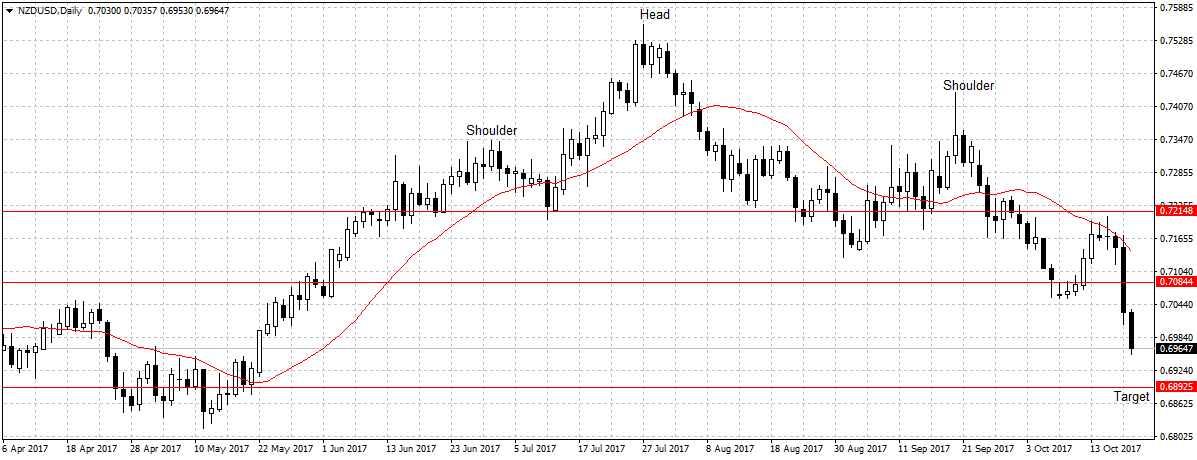

NZDUSD

As explained during the week, the uncertainty surrounding the New Zealand dollar and the success of the 2018 fiscal budget with the US senate boosted the NZDUSD selloff last week.

However, until the New Zealand First coalition announces its economic growth plan, investors will continue to pull out money from the market. So this week, I remain bearish on this pair with 0.6892 as the target.

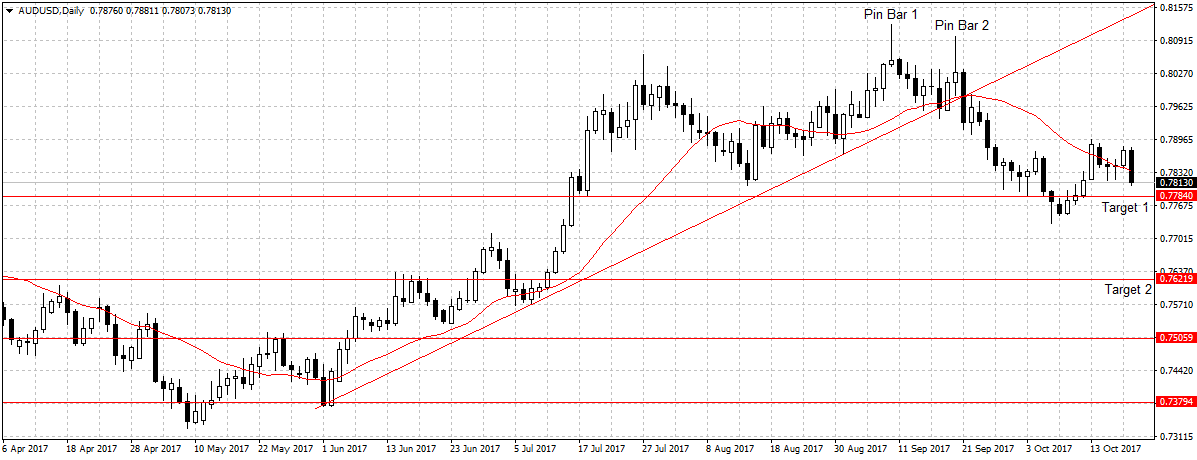

AUDUSD

AUDUSD remains on track for 0.7784 targets as explained last week. But Australian inflation rate due on Wednesday will confirm pricing and its impact on highly indebted Australian household.

Hence, I remain bearish on this pair and will look to add to my position below the 0.7784 support level.

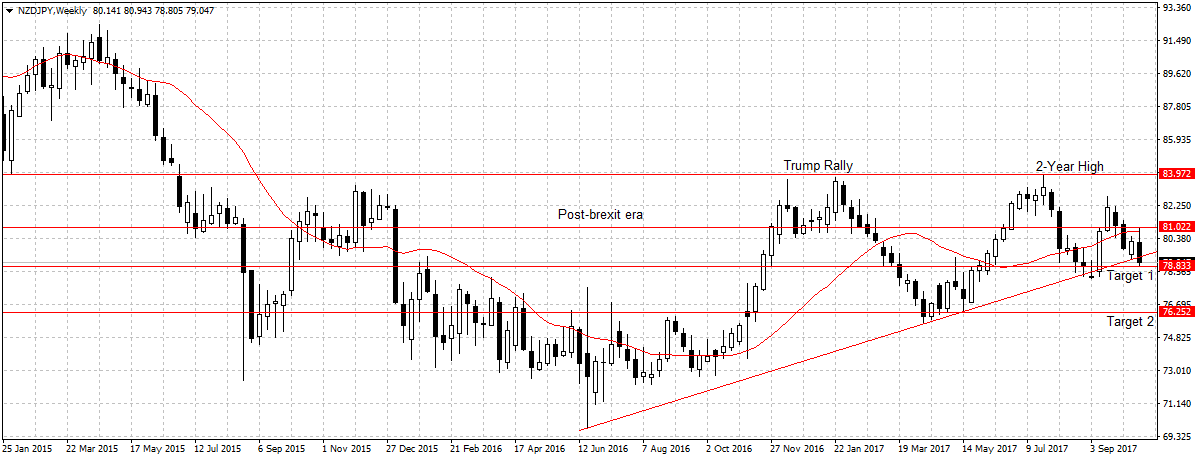

NZDJPY

Similarly, the NZDJPY should break 78.83 support level now that Prime Minister Shinzo Abe has won convincingly.

Again, if the new coalition party failed to present a holistic economic plan in coming days amid rising food prices and weak wage growth. NZDJPY may head towards 2017 low of 75.61 support level. Therefore, our forex weekly outlook Oct 16-20 holds. This is an excerpt from last week analysis.

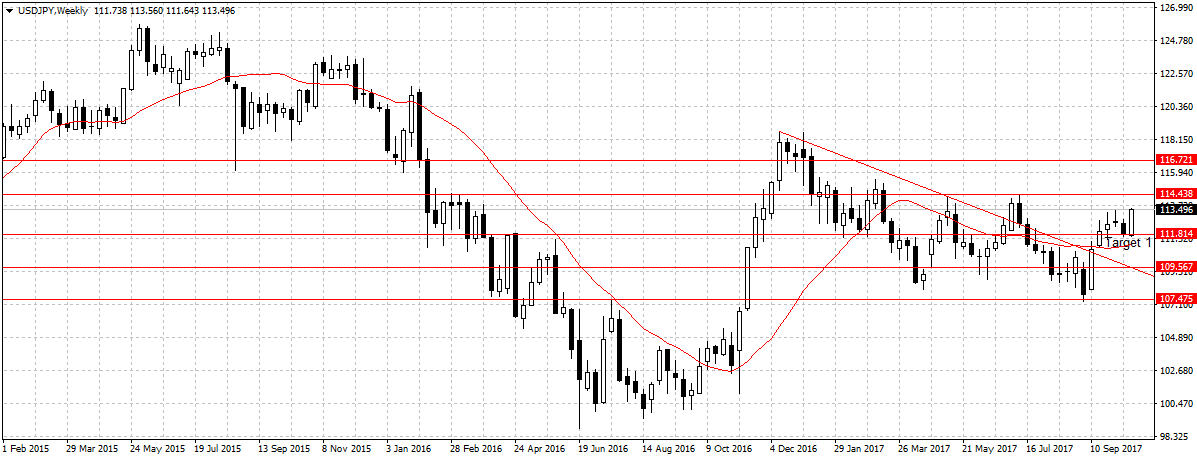

USDPY

Both the US and Japan’s economic fundamental are strong but the likely surge in the Japanese assets in the aftermath of the election should strengthen the Yen against the dollar and weigh on this pair outlook going forward. Therefore, I would expect a pullback from 113.49 towards 111.81 support level.

Therefore, USDJPY may touch 114.43 resistance level per adventure Shinzo Abe lose the election or win with a slight margin that gives voice to the opposition in parliament. A convincing victory would strengthen Yen against the US dollar to 111.81 support. This is an excerpt from last week analysis.