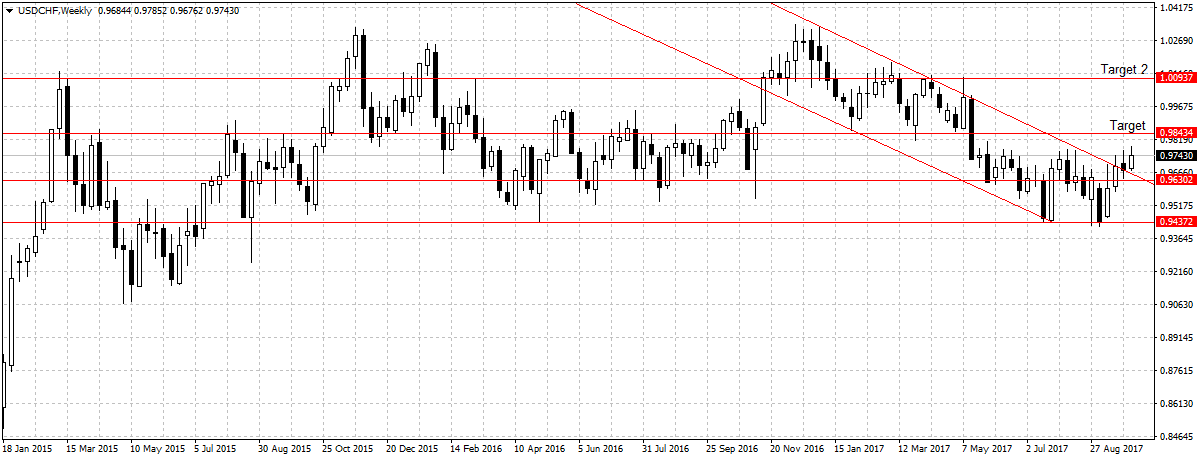

- USDCHF Heading Towards Parity

The renewed interest in the U.S. assets amid growing uncertainty in the Euro-area and fall in global commodity prices, that undermines emerging markets potential, continued to fuel the greenback attractiveness against its counterparts. This includes the Swiss Franc CHF.

Since the USDCHF plunged in November following the surge in global risk, especially in the U.S. This pair has failed to call the bottom until last month when Federal Reserve announced the commencement of balance sheet normalization.

Also, the Swiss National Bank loose monetary policy is weighing on the attractiveness of the Swiss Franc as the apex bank as long said the currency is overpriced. Meaning it may not be cutting monetary accommodation anytime soon.

Technically, this pair has lost about 604 pips since peaking at 1.0342 in November, but with a break above the descending channel and renewed interest in the U.S. dollar. This pair is likely to reach 0.9843 resistance level. A sustained break would open up 1.009 parity level as shown above.