- Forex Weekly Outlook September 25-29

The US Federal Reserve left interest rate unchanged last week, but announced the commencement of its $4.5 trillion balance sheet normalization in October and revised up economic growth forecast from 2.2 percent to 2.4 percent in 2017. Stating that continuous job creation and improved economic outlook will further aid the labor market and lower jobless rate in 2018 and 2019 to 4.1 percent. However, with the strong economic projection, the US dollar failed to sustain its earlier gains after Donald Trump’s comments on North Korea at the United Nations General Assembly.

In Japan, the Bank of Japan also kept the interest rate at -0.1 percent but maintained the ongoing quantitative easing program. A decision one of the Monetary Committee disagreed with and insisted that the current policy won’t pressure prices enough to attain the central bank’s 2 percent inflation target.

This week, EURJPY, AUDUSD, CADJPY, and NZDJPY picked last week top my list.

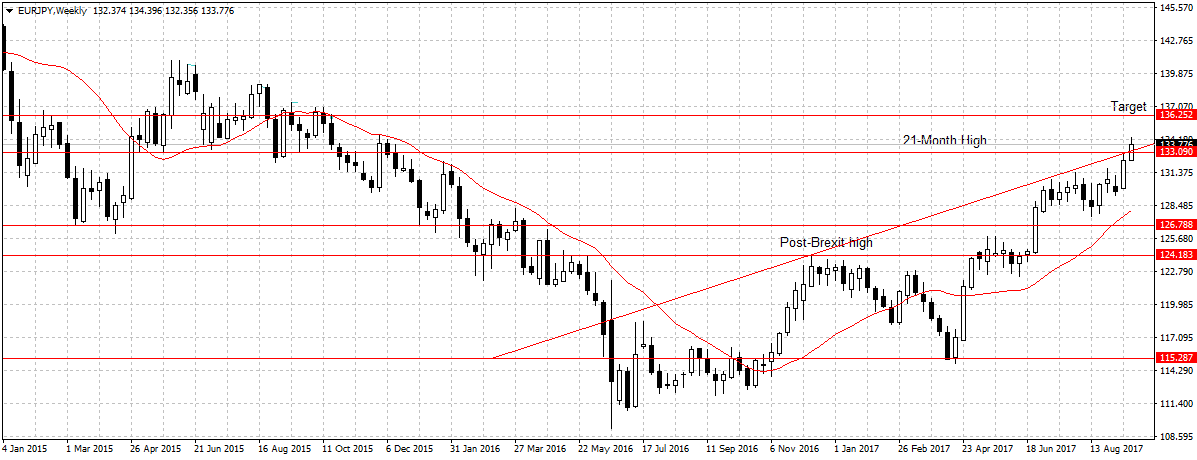

EURJPY

The Euro-area economy continued to improve amid growing business confidence. The manufacturing sector expanded by 58.2 in September, while the services sector grew by 55.6. Another indication of a healthy economy and increased business activities.

Adding this positive economic data to Angela Merkel wins in Germany, further validate the Euro bullish position and the continuous gain is expected to attract enough buyers to boost the EURJPY towards our target.

Also, the anti-U.S. rally staged in North Korea over the weekend would weigh on Japanese Yen this week and increase political uncertainty in the country. Again, a sustained break above the 21-month price level, as shown above, affirm bullish continuation. Therefore, I remain bullish on this pair with 136.25 as the target as explained last week.

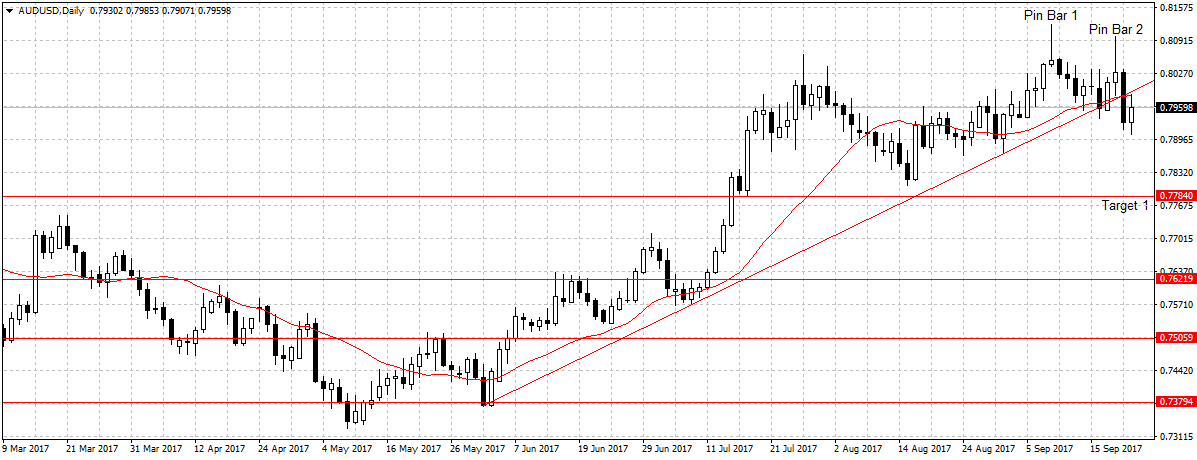

AUDUSD

The Reserve Bank of Australia’s dovish statement impacted Australian dollar’s outlook. However, the uncertainties in the U.S. are weighing on the U.S. dollar attractiveness and with the Anti-U.S. rally staged in the North Korea over the weekend, investors are likely to avoid the U.S. assets to avert volatility.

Technically, the two pin bars above the ascending trendline indicates waning upside strength, but a close below the trendline and the 20-day moving average confirmed bearish continuation. But the increasing uncertainties in the U.S., including the Obamacare repeal vote due this week, could halt progress. Therefore, while I am bearish on AUDUSD as I believe the Australian dollar is currently overpriced, I will be staying neutral to monitor geopolitical events in relation to price action.

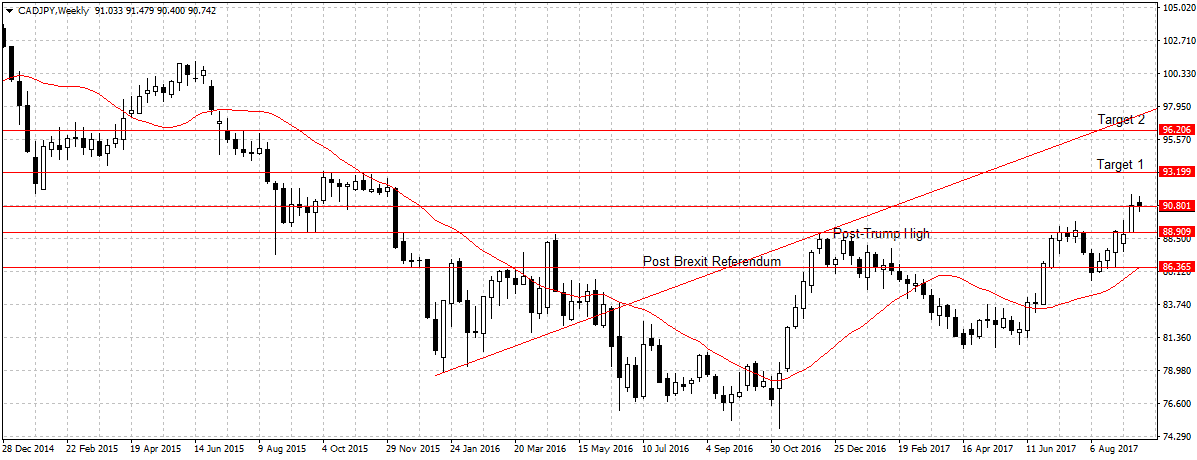

CADJPY

The Canadian consumer prices improved in August to 1.4 percent on rising gasoline costs. Although it was below the 1.5 percent predicted by economists, it was higher than the 1.2 percent from preceding month. Yet the Canadian dollar dipped last week following Donald Trump’s comments. This is because Canada’s largest trading partner, the U.S., exert a certain effect on the economy.

This week, I will expect the gain in commodity prices and Japan’s uncertainty to boost this pair attractiveness for 93.15 resistance levels as explained last week.

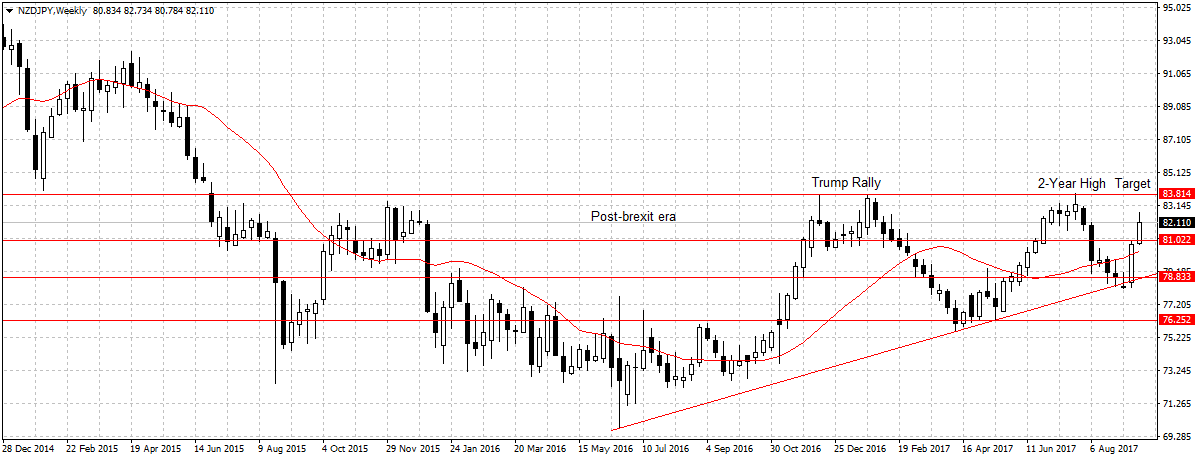

NZDJPY

As stated last week, This pair closed above the 20-day moving average last week. However, a close above the 81.02 resistance level is needed to validate bullish continuation. Therefore, this week I will look to buy this pair above 81.02 resistance level and expect a sustained break to boost its demand towards 83.81 targets.

This week, I remain bullish on this pair for two reasons: Haven assets and emerging currencies would likely be the focus this week. Two, the Yen is expected to slide further amid political uncertainty.