- Forex Weekly Outlook September 18-22

As projected, the U.K consumer prices rose from 2.6 percent in July to 2.9 percent in August. Boosting the Pound to more than 14-month high last week as investors believe the almost 3 percent inflation rate would force policymakers to raise rates in order to curb escalating consumer prices. However, wage growth remains weak, even with the unemployment rate at a 42-year low, earnings grew at 2.1 percent year-on-year and below the pace of inflation. Another indication that growing job market is yet to translate to wage growth.

In the US, inflation rate climbed higher than projected for the first time in five months, and surged from 1.7 percent year-on-year in July to 1.9 percent in August. While this is slightly below the 2 percent inflation target of the Federal Reserve it is closer than experts projected and likely to aid balance sheet normalization due to be announced in October.

But rising consumer prices has started eroding consumers’ buying power as retail sales fell 0.2 percent in August while the preceding two months were revised down. Signaling weak consumer spending and partly the reason factory production declined by 0.3 percent.

Also, while the extent of Hurricane damage is yet to be evaluated, it impacted some of the figures as data collection lagged behind in areas affected.

This week, AUDUSD, CADJPY, EURJPY, NZDJPY and EURGBP top my list.

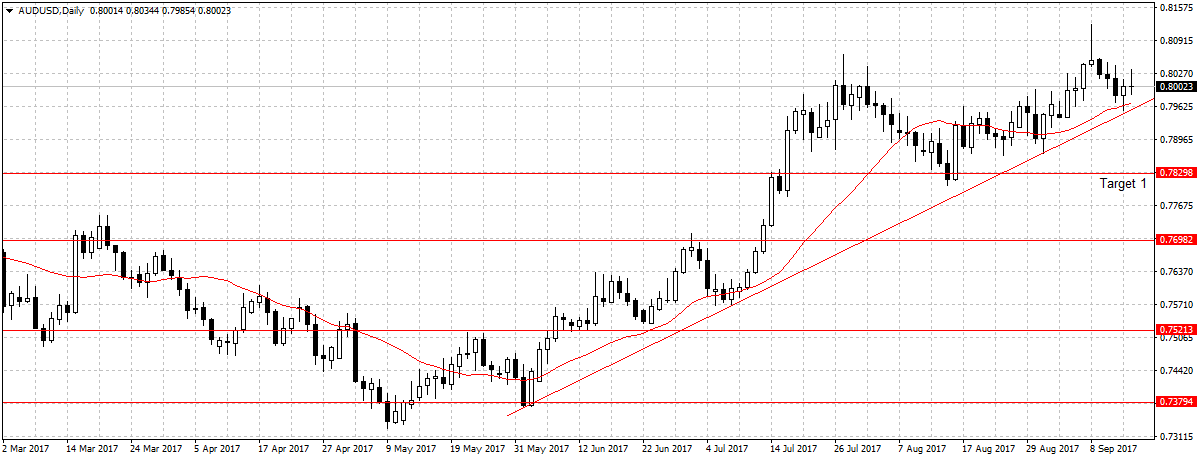

AUDUSD

The Australian dollar rose more than two-year high against the US dollar two weeks ago, but plunged after the Reserve Bank of Australia Governor Philip Lowe said the high exchange rate is impacting inflation rate and economic output. Since then the Aussie has loss 122 pips and closed as a gravestone doji last week. A sign of bearish pressure.

Also, the US inflation rose better than expected and forecast to sustain its progress in the fourth quarter, when the effect of the Hurricane would have filtered through key economic sectors.

Again, while the uncertainties surrounding tax cut and North Korea missile threat are weighing on the US dollar outlook. The Australian dollar, on the other hand, is overpriced and likely to remain less attractive in coming days.

Technically, I don’t see this pair breaking 0.8121 resistance level and expect a break below the 20-day moving average and the ascending trendline as shown above to reinforce sellers’ interest towards 0.7829 support level. Especially now that the Hurricane impact is limited and data showed increased odds of the Fed commencing balance sheet normalization next month. This week I will look to sell this pair below the ascending trendline for 0.7829 targets.

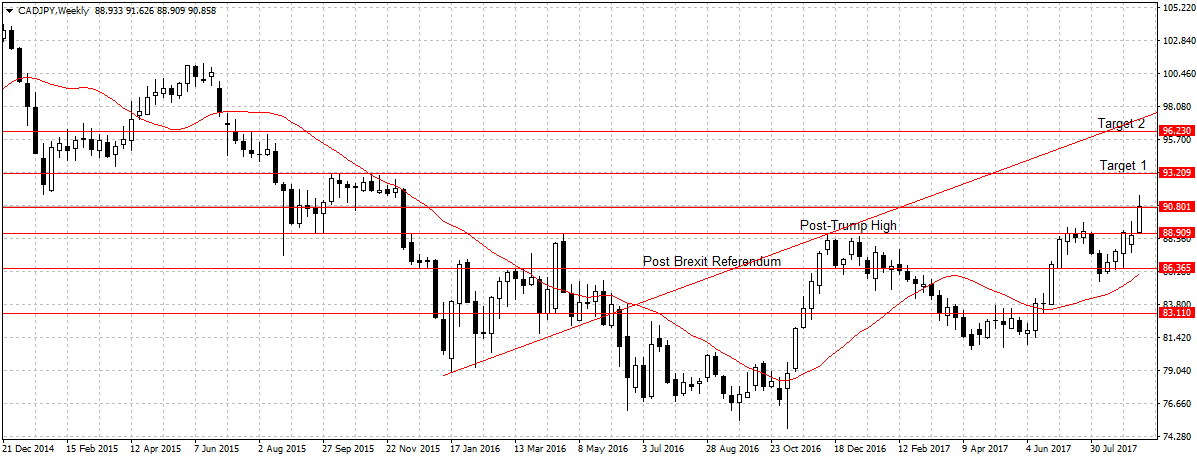

CADJPY

The Canadian dollar rose to more than 19-month high against the Japanese Yen last week. However, after the North Korea fired another missile towards Japan this weekend, the second within two weeks, investment inflow is likely to be affected and business sentiment weaken as businesses and investors will look to assess the situation before making further commitments. This will affect the Yen outlook against other currencies.

Another key fact to note is that both the Japanese and Canadian economies are growing healthy but the growing uncertainty in Japan and near-zero inflation rate plunged the currency against its counterparts last week.

This week, I will expect a sustained break of 90.80 price level to increase buyers’ demands for CADJPY and open up 93.20 resistance level. Therefore, I will be looking to buy this pair above the 90.80 this week.

Please note that the Bank of Japan is expected to maintain current policy rate on Thursday when the apex bank is due to announce its rates and release economic outlook. Likewise, the Canadian consumer prices due on Friday will impact the Canadian dollar outlook, a positive data will further boost loonie outlook against the yen but a better than expected Japan policy rate will void this analysis.

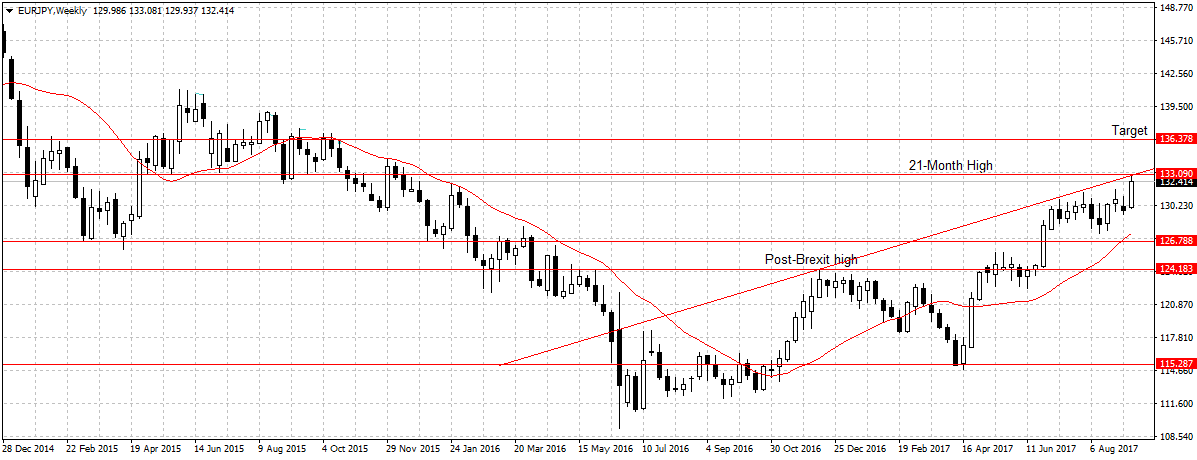

EURJPY

Since the European Central Bank president, Mario Draghi said inflation rate remains a concern and far below the apex bank target, the odds of the apex bank raising rates or unwinding balance sheet soon has dropped. But the strong economic data, growing manufacturing sector, surge in exports, consumer spending and foreign direct investment amid weak wage growth, is supporting the Euro economic outlook.

Again, while the Japan economy grows faster at 4 percent in the second quarter. The Bank of Japan governor, Haruhiko Kuroda said it is not sustainable. Also, the uncertainty in the world’s third-largest economy would impact the Yen attractiveness this week.

This pair has gained more than 900 pips since June and continued to establish high-high candlesticks. Therefore, this week I will expect a close above 133.09 resistance level to boost the attractiveness of the EURJPY towards 136.37 targets. I am bullish and will be buying above 133.09 levels.

Last Week Recap

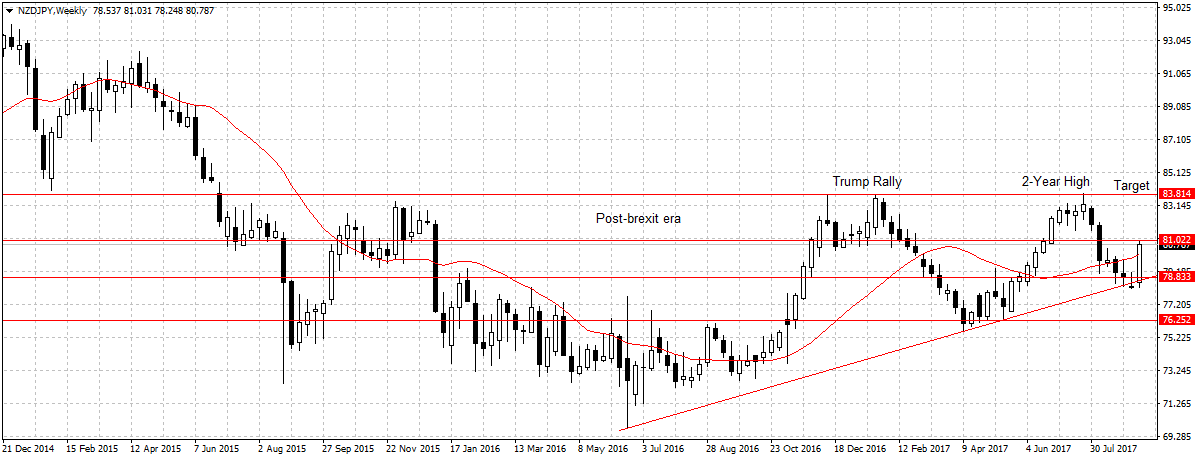

NZDJPY

The growing demand for haven assets boosted the New Zealand dollar attractiveness last week, but the uncertainties surrounding the Japanese Yen aided its gains.

This pair closed above the 20-day moving average last week. Indicating bullish momentum, however, a close above the 81.02 resistance level is needed to validate bullish continuation. Therefore, this week I will look to buy this pair above 81.02 resistance level and expect a sustained break to increase its demand towards 83.81 targets.

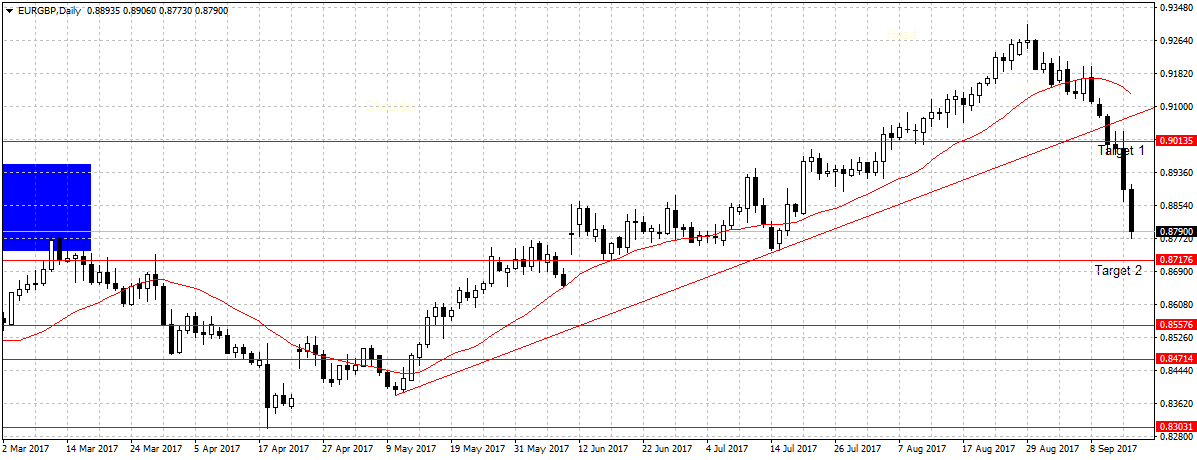

EURGBP

As explained last week, the Pound gained across the board on rising inflation.

This week I will expect the increase in the odds of the Bank of England raising rate to aid EURGBP to 0.8717 targets.