- Forex Weekly Outlook September 11-15

The US dollar plunged against its counterparts last week following increased Hurricane damage and North Korea missile threat. These uncertainties weighed on economic activities and plunged new job creation. The labour market added fewer jobs, 156,000, in August than expected, below the 180,000 jobs projected by economists and 189,000 recorded in July.

Also, while the second quarter economic growth was revised up to 3 percent from 2.6 percent previously reported, wage growth remained lackluster, rising just 0.1 percent in August. Another reason the markets doubt the Fed will raise rates anymore this year, especially with the US economic activities expected to be impacted by the Hurricane damage in the third and fourth quarters. Hence, the reason the odds dropped to 25 percent from 50 percent last week.

However, the services sector sustained growth, factory activities and private businesses added more jobs. Indicating the economy remains healthy, but surged in uncertainties is weighing on the overall outlook.

This week, GBPAUD, EURCAD, EURGBP, NZDJPY and GBPJPY top my list.

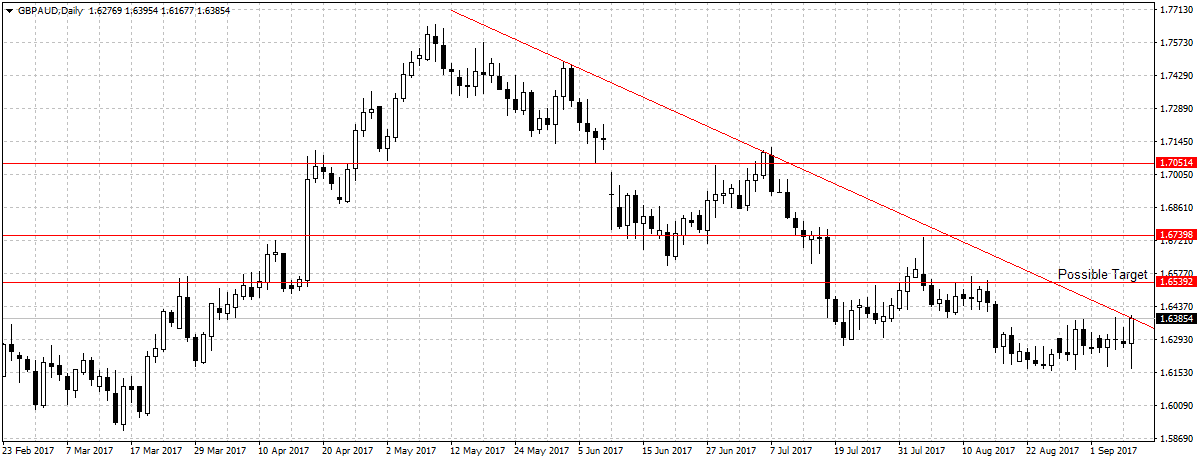

GBPAUD

While the Pound Sterling remained weak and largely weighed upon by the ongoing Brexit negotiation. The embattled currency has defiled some predictions as certain sectors, like the manufacturing sector, remain resilient. Also, the possibility of the Monetary Policy Committee raising rate later in the year due to surging inflation rate is aiding the Pound resilience.

The Australian dollar, on the other hand, dipped last week against the pound and few other currencies after data showed the economy grew by 0.8 percent in the second quarter but household savings declined while wage growth remains weak. Growing by just 0.3 percent in the quarter and 2.1 percent year-on-year.

Again, while the drop in savings signaled a surge in consumer confidence, the flat retail sales and the decline in trade surplus to 0.46 billion in July from 0.89 billion in June says otherwise. Accordingly, the Reserve Bank of Australia governor, Philip Lowe said in a statement that the higher Australian dollar exchange rate is expected to weigh on price pressures in the economy and hurt economic output and employment. This suggests that despite the surge in commodity prices and growing economy, the apex bank may not raise rate anytime soon.

In light of this, I will be looking to buy this pair above the downward trendline started on May 10 for 1.6539 targets as shown above. A sustained break above the trendline would affirm mid-term bullish continuation and open up 1.6539 targets. Failure to do so will invalidate this analysis and reign-in prices.

EURCAD

Since the Bank of Canada first raised rates in July, the Canadian economic outlook has changed and strengthened cash inflow. This surge in new investment was also aided by a healthy labour market and moderately stable commodity prices. Last week, the BOC once again raised rates by 25 basis points for the second time within two months. A sign that the economy is growing and expected to continue into the future. Accordingly, the labour market added 22,200 jobs in August, while the unemployment rate improved to 6.2 percent from 6.3 percent recorded in August. This strong economic data is expected to boost Canadian economic outlook and subsequently support the currency against its counterparts going forward.

Also, while the European Central Bank is yet to decide on balance sheet normalization or when inflation rate would meet the apex bank’s 2 percent target. The Bank of Canada is making decisions. However, while I expect the Canadian dollar to gain further this week, the uncertainties in the U.S. are expected to hurt the currency outlook and limit volume of trade. Still, I will be looking to sell this pair below 1.4602 once price closed below that level.

Technically, price moved below the 20-day moving average two weeks ago and has since sustained it. But bearish confirmation below 1.4602 is needed to validate further sell while targeting 1.4398 support level. A sustained break should open up 1.4172 support, our target 2.

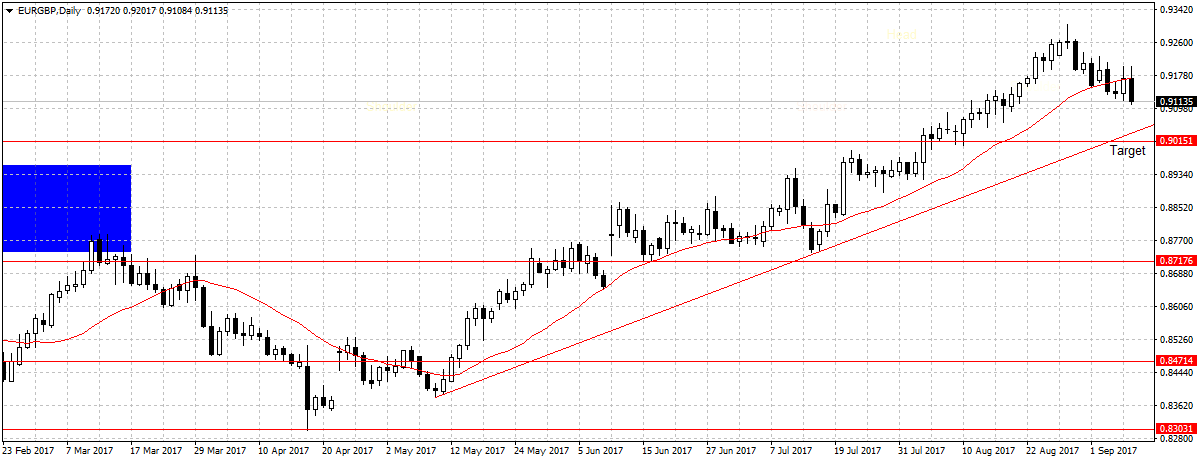

EURGBP

Since the EURGBP called the top on August 29, this pair has plunged by 192 pips. However, last week, this pair closed below the 20-day moving average for the first time since July 14. A sign of Pound resilience and ECB monetary policy stance. Therefore, if consumer prices due on Tuesday shows inflation rises from the current 2.6 percent to the projected 2.8 percent, the Bank of England stance on interest rate hike is likely to change as escalating inflation rate is predicted to force the apex bank to raise rates regardless of the Brexit outcome. If happened, it will boost the Pound temporarily.

Also, it is expected that the monetary policy committee will keep interest rate at record low of 0.25 percent on Thursday, but investors will look into the monetary statement for a clue. An increase in the odds of the apex bank raising rates would aid pound outlook against the Euro and vice versa.

This week, I will look to sell this pair below 20-day moving average for 0.9015 support as shown above, while monitoring economic data for a clue on monetary stance.

Recap of Previous Analysis

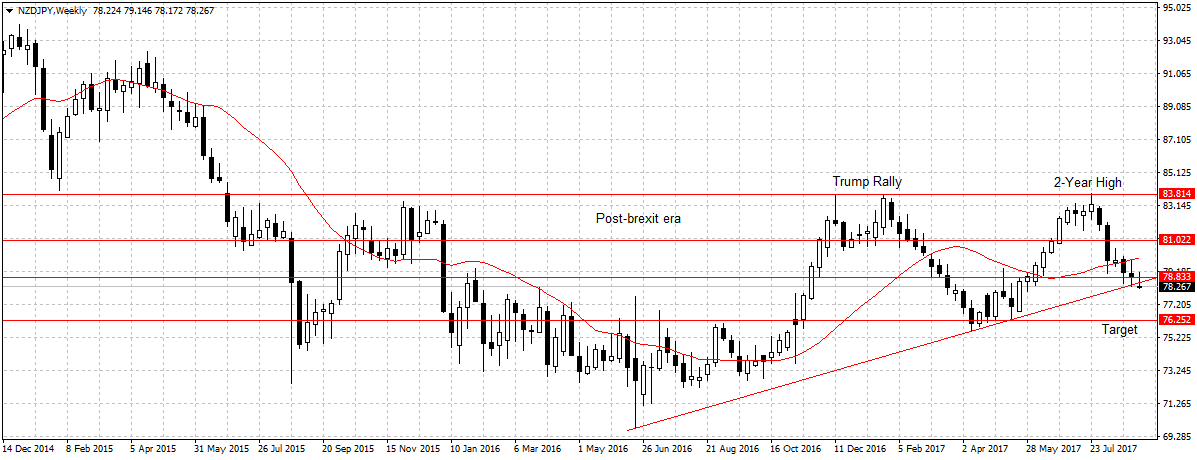

NZDJPY

After our first target was hit three weeks ago, this pair volume of trade dropped following North Korea missile test over the Southern region of Japan. But with the last week candlestick closing below the ascending trend line and as bearish a pin bar as shown below. Once again NZDJPY has confirmed bearish continuation, therefore I remain bearish on this pair with 76.25 as the target.

After our first target was hit three weeks ago, this pair volume of trade dropped following North Korea missile test over the Southern region of Japan. But with the last week candlestick closing below the ascending trend line and as bearish a pin bar as shown below. Once again NZDJPY has confirmed bearish continuation, therefore I remain bearish on this pair with 76.25 as the target.

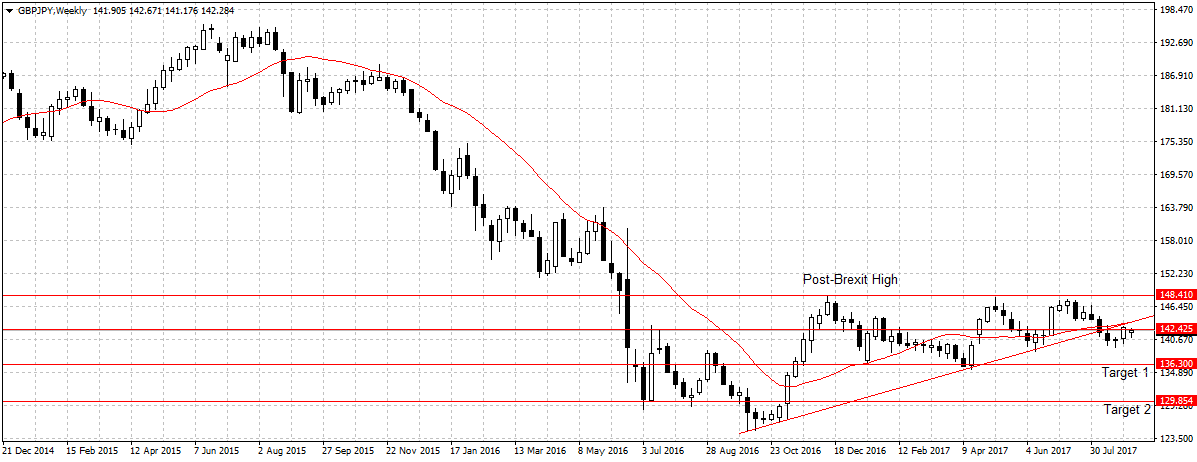

GBPJPY

The Pound remains resilience and for the last three weeks it has gained against the Yen, however, it failed to break the ascending trendline that doubled as the resistance and also the 20-day moving average. Suggesting that downward pressure remains and current pull back was merely caused by growing global uncertainties due to North Korea missile threat.

Hence, I remain bearish on this pair as long as price remains below the ascending trendline and will look to sell below 142.42 price levels for 136.30 targets, a sustained break should open up target 2 as shown above.

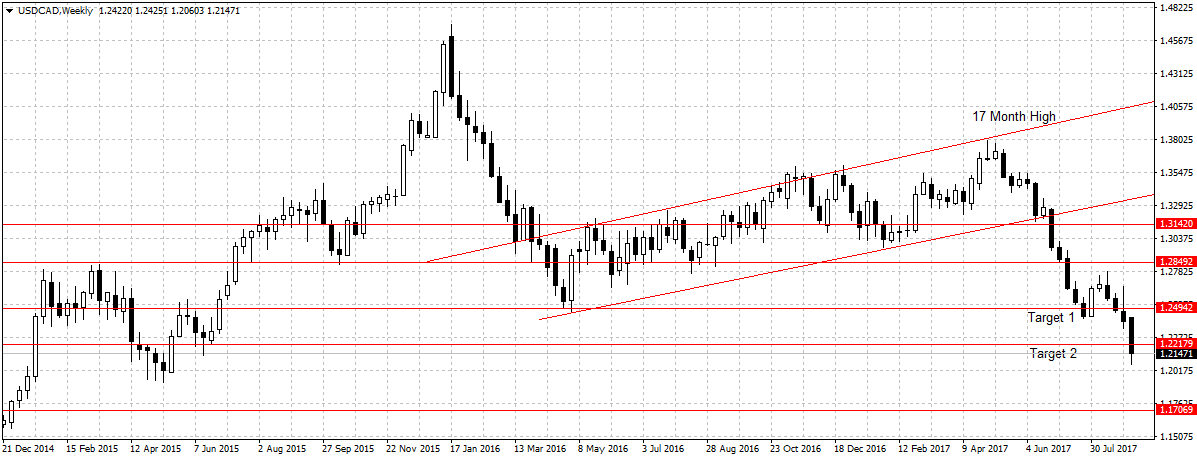

USDCAD

Last week, USDCAD’s target 2 was hit after 5 weeks. But the uncertainties in the US, Canada’s largest trading partner, forced me to stand aside, even though I expect the renewed interest in the Canadian economy to bolster Canadian dollar outlook towards 1.1706 support. This week, I will be standing aside on this pair while monitoring global events and update accordingly.

Last week, USDCAD’s target 2 was hit after 5 weeks. But the uncertainties in the US, Canada’s largest trading partner, forced me to stand aside, even though I expect the renewed interest in the Canadian economy to bolster Canadian dollar outlook towards 1.1706 support. This week, I will be standing aside on this pair while monitoring global events and update accordingly.