Markets

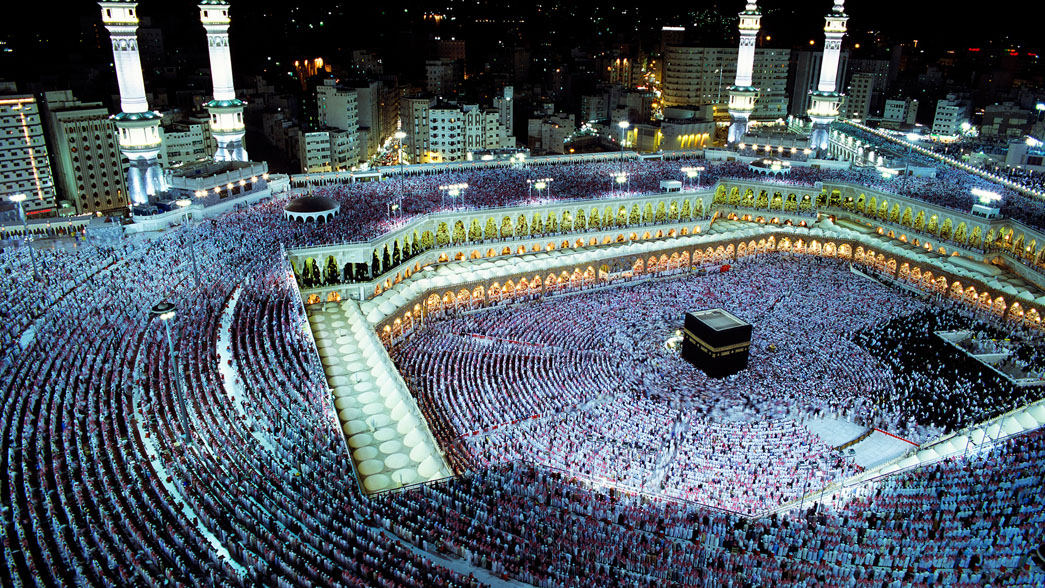

Despite Recession, States, Others Spend Over N136.5bn on Hajj

Published

7 years agoon

- Despite Recession, States, Others Spend Over N136.5bn on Hajj

At least N136.5bn has been spent on Hajj in 2017 by state governments and individuals despite the current recession in the country, investigation has revealed.

According to the National Hajj Commission of Nigeria, no fewer than 91,000 Nigerians had arrived in Saudi Arabia out of the over 1.7 million foreign pilgrims in the country to perform this year’s Hajj. Meanwhile, the average Hajj fare approved by NAHCON to states for each traveller is N1.5m.

For example, information made available by NAHCON showing the approved 2017 Hajj seats and fares per state disclosed the package for travellers from Nasarawa State as N1,544,659.85; Niger, N1,525,483.30; Ondo, N1,485,096.07; Katsina, N1,498,502.70; Bauchi, N1,523,122.41; Plateau, N1,529,036.80; Sokoto, N1,521,461.65; and Kwara, N1,501,571.27, among others.

Therefore, at an average fare of N1.5m, 91,000 Nigerians would have spent a minimum of N136.5bn on the exercise, with part of it coming from public purse provided by state governments.

Although going on Hajj at least once in a lifetime is one of the five pillars of Islam, the Quran described it as a religious obligation that is meant for the faithful who can afford it. Meanwhile, visiting Jerusalem for pilgrimage is not an obligation for Christians. However, state governments have been sponsoring people to Mecca and Jerusalem for pilgrimage. Also, investigation revealed that Katsina, Bauchi, Plateau and Sokoto states had sponsored people on pilgrimage this year.

For instance, Governor Aminu Masari of Katsina State recently disclosed that his administration had been subsidising Hajj exercise for Muslims with N1bn annually.

Masari, while inaugurating an 18-member board for the Katsina State Pilgrims’ Welfare Board, had said no amount spent on religious activities could be considered as too much and described pilgrimage to Mecca as “neither a picnic nor a holiday, but an act of worship, as enshrined in the Holy Quran and the Sunnah of Prophet Muhammad.”

Similarly, the Bauchi State Government spent over N262,650,000 as subsidy on the state’s Muslim pilgrims to this year’s Hajj.

Governor Mohammed Abubakar had disclosed this while delivering his farewell address to 3,090 pilgrims, where he boasted that the state could afford the sponsorship despite the economic recession.

“Despite the economic hardship situation, this administration has continued to fund the operation of the state Pilgrims Welfare Board, both at home and at the holy land, so as to guarantee your comfort and satisfaction.

“We have also subsidised the cost of your accommodation in Mecca, upon which the government had to pay at least the sum of 850 Saudi Riyals (N85,000) for each of you so that you will be accommodated in a beautiful edifice close to the Haram,” Abubakar had said.

Also this year, the Plateau State Government went back on its 2015 decision to no longer sponsor both Muslims and Christians on pilgrimage due to the dwindling economic fortune of the state.

It was reported that the state government had sponsored 616 Muslims for the 2017 Hajj, with the state governor, Simon Lalong, saying at a farewell ceremony for the pilgrims from the state that the state government was willing to make the “sacrifice as a result of the relevance of holy pilgrimage to the citizens of the state.”

The Sokoto State Government had spent N91m to sponsor 90 Islamic clerics to the lesser Hajj in June.

The state Commissioner for Religious Affairs, Alhaji Mani Katami, had also announced that each of the benefiting clerics was entitled to a Basic Travelling Allowance of N250,000.

State governments’ sponsorship of pilgrimage has been going on for long. Last year, the Executive Secretary, Taraba State Muslim Pilgrims Welfare Board, Alhaji Umar Leme, said the state government had released N288.5m to sponsor about 166 persons on Hajj.

In 2014, the Borno State Government said it had spent about N500m to secure good accommodation and welfare for 2,645 pilgrims to Mecca, and that 300 Saudi Riyals (N30,000) were given to each of them to enable them to slaughter rams during Hajj.

The Niger State Government in 2013 said it had spent about N5.1bn in the previous six years to subsidise Muslim and Christian pilgrimages to Mecca and Jerusalem respectively.

In his defence of the expenditure, the then governor of the state, Babangida Aliyu, had described the sponsorship as the only avenue through which some people would benefit from the government.

“They do not benefit from electricity, housing, roads and other infrastructure; they only benefit directly from the government through subsidy on pilgrimage,’’ he had said.

It was also learnt that even the Federal Government in 2016 subsidised the cost of pilgrimage for 65,167 persons with a concession of N121.9 for a maximum of $1,000 per person. The pilgrims enjoyed a concessionary rate of N197 to a dollar as the official exchange rate was N318.9 to a dollar.

Meanwhile, the Executive Chairman of NAHCON, Alhaji Abdullahi Muhammad, on Friday commended the Saudi Arabian authorities for providing all the necessary logistics support for pilgrims at the Jamarat, the place where pilgrims perform the symbolic stoning of the devil.

He also commended the authorities for placing sprinklers at strategic locations for pilgrims, saying it would go a long way in reducing the effects of the hot weather being experienced in the country.

He, therefore, appealed to Nigerian pilgrims to maintain good behaviour while in the country as they had done so far.

But the sponsorship of pilgrimage is increasingly becoming a subject of controversy with the dwindling economic fortune in the country and the subsequent resolution by some states including Niger, Lagos, Kaduna and Kano to abolish it.

However, not all states that claimed to have stopped the sponsorship of pilgrimage have been able to fully commit to the resolution.

Even though, the Governor of Kano State, Abdullahi Ganduje, said in September 2016 that the state government had abolished sponsorship of Hajj, he added that it had not stopped sponsoring clerics and medical personnel on Hajj and had spent N3bn that year.

“So, the services we are providing and the Pilgrims Welfare Agency officials we are sponsoring, the medical (members of) staff and all the medication, if you add all together, you will see that we spent over N3bn,” he had said.

“So, during our last administration, we cancelled it (sponsorship of pilgrimage). In fact, I was the one who made the announcement and some people thought heavens would fall because we cancelled it. And when I came in, we did not have any problem because people are used to it. So, the only people we can sponsor are stakeholders, medical team, the Ulamas who are preaching here and the civil servants from the Pilgrims Welfare Agency.”

The Kaduna State Government has also cancelled the annual sponsorship of pilgrims to Mecca and Jerusalem and feeding of Muslim faithful during Ramadan, with the state governor, Nasir el-Rufai, saying the government could no longer afford such luxury.

Stressing the financial burden of such sponsorships on the state, el-Rufai had in 2015 said that in the previous year alone, the state government and the state’s 23 local government areas had sponsored over 2,000 pilgrims to Hajj and 800 others to Jerusalem at a cost that was “nearly N1.5bn.”

The Executive Chairman of CACOL, Mr. Debo Adeniran, described the state sponsorship of pilgrimage as a form of corruption, which must be stopped.

He said, “There are so many atrocities various administrations have been committing, including the sponsorship of pilgrimage. Such atrocities start from lowering the exchange rate for pilgrims. There is no government that has the authority to spend public funds on frivolities like religious tourism. Nigeria doesn’t have any religion, so any public fund spent on religious activities, building religious worship places and so on are resources wasted, misspent, misappropriated.

“Every public office holder who has funded any religion has misappropriated resources and they are liable to be charged for misappropriation of funds. So the amount that is being expended on Hajj would have been able to fix some dilapidated roads, educational facilities, and so on. What is the country benefiting from religious pilgrimages and all that?

“We are only improving the economies of countries such as Saudi Arabia and Israel while we are spending our resources unwisely. This is wasteful, unnecessary and reprehensible. Nigeria should stop it once and for all and that should be the focus of the present administration because putting money in things that are not right is misappropriation of funds. It is corruption and should be stopped.”

The President of the Muslim Congress, Nigeria, Dr. Lukman Abdurraheem, also described state sponsorship of the Hajj exercise as fraudulent.

He said it was wrong to use taxpayers’ money to send people on pilgrimage, adding that most states were using the exercise to steal state resources.

He said, “We believe that state sponsorship of Hajj is a fraudulent practice. If you go by what the Holy Quran says, we should only visit Kaaba (a building at the centre of the Sacred Mosque in Mecca, Saudi Arabia) if we have the means to do so.

“The government doesn’t have to sponsor Muslims on Hajj; its role is to provide good roads, electricity, potable water and other social amenities. States are only using pilgrimage sponsorship to steal money. Any religious person will tell you it’s wrong to use taxpayers’ funds to send people on pilgrimage. That’s why I commend states like Lagos for stopping it.”

Chairman, Osun State Board of Traditional Medicine, Chief Kayode Esuleke, also condemned the situation, saying it shows bias against the traditional religion worshippers.

“We are misappropriating public funds by sponsoring some people on pilgrimage. What the Quran says is that Muslim faithful should visit Mecca once in their lifetime if they can afford it, and not that they should be sponsored with taxpayers’ money.

“Is it right that our collective money should be used to sponsor Muslims and Christians on pilgrimage? It shows bias towards some religions. The money spent by states to sponsor pilgrims will solve some of the problems we have with infrastructure,” Esuleke said.

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

President Tinubu Presents N47.9trn 2025 Budget As Debt Servicing, Security, Infrastructure Take Lion Shares

-

I’m Not Nigeria’s PR, UK Party Leader, Kemi Badenoch, Tells Shettima

-

Nigeria and France Forge Strategic Alliance to Boost Solid Minerals Sector

-

Zhongshang Fucheng Moves to Auction Nigerian Properties in UK Following $70M Arbitration Award

-

Nigerians and Indians Lead UK Job Market Growth Amid Post-Brexit Migration Shifts

-

Violent Protests Erupt Across Nigeria, Leaving Six Dead and Many Injured

Sign up for our Daily newsletter

We’ll be in your inbox every morning Monday-Saturday with all the day’s top business news, inspiring stories, best advice and reporting from Entrepreneur, To share your newsletter use this email: entrepreneuredition@