- Forex Weekly Outlook August 28 – September 1

The three key Central Banks’ Governors, Janet Yellen, Mario Draghi and Haruhiko Kuroda on Friday agreed that weak global inflation and poor wage growth are impeding central banks from reducing monetary accommodation. Suggesting top global banks are not in a hurry to hike rates just yet.

Also, global uncertainties remain high after North Korea fired 3 short range missiles on Saturday. This is coming amid U.S. political unrest and Brexit ongoing negotiation.

Again, the Bank of Japan Governor, Haruhiko Kuroda, believed the 4 percent economic growth rate recorded by the world’s third largest economy in the second quarter is unsustainable and vowed to maintain an accommodative policy for some time.

Overall, the weak wage growth and low consumer prices remain a concern for central banks. However, growing job creation and moderate domestic spending have helped sustain growth in most nations.

This week, GBPJPY, NZDJPY, USDCAD, and GBPUSD.

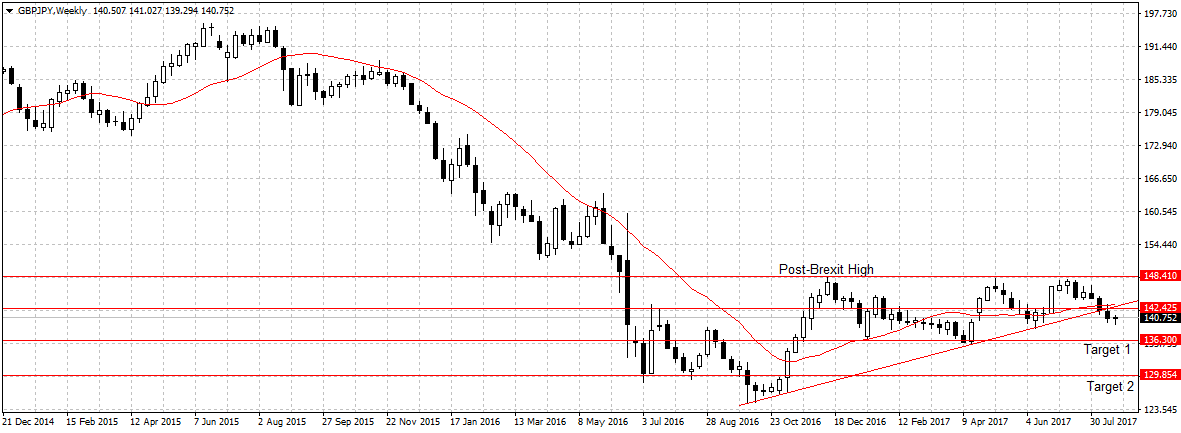

GBPJPY

Since I first mentioned this pair two weeks ago, it has plunged by another 69 pips. However, the volume of trade remains low. But with the U.K consumer spending waning and economic growth stagnant at 0.3 percent, the lowest among Group seven nations. It is right to expect a further decline of the British pound —especially as the third leg of Brexit negotiation commences this week.

Technically, since this pair closed below the ascending channel two weeks ago, it has failed to break 142.42 resistance level and has remained below the 20-day moving average.

This week, I remain bearish on this pair as long as 142.42 resistance holds.

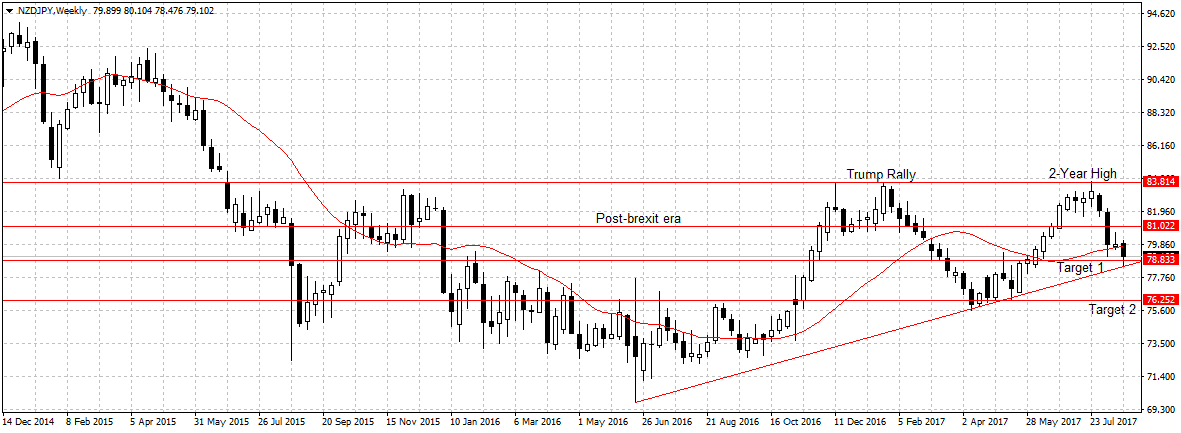

NZDJPY

As explained last week, this pair dropped 79 pips to hit our first target at 78.83. But failed to closed below key support level to validate bearish continuation after the Bank of Japan Governor, Haruhiko Kuroda said inflation rate is far from BOJ’s 2 percent target and wage growth remains low even with recent progress, therefore, he is not looking at unwinding balance sheet or raising rates until these imbalances normalized. This statement weakened the Yen outlook marginally, however, the rising global uncertainties continued to boost Yen attractiveness because of its haven status and growing economy.

Therefore, this week I will look to sell this pair below 78.83 support levels that double as the ascending channel as seen above for 76.25 support, our target 2.

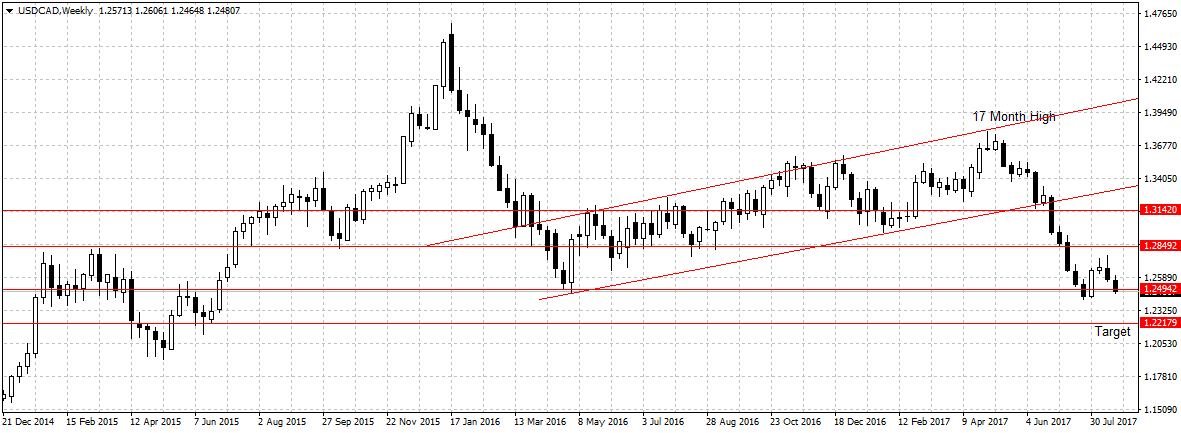

USDCAD

The USDCAD closed slightly below our key support (five weeks ago target 1) to reaffirm bearish continuation. Again, while the US dollar attractiveness is weighed upon by uncertainties, the Canadian dollar strength is also impacted by the growing US uncertainties, its largest trading partner.

However, the Canadian fundamentals just like the US are solid but with minimal domestic headwinds, the economy continued to create new jobs and the rising housing cost has been curbed. Making the Canadian dollar more attractive to investors than the US dollar, especially after the Bank of Canada raised rates for the first time in 7 years.

This week, I remain bearish on this pair and will look to sell below 1.2494 resistance for 1.2217 targets, our second target 5 weeks ago.

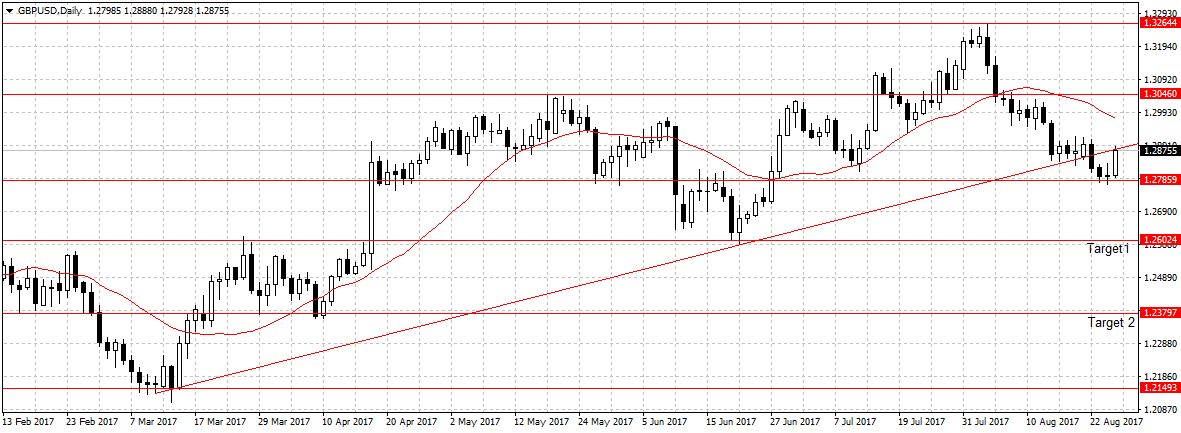

GBPUSD

The weak US dollar is aiding the British Pound, even though the U.K economic data shows the economy has started slowing down ahead of Brexit negotiation. The pound is likely to gain against the US dollar just like other major currencies are expected to surge as the Donald Trump administration looks to access the damage of Harvey continuous rain damage, estimated at $24 billion and the danger of North Korea 3 short range missiles.

While I remain bearish on this pair, I will be standing aside this week to watch price action as I expect the US dollar to dip further this week. However, on a sustained break of 1.2785 support level, I will look to sell for 1.2602 targets.