- Forex Weekly Outlook August 14-18

Currencies of developed nations plunged last week following Donald Trump’s response to North Korean missile threat. Deepening global uncertainties further. However, these uncertainties have increased emerging economies attractiveness, especially haven assets.

The renewed interest in the emerging assets has bolstered the attractiveness of emerging currencies as investors looks to avert volatility ahead of North Korean threats.

This week GBPJPY and CADJPY top my list.

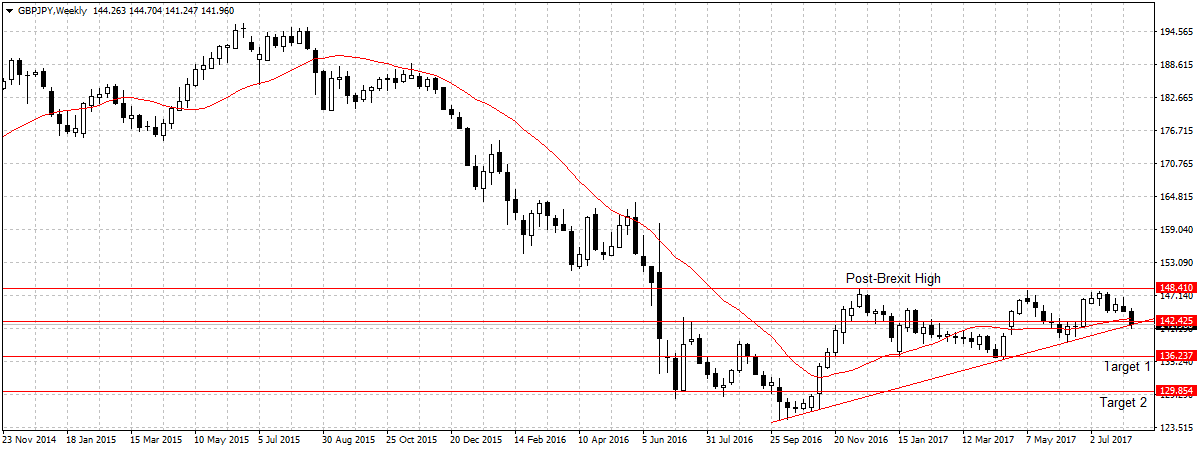

GBPJPY

The United Kingdom economy remains subdued as the nation strives to negotiate its way out of the European Union. Since the U.K voted to leave the European Union, the inflation rate has jumped above the Bank of England’s 2 percent target to 2.6 percent year on year, pushing input costs to a 3-month high in July. While consumer spending declined by 0.8 percent year-on-year.

The surge in prices is weighing on new investments, especially with the BOE not kin on hiking rate to support new job creation and growth. Pound sterling remains unattractive and it is expected to get worse as global uncertainty intensifies.

Again, while Japan is pulling up missile shield its assets continued to gain with Japanese yen rising to 8-week high of 108.70 against the US dollar and 7-week high of 141.24 against the pound. Also, the Japanese economy has expanded for a fifth consecutive quarter in the first quarter of 2017. Giving it an edge over other Group-7 economies.

Since this pair called the top at 147.75 five weeks ago, it has lost 651 pips to close below 20-day moving average and 142.42 key support last week. This week, I will be looking to sell this pair below the ascending trending for 139.90 support levels, target 1. A sustained break should open up 129.85, our target 2.

CADJPY

The Canadian economy has expanded substantially since its manufacturing and labour market increased following interest rate hike by the Bank of Canada. However, the uncertainties in the US and the global market continued to hurt Canadian economic outlook. This includes loonie.

The Canadian currency has lost 426 pips in the last three weeks. Indicating that not just the slump in global commodities that is hurting the loonie but also the weakness in the U.S. economy. It’s largest trading partner.

Therefore, this week, I will be looking to sell this pair below 86.36 price levels for 83.11 support levels and expect the continued decline in Canadian dollar and surge in the attractiveness of the Japanese yen to propel the pair towards 80.27, target 2.